Yesterday’s Troika press conference has attracted more attention than usual because of an exchange between journalist and broadcaster, Vincent Browne and Klaus Masuch, head of EU Countries Division at the European Central Bank. The exchange can be seen here.

Although not named we can only assume that Browne was referring to Anglo Irish Bank. Anglo’s 2008 Annual Report provides details for the year ended 30th September 2008. This is also the date of the guarantee so it gives us a good indication of the liabilities that were guaranteed on the same night.

By the end of September 2008, the Anglo balance sheet had ballooned to a massive €100 billion. On the asset side Anglo had forwarded loans of around €72 billion. We now know that Anglo made losses of around 50% on this loan book. We have filled that €30 billion+ gap.

Then comes the issue of where Anglo got the money to make these loans. The Anglo balance sheets reports €100 billion of liabilities of which over €70 billion were just deposits (€52 billion from ‘customers’, €20 billion from banks). It also shows that there was about €17 billion of 'Debt Securities' (i.e. bonds) in issue at that time.

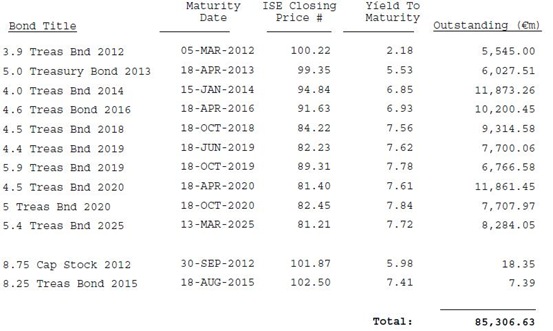

A note to the accounts gives a breakdown of this total at the 30th September 2008:

Medium term note programme: €10,622 million

Other debt securities in issue: €6,658 million

The category of 'other debt securities' includes commercial paper and certificates of deposit which are almost analogous to deposits. There were also some €4 billion of subordinated liabilities but those are not of concern here as most of those were not repaid. [Junior debt holders in the covered banks incurred €15.5 billion of losses across the covered banks.]

Anyway at the end of September 2008 Anglo had €10.6 billion of bonds outstanding. A breakdown showing the amounts of these that were secured and unsecured is not provided. These bonds (along with all other liabilities) were guaranteed on September 30 and over the past three and half years many of these have been repaid. After Monday's payment of €1.25 billion there will be around €3 billion of Anglo bonds left to be repaid.

The issue raised by Browne is the repayment of unsecured bondholders in Anglo after the expiry of the original two-year guarantee in September 2010. Unfortunately for 2010, Anglo changed its year end to 31st December so we cannot get the exact balance sheet position at the expiry of the original guarantee from the 2010 Annual Report.

By the 31st December 2010 the balance sheet of Anglo had shrunk to €72 billion and the total amount of debt securities outstanding had fallen to €6.9 billion. All the deposit-like 'other securities' had been redeemed so the €6.9 billion was all bonds. At this stage the bank was again mainly funded by deposits but these were now almost 80% central bank deposits.

Of the €6.9 billion of bonds we are told that "€3.0bn of medium term notes, all of which are Government guaranteed with maturities of up to five years, were issued during the year." That means there could only be a maximum of €3.9 billion of bonds which were outside the guarantee.

This was confirmed in March 2011 with this release from the Central Bank. This showed that on the 31st March 2011 there was €3,147 million of senior unsecured unguaranteed bonds in Anglo on the 18th of February 2011 from a total of €6,255 million of bonds (the other €3 billion being the guaranteed bonds).

It is the re-payment of these €3.1 billion of unsecured bonds that was the subject of yesterday's exchange. It is hard to know how much could be saved if these bonds weren't repaid but given the 60%-80% haircuts applied to subordinated debt it is likely that a haircut of 40% to 60% would be applied to senior debt. If we take the mid-point and assume that a 50% haircut could be applied then the State will lose around €1.5 billion by repaying these bonds.

Of course, we don’t have the money to repay these bondholders. We have borrowed it (or rather we will borrow it) through the Promissory Notes. Repaying the bonds will not cost us €1.5 billion. The price is €1.5 billion but the cost will be the annual interest payments made on the borrowing to pay the bonds. At an interest rate of 5% it would cost €75 million per year to service €1.5 billion of debt. The true savings of not repaying these bonds is this €75 million per year.

Here is the question and the answer and some subsequent comments from this transcript.

Vincent Browne: “Klaus Masuch, did your taxi driver tell you how the Irish people are bewildered that we are required to pay unguaranteed bondholders billions of euros for debts that the Irish people have no relation to or no bearing with, primarily to bail out or to ensure the solvency of European banks? And if the taxi driver had asked you that question,hat would have been your response? That’s my first question.”

Masuch: “I can understand that this is a difficult decision to be made by the government and there’s no doubt about it but there are different aspects of the problem to be, to be balanced against each other and I can understand that the government came to, came to the view that, all in all, the costs for the, for Irish people, for the, for the stability of the banking system, for the confidence in the banking system of taking a certain action in this respect which you are mentioning could likely have been much bigger than the benefits for the taxpayer which of course would have been there. So the financial sector would have been affected; the confidence of the financial sector would have been negatively affected, and I can understand that there were, that there was a difficult decision but that the decision was taken in this direction.”

Browne: “That, that… Well, that doesn’t address the issue. We are required to pay, in respect of a defunct bank – that has no bearing on the welfare of the Irish people at all – we are required to pay in respect of this defunct bank, billions on unguaranteed bonds in order to ensure the health of European banks. Now how would you explain that situation to the taxi driver that you talked about earlier?”

Masuch: “I think I have addressed the question.”

Browne: “No you haven’t addressed the question because you referred to the viability of the Irish financial institutions. This financial institution I’m talking about is defunct. It’s over. It’s finished. Now, why are the Irish people required, under threat from the ECB, why are the Irish people required to pay billions to unguaranteed bondholders under threat from the ECB?”

In his answer Mausch basically said that it was the government’s view (he never actually have his view) that the benefits of repaying these bonds were greater than the savings that could be made by not repaying them. We know that the saving could be around €1.5 billion.

It would have been useful if Mausch was pressed further on what he felt these benefits were. It is still not clear what benefits, if any, did accrue from undertaking to repay these bonds; it certainly wasn’t “stability of the (Irish) financial system”. There may have been benefits from repaying these bonds and this has been couched in references to veiled threats from the ECB. Would the ECB “pull the plug” if these €3 billion of bonds aren’t repaid? Unlikely, but in the greater scheme of things the €1.5 billion in question here is not the key issued.

The key issue is the €25 billion of Promissory Notes given to Anglo (along with €6 billion to Irish Nationwide) to cover the loan losses referred to above. Most of the money that these Notes allowed Anglo to get from the Central Bank went to repay depositors rather than bondholders.

This issue is how (or whether) we repay the €28.5 billion of these Notes that are still outstanding. This money is owed to the Central Bank of Ireland but when the Central Bank gets it, it will just “burn” it. There is no one waiting for this money to be repaid so the question is why do we have to repay it now. Prof Karl Whelan is once again excellent on this point in this article in Business and Finance.

This issue was raised at both the Noonan/Howling and Troika press conferences. You can listen to the responses in this extract. It seems we can expect some kind of ‘position paper’ to be released before the end of February. This issue is far more significant than some pre-ordained grandstanding about bond payments. The bondholders are gone. The debate must move on. Maybe the next haranguing of the ECB will press them on this.