The Central Bank have released their Credit, Money and Banking Statistics for January. We have looked at these before. This month, however, for the first we are provided with a breakdown of some data for the banks covered by the Eligible Liabilities Guarantee. The release from the Central Bank details this addition and some caveats about their interpretation.

In this release, a further subdivision relating to the six banks covered under the Government’s guarantee schemes, (described as the Covered Institutions) is presented for the first time in Table A.4.2. It is important to note that these Money and Banking Statistics cover banks’ operations within Ireland only. In line with the recognised international standards for Money and Banking Statistics - intra-group assets and liabilities, including those vis-à-vis group members both within and outside Ireland, are recorded in full, on a gross basis in these tables.

We present some of the new figures here. First up are the total liabilities of the six covered institutions which are almost identical to the total when the original “blanket” guarantee was introduced in September 2008.

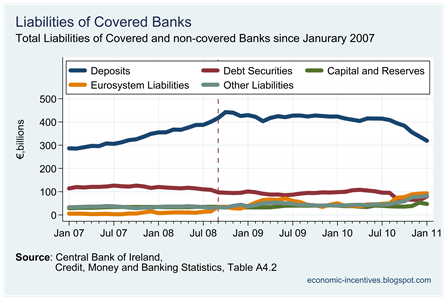

The next graph gives the breakdown of these liabilities by type and we see that they has been a change in the mix of liabilities on the covered banks’ balance sheets.

Deposits are by far the greatest liability the banks have but with the expiry of the original guarantee in August these have shown a rapid decline of nearly €100 billion since then. We can also see the declining importance of Debt Securities (bonds) over the period, although there was a large jump in January (not shown on the diagram).

The liabilities that have taken the place of the deposits and bonds are Eurosystem Liabilities which were €93 billion in January and Other Liabilities of €82 billion which includes the Emergency Liquidity Assistance from our own Central Bank. We will look at these liabilities in more detail in subsequent posts.

No comments:

Post a Comment