In preparation of a recent discussion I went looking for the rates of social welfare payments over the past few years. These are usefully provided as part of the supplementary documents produced with the Budget.

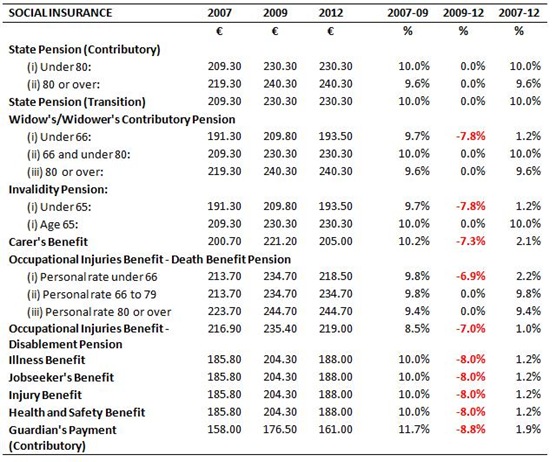

Here are social insurance payments (made from the Social Insurance Fund into which PRSI contributions are paid) from the 2007, when the economy and tax revenue peaked, right through the current rates in 2012. The table just provides the personal rates.

All Social Insurance payments are higher than they were in 2007. For Pensions this is as much as 10%, but for Illness, Jobseeker’s, Injury and other Benefits that increase is a much more modest 1%. All of the payments increased between 2007 and 2009, and while some have of them have subsequently been reduced none are below their 2007 levels.

Here are the Social Assistance payments (made by the Department of Social Protection and funded from general taxation). Again only the personal rates are provided.

Again most payments are above the 2007 levels. The exceptions are Jobseeker’s Allowance for the under 24s and Child Benefit for all children with the reduction for the third child being the greatest.

A full list of the all the payments and rates for qualified adults/children can be read here.

It is also important to factor in inflation to determine the real changes in the rates. For example, in December 2007, the CPI excluding mortgage interest was at 103.1 (using the 2006 base). In December 2011 this index was at 104.2. That is a rise of 1.1% over the four years.

Here are changes that have taken for some of the main commodity groups in the CPI over the same period.

In the first three months of 2012, the CPI excluding mortgage interest has risen 1.9%.

No comments:

Post a Comment