Here we will give a look at the asset side of the balance sheets of Irish banks, looking specifically at loans and in particular at some large changes that seemed to have occurred in October based on the most recent release of the Central Bank’s Money, Credit and Banking Statistics.

First up, is the total amount of loans on the balance sheets of the domestic banks, broken into the covered group (AIB, BOI, IBRC and PTSB) and the non-covered group (Ulster Bank, National Irish Bank, etc. and also credit unions).

There has been a fall in the amount of loans on the balance sheets of the covered banks. Some of this is due to repayments on existing loans exceeding the amount of new loans issued but most of the drop from a peak of €513 billion in July 2009 can be explained by the transfer of over €70 billion of developer loans to the National Asset Management Agency (NAMA) and the sale of loans to other banks.

The total amount of loans the covered banks had was steady at around €400 billion from May of this year but there was another sharp drop to €377 billion in October. It would be possible to explain this drop in a chart or two but we will use the drop as a reason to have a fuller look at the loans on the balance sheets of the banks.

Loans in the non-covered domestic group peaked at €165 billion in October 2008 and have fallen by more than half since then, although for 2011 loans in the non-covered domestic group have been relatively steady. In January they were €79 billion and by October they were also €79 billion. From January to November 2010 these loans fell steadily from €113 billion to €99 billion.

The large drop in December 2010 (from €99 billion to €79 billion) can be explained by departure of Bank of Scotland (Ireland) from the Irish market. The loans still exist but they were transferred to Bank of Scotland’s parent group in the UK and no longer appear on the Central Bank of Ireland’s aggregate banking balance sheet statistics.

From here on we will focus on the €377 billion of loans on the balance sheet of the covered banks. It is important to note that these are non-consolidated figures, that is they just cover the Irish operations of the banks. Here is the Irish/non-Irish resident split of the loans.

Loans to Irish residents peaked at €364 billion in June 2009. Repayments but mainly transfers to NAMA saw this fall under €300 billion May of this year. Loans to non-Irish residents from the covered banks have fallen from €156 billion in June 2010 to €102 billion now.

The large drop in October from the first graph can be mainly attributed to the drop from €294 billion to €275 billion in loans to Irish residents, though loans to non-Irish residents also fell (from €108 billion to €102 billion).

Looking at loans to Irish residents (because it is the largest drop but also because we don’t have this breakdown for loans to non-Irish residents) gives a further insight into this drop.

Loans on the balance sheets of the covered banks to the private sector (households and businesses) peaked at €256 billion in October 2008. They then showed a consistent fall over the next three years at stood at €178 billion in September 2011. From here the big fall in October 2011 can be seen with a drop to €157 billion.

The exposure of balance sheets of the covered banks to Irish private sector loans has fallen by nearly 40% in the past three years. The increase in loans to general government are the €30 billion of Promissory Notes given to the IBRC during 2010.

To get a further insight into the changes to private sector loans we have to move away from the balance sheet data and move to the data presented on overall credit in Ireland. This is credit forwarded by all credit institutions and not just the covered banks but the covered banks make up about two-thirds of the total. Here are the private sector loans to the household, non-financial corporation, financial intermediary and insurance on the balance sheets of all banks operating in Ireland going back to the start of 2005.

It is clear that that the reason for October drop is to be found in the household sector. The drop in business loans from a peak of €170 billion in August 2008 to €87 billion now is almost fully explained by the transfer of developer loans to NAMA.

The next step is loans by purpose for the household sector.

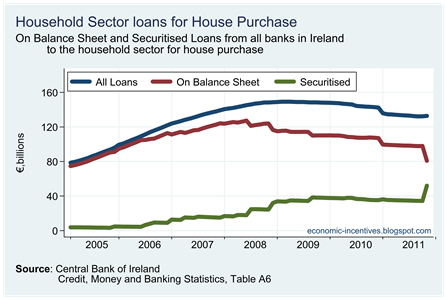

There seems to have been a huge drop in loans for house purchase (residential and investment) to the household sector over the past few years from a peak of €128 billion in May 2008 to €81 billion in October 2011, with a €17 billion drop in that month alone.

Of course, Irish households are not repaying debt at that rate and a drop of €17 billion in one month is absurd. The transaction data provided by the Central Bank show that loans for house purchase to the household sector declined by €319 million in October. The €17 billion drop is on the balance sheets of the banks not the households (and is down to one of the covered banks as we have seen above).

So what gives? The next table from the Central Bank gives outstanding amounts (including securitised loans). Here are loans for house purchase to the household sector.

This explains what has happened in October. Loans for house purchase on the balance sheet of the covered banks fell but only because securitised loans increased by the same amount.

We can see that the total amount of loans to the household sector from bank operating in Ireland stopped rising in 2008 and has been falling gradually since then. The stepped drop at the end of 2010 is again explained by the departure of Bank of Scotland (Ireland) from the Irish market.

The Information Note from the Central Bank to the October Money, Credit and Banking Statistics gives mention of this securitisation in a footnote of page 2:

This is due to a credit institution derecognising loans from the statistical balance sheet that had been securitised, in line with the methodology applied by the reporting population in general.

Hmmm. One the covered banks didn’t realise that it had been reporting €18 billion of securitised loans on its balance sheet that shouldn’t have been there at all. How very reassuring. So what did it replace the €18 billion of mortgages on its balance sheet with? If we go back to the aggregate balance sheet data of the covered banks we can probably infer the answer.

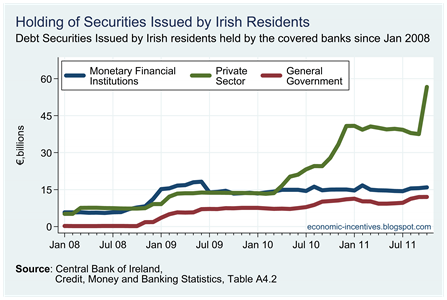

There was an €19 billion rise in the holding of securities issued by the Irish private sector. This has risen quite significantly recently with most of the rise occurring when the banks received NAMA bonds for their developer loans in 2010. It was largely steady for the past year until the almost vertiginous rise in October which as we have seen is as a result of “a credit institution derecognising loans from the statistical balance sheet that had been securitised”. It now seems they had €18 billion of bonds they didn’t know about as well!

The above graph also shows that the banks hold about €16 billion of bonds in Irish banks. It is not clear how many of these are from the covered banks or in fact if much of it is the banks’ holding of their own bonds. The rise in the banks’ holding of Irish government bonds can also be seen and stood at €12 billion in October. This is about 14% of the total stock of Irish government bonds.

I can’t say that there is much to be learned from digging into this non-securitised / securitised shift in October. It is hard to say who is now carrying the risk of these loans. It is probably a company linked to the bank as it is unlikely they would have overlooked a transaction with an external third party.

No comments:

Post a Comment