Only a dope could have this hope.

One suggestion from the United Left Alliance is that €6 billion can be raised annually from a 5% wealth tax. This proposal has no grounding in reality and is populist poppycock.

The figure of €6 billion is attributed to analysis by an old friend, Tom O’Connor. The article which contains the analysis can be read here: Wealthy Irish have €121bn and should be taxed more. Here is the only accurate calculation of this loony proposal from the ULA: 5% of €121 billion is €6.05 billion. The rest is nonsense.

Let’s start with Mr O’Connor’s “analysis” where the conclusion that “33,000 millionaires hold €121 billion”. The numbers used come from the 2006 report by Bank of Ireland Asset Management on The Wealth of The Nation. You can read this short report here.

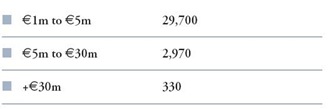

Much of the basis for the proposition comes from the numbers in this table from page 13 which the report admits are “very approximate estimates”.

From here things get messy. Tom O’Connor, in his piece, starts with

Firstly, the report estimated that there were 330 individuals whose wealth well exceeded €30m. If we take a very conservative estimate of each holding €40m, then the collective wealth of these 330 individuals was €13.2bn

The report also stated that there were 3,000 millionaires whose wealth ranged from €5m-€30m. Taking the midpoint value of €18m, this means that that these 3,000 individuals held €54bn in wealth. The remaining 29,670 millionaires held between €1m-€5m each. If we take the midpoint here of €3m, then these 29,670 millionaires were worth €89bn in total.

Of course the figures in the table are 330, 2,970 and 29,700 and not the 330, 3,000 and 29,670 used by Mr O’Connor but that is not his worst crime. Extrapolating the total wealth from the crude figures given in the table is difficult (impossible?) but why should we let the facts get in the way of a good story. In Mr O’Connor’s article we are told that the wealth of these 33,000 millionaires in 2006 was €156.21 billion.

The smallest part of this comes from the 330 people with a net worth of €30 million or more. An average figure of €40 million is plucked for these people giving the total of €13.2 billion. We have no basis to argue against this figure as it is a pure guess. The other two categories can be scrutinised in a little more detail.

It is clear that the shape of the distribution of wealth has little influence on this analysis. Amazingly, for the groups with net worth of between €1 and €5 million and between €5 and €30 million the midpoints are used to provide an average. Only if the distribution of wealth were uniform would this be appropriate. The figures themselves show how skewed the distribution of wealth is. There are estimated to be 10 times more millionaires in the €4 million range from €1 to €5 million than in the €25 million range from €5 to €30 million.

The distribution of wealth is a hugely skewed distribution and there is no way that the mean value of a group of people within a particular range will be the midpoint of that range. The mean value will undoubtedly be closer the the lower end of the range. The figures of €18 million and €3 million chosen above are nonsense. The total of €156.21 billion is nonsense.

The next bold move is to translate this 2006 figure to a 2010 equivalent. Cue Tom:

Fortunately, we can update the 2006 figures to check this out: the original report tells us that these millionaires held 71% of their wealth in property; 3% in bonds; 10% in cash and 16% in equities. The breakdown of the original €156bn is thus: €112.4bn in property; €15.5bn in cash; €4.7bn in bonds and €23.4bn in equities.

Unfortunately the report tells us nothing of the sort. The breakdown provided above is in the report but refers to ALL households and not the 33,000 millionaires. See top of page 9 of the report. And actually the proportion of assets held in property in 2006 was 72% (not 71%) and in equities was 15% (not 16%). The figures in brackets are the ones used by Tom O’Connor but they what they were estimated to be in 2005 and had changed for 2006.

It is likely that the asset mix of millionaires is substantially different to the asset mix of the entire population. It does not take too much work to find the report confirm this (page 12).

The focus on the asset base excluding residential property of the top 1% of the population is because residential property is only a small component of their overall assets.

We can be fairly sure that a “small component” is somewhat lower than 72%, or 71% or whatever makey-uppy figure you want to use. How is it plausible for someone to suggest that nearly three-quarters of the wealth of Ireland’s millionaires is attributable solely to property?

Anyway using these erroneous proportions and some estimated value changes since 2006 we get the following conclusions.

There is an asterisk beside the 2010 property assets total as a 33% drop from the suggested 2006 figure of €112.5 billion would actually bring this to €75 billion. But who’s worrying about two and a half billion. Now even, these assumed changes in values are way off. Property values are down by more than 33% and somebody should tell Sean Quinn that Ireland’s 33,000 millionaires have lost a total of €1.5 billion since 2006. I think he managed twice that all on his own (though it was through CFDs rather than equities) and surely our millionaires took a bit of a hit as part of the huge drop in equity in the banks which must be around €40 billion or so.

That aside, the fact remains that this total net worth figure of €121 billion for Ireland 33,000 supposed millionaires is nonsense. Even if the weights are appropriate (they are not), the value changes used are also pretty weak (and net worth does include residential property unlike the claim made in the O’Connor article).

Actually, I’m not quite sure why he went to all this trouble. Maybe, it was to try to give some legitimacy to the analysis but this clearly did not work. However, there is a figure that is frequently quoted in the Bank of Ireland report (see pages 1, 2, 12, 13 and 14) and it is that:

The asset base (excluding residential property) of the top 1% of the population increased from €86 billion in 2005 to €100 billion last year, an increase of 16%.

Wouldn’t it have been so much easier to say this rather than go through all the rubbish above. So 1% of the population had €100 billion of assets in 2006. This €100 billion figure looks a little to much like trying get a nice round attention-grabbing number. These is little basis for this (or in fact any of the numbers in the Bank of Ireland report) and it is largely based on guesswork with little or no reference to actual data.

If this supposed €100 billion of assets from 2006 had just stayed still, the proposed 5% wealth tax would yield €5 billion. Of course wealth does not stay still and would have shown significant declines since 2006. I can’t say by what amount but it would reduce the yield on this proposed tax. A 20% reduction (plausible?) would bring the yield down to €4 billion. So another €2 billion gap needs to be filled from the €6 billion they claim it would yield.

Anyway, at €100 billion, a 5% tax would yield €5 billion in the first year. If there was zero growth in values, the next year there would only be €95 billion in assets to tax. This means we would be down to a yield of €4.75 billion. After 10 years in this zero growth scenario there would be just €63 billion of the €100 billion assets left and the wealth tax would be yielding €3.1 billion a year. The only way to keep revenue stable would be to keep increasing the rate.

Of course, the wealth isn’t just going to stay around here to be eroded down to nothing. Wealth does not stay still and this applies to location as well as value. A 5% wealth tax would mean assets in Ireland would need to generate 5% to just to hold their value. Any positive inflation would require a higher rate to hold their real value and then they would need to match the equivalent return from investing elsewhere to make it worthwhile to keep the asset in Ireland. This suggests that double-digit asset growth is needed (every year!) in order to avoid wide scale capital flight from Ireland.

A 5% wealth tax on a tiny proportion of the population might make for good electioneering but it makes for bad economics. But then we knew that before we started. And to be fair to Tom O’Connor his piece is an argument for a 1% wealth tax which is a plausible suggestion. It is the loony left who made the jump to 5%.

No comments:

Post a Comment