We gave a brief look at the CSO earnings data last week. Here we will consider the release in more detail. We will start by looking at average weekly earnings.

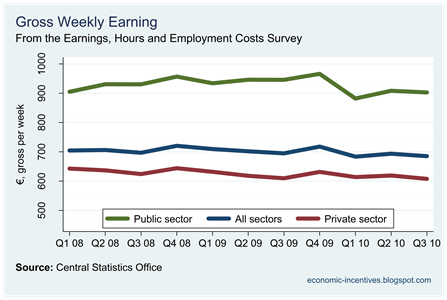

Since the first release of the Earnings, Hours and Employment Costs Survey (EHECS) in Q1 2008 average weekly earnings across the economy have fallen by 2.7%. There has been a 5.4% fall in the private sector and a 0.2% fall in the public sector (though it should be noted that the public sector figures do not take the Public Sector Pension Levy into account as these are gross figures). However, if we take the past year this has reversed as year public sector wages have fallen by 4.5% with only a 0.3% drop in private sector average earnings.

These public/private sector details and an analysis by the 15 activity sectors used by the CSO is provided below. Click the table to enlarge.

When we look at the breakdown by sector we see that the top sector is Electricity, Water Supply and Waste Management which is now the only sector to have an average weekly wage of more than €1,000 euro and has shown the greatest increase since the start of the survey. Accommodation and Food Service has remained the bottom category though it did show one of the three largest quarterly changes (shown in green).

In general the rankings of the categories have remained steady. The only categories to show a change of more than one position are Education (6th to 8th), Administration and Support Services (12th to 14th) which both fell by two positions and Manufacturing (8th to 6th) which rose by two positions. The biggest fall in weekly earnings has been in the Financial Insurance and Real Estate sector which has seen a fall of 16.4% but it still remains the third ranked sector.

As we have noted before the is only a rough barometer of average weekly earnings as it is simply the aggregate earnings divided by the number of employees. Thus, in a sector in which a large number of low paid staff are let go this average would increase even if the average earnings of remaining employees were unchanged. In fact, their earnings could be falling even as the average rate was rising. So a word of caution is required when interpreting the above table.

What the EHECS is very good for is provided a guide to the level of aggregate earnings in the economy. This takes account of earnings and the number of employees. Here is an index of aggregate earnings since the start of the survey.

Aggregate earnings are down nearly 15% since the start of 2008 and although some moderation in the decline has occurred in 2010, they are still below the 2009 levels. This goes a long way to explain why Income Tax receipts are performing so poorly this year.

We can break this down to look at the relative performance of earnings in the public and private sectors. In terms of the changes in average weekly earnings the comparison is broadly similar (once the pension levy is taken into consideration). The aggregate earnings comparison is not so similar.

Aggregate private sector earnings are down nearly 20% with the equivalent figure for the public sector being a drop of less than 4%. Public sector earnings were actually ahead of the Q1 2008 levels until the pay cuts introduced in last year’s Budget kicked in at the start of the 2010.

The pension levy would go some way to narrowing this difference but a significant gap would still exist. While weekly earnings in the private sector have shown a moderate decline, aggregate earnings have suffered because of huge cuts in employment. The public sector has seen some reductions in weekly earnings but has been largely insulated from losses in employment.

The EHECS suggests that there has been a 202,100 reduction in the number of employees in the private sector since the start of 2008 – a fall of 15.0%. In the public sector employee numbers have fallen by 14,900 – a fall of 3.6%.

The following table gives the aggregate earnings indices by sector. Again click to enlarge.

Again, the Electricity, Water Supply and Waste Management sector performs best with aggregate earnings up 8.8% since the start of 2008. Human Health and Social Work is the only other sector to show an increase over the same period.

The Construction sector has seen aggregate earnings fall by over 55% which is 30 percentage points worse than any other sector. Reductions of more than 20% have also been recorded for Administration and Support Services (-25.0%), Financial, Insurance and Real Estate (-24.6%), Professional, Scientific and Technical (-21.4%) and Information and Communications (-20.6%).

A table of the employment numbers, which along with the average weekly earnings data, was used to create this indices can be seen here.

No comments:

Post a Comment