The non-financial institutional sector accounts include items for ‘interest paid’ and ‘interest received’. However the number reported by the CSO is the total after adjustment for FISIM (financial intermediation services indirectly measured).

The purpose of this is to try and account for financial services that are not paid for directly but are paid for indirectly via the gap between deposit and lending rates of financial institutions. Thus a part of interest expenditure is to pay for the cost of the money provided and a part of it is to pay for the cost of financial services provided. This latter part is included in consumption for households and as part of intermediate consumption for non-financial businesses.

The release last week by the CSO includes interest figures but these are after the adjustment for FISM has been carried out. However, eurostat publish item D.41(g) which is “total interest before FISIM allocation” which allows us to produce the following table.

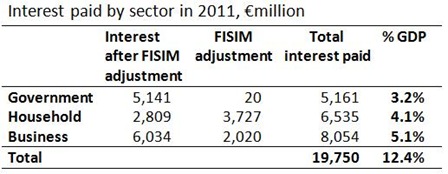

The total amount of interest paid was nearly €20 billion or 12.4% of GDP.

If we were to assume an average interest rate of 4.0% that would imply a total debt of around €500 billion. At 4.5% the debt would be around €440 billion. These figures give the ballpark for what the aggregate debt burden of the government, household and non-financial corporate sectors is.

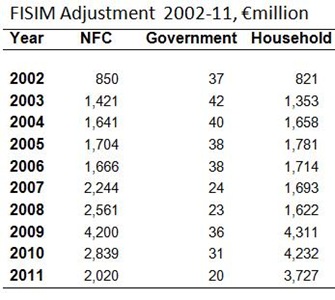

The FISIM adjustment for the household sector seems ‘large’. For all years from 2002 to 2008 it was below €2 billion but from 2008 to 2009 it jumped from €1.6 billion to €4.3 billion. It has remained high since then. The FISIM for the non-financial corporate sector similarly rose in 2009 but it has fallen back since then.

A table of total interest paid since 2002 and some further details on FISMIM are below the fold.

The interest charge for the economy peaked in 2008. Since them the amount of interest paid buy the NFC and household sectors has fallen significantly, while the interest bill for the government sector is going in the opposite direction.

Here are the FISIM amounts for each sector in the same period:

The FISIM adjustment is calculated on the basis on a reference rate which is the average of the short term interbank rates up to 12 months maturities - this is considered to be the risk free interest rate .

FISIM is measured as the difference between this reference rate and the actual rate paid by these corporations applied to their loan liability positions. The collapse in the reference rate from 2008 - 2009/10 meant that practically all the interest paid was recorded as FISIM.

FISIM is calculated in line with the agreed methodology outlined in ESA 95 - the EU standard. However in the wake of the financial crisis it has become clear that this measure needs to be disaggregated into the service element and the risk premium element. To try to resolve this both OECD and Eurostat have Task Forces working on finding a solution to this matter.

No comments:

Post a Comment