Last week’s Quarterly National Accounts release allows us to look at the contributions made by the components of GDP to the growth rate. This is the domestic economy (C + I + G) and the balance of trade (X – M). Here are the real quarterly GDP growth rates since the start of 2008.

We can see that the quarterly growth rate has been negative for 10 of the past 12 quarters. Here are the contributions of the individual components of GDP to the growth rates over the same period.

The stand out colours are the maroon of investment (mainly on the downside) and the orange of net exports (mainly on the upside). Consumption did have a significant negative contribute to the growth rate but this has reduced since the middle of 2009. The direct effect of government is quite small but is mainly negative. Government expenditure will have indirect effects on GDP through the effect transfer payments have on consumption.

We will focus on the two largest contributors to the recent growth rates – net exports and investment. Here are the contributions of the components of net exports, exports and imports.

In 2008 and 2009 it is evident that the positive contribution of net exports to the GDP growth rate was coming from imports – falling imports. During this period exports were falling as can be seen but this was outweighed by the greater fall in imports. With intermediate goods for production (materials and capital) making up about 70% of Irish imports this was not a positive development for the economy even though it had a positive effect on the growth rate.

It is only in 2010 that the contribution of trade to the growth rate has been the result of rising exports. During this time imports have also been rising, represented by the negative contribution of imports in 2010 but these are now outweighed by the rise in exports.

The National Accounts do not provide us with any breakdown of the Investment total provided. This category is made up of capital formation of households (mainly buying houses) and firms, and capital expenditure by the government. We can get some insight into the patterns of these from the Non-Financial Institutional Sector Accounts.

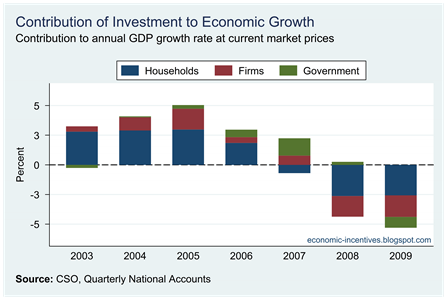

These data are nominal and only available annually (though there has been a suggestion from the CSO that quarterly updates may be provided). Data are available from 2002 to 2009 and it will be October before the 2010 data are published. Here are the annual contributions of household, firm and government investment to the nominal GDP growth rate since 2002.

The biggest contributor is the household sector which comprises mainly investment on houses. In 2009, the investment of all three sectors contributed negatively to the growth rate. This is likely to have continued in 2010.

Finally, for investment the CSO also publishes a breakdown of investment by use in Table 15 of the National Income and Expenditure Accounts. Not surprisingly, house building has had the largest effect on the growth rate (again in current prices).

No comments:

Post a Comment