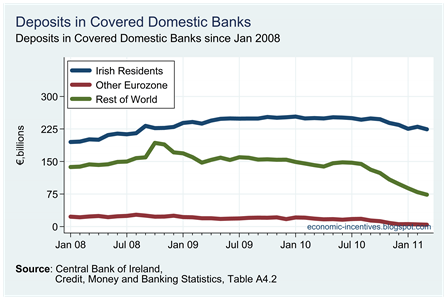

Not surprisingly the level of deposits in the six covered banks continues to fall. We have not got a recent update of the consolidated balance sheets of the banks so some of this may be due to transfers between subsidiaries of the banks but as we will see below this could only be a partial explanation.

Since last August there has been a €100 billion drop in the amount of deposits in the covered banks. As the graph below shows most of this has been for residents outside the eurozone and is probably mainly money based in London.

The Central Bank does not provide a breakdown of the sectors of rest of the world deposits in the covered banks but can be seen from this graph of all banks operating in Ireland that this drop has been in deposits from other financial institutions, i.e. inter-bank lending.

Returning to the covered banks, the Central Bank does provide a breakdown of Irish resident deposits in the six banks. It is pretty evident that Irish private sector deposits are leaking out of the covered banks.

This time last year the Irish private sector had almost €130 billion on deposit in the covered banks. The most recent figure put this at €106 billion. More and more private sector deposits are leaving the covered banks.

We can get some insight into where they are going if we look at Irish resident private sector deposits in the non-covered domestic banks and other banks operating in Ireland. In the last six months deposits in these banks have risen by more than €6 billion.

Where did the other €18 billion go?

No comments:

Post a Comment