Over on Notesonthefront there is a post which contains the following:

As seen, Irish high-income earners are taxed at relatively low-rates. We’re right down there with other peripheral countries (with the exception of Italy) and low-tax, high-poverty UK.

The accompanying chart in the post purports to support the claim but is a little wide of the mark. High-income earners are not taxed at relatively low rates in Ireland. Here is the same chart for the EU15 but breaking income deductions into Income Tax and Social Contributions, and ranking them by effective income tax rates.

All data is 2010, except for Ireland which is 2011. Of the EU15, Ireland has the 6th highest effective rate of Income Tax on a double-income no-child couple earning 200% and 167% of the average wage (as determined by the OECD). The arithmetic average of the effective tax rate on this group across the EU15 is 27.1%, 2.8 percentage points below the effective rate in Ireland.

The same chart ordered by employee Social Insurance contributions presents a different picture.

Ireland is last among the EU15 when it comes to employee social insurance contributions. For high-earners, Ireland is an above-average taxed, low-social insured economy. A chart ranked by total deductions is here.

The OECD tax-benefits calculator used in the linked post allows us to determine what happens when the couple above lose the income of the person earning twice the average wage. The chart below shows the percentage of their original net pay the couple will have from claiming unemployment benefit during the first month of unemployment, what is known as the replacement rate.

All data is 2010. In Ireland, the loss of income would see the couple drop to 59% of their previous net pay. This is the third lowest in the EU15. Ireland has low social insurance contributions on high earners and in return high earners get (relatively) low social insurance benefits against unemployment.

What happens if we repeat the first chart but instead use a single-income no-child couple with that income equal to the average wage?

Ireland, which has the sixth highest effective income tax rate on the “high-income” couple, drops to 12th place when it comes to the effective income tax rate on the “average-income” couple. The arithmetic average for the EU15 is 14.0% which is greater than the 9.6% levied in Ireland. If we rank the above chart by social insurance contributions we get:

For average earners Ireland is a low-taxed, low-social-insured economy. A chart ranked by total deductions is here. Ireland is at the bottom.

And what happens to the “average” income couple should they lose this income? Here is the net income compared to the original income in the first month after becoming unemployed (the replacement rate).

The Irish single-income couple earning 100% of the average wage makes the lowest social insurance contributions in the EU. However, if they lose that income in the first month of availing of unemployment benefit their net income drops to 78.1% of the previous income. This is the second lowest drop in the EU15.

So for a “high-income” no-child couple (200% & 167% of the average wage) Ireland has (Ireland versus EU15 mean):

- the sixth highest effective income tax rate in the EU15

- 29.7% versus 27.1%,

- the lowest rate of employee social insurance contributions in the EU15

- 3.6% versus 10.1%,

- the 13th highest replacement rate after the loss of the first income in the EU15

- 59.1% versus 68.5%.

And for an “average-income” no-child couple (single income at 100% of the average wage) Ireland has:

- the 12th highest effective income tax rate in the EU15

- 9.6% versus 14.0%,

- the lowest rate of employee social insurance contributions in the EU15

- 3.2% versus 11.9%,

- the second highest replacement rate in the EU15.

- 78.1% versus 63.9% .

All data (bar Ireland 2011 data where appropriate) are derived from the OCED’s tax-benefit calculator and is posted below the fold.

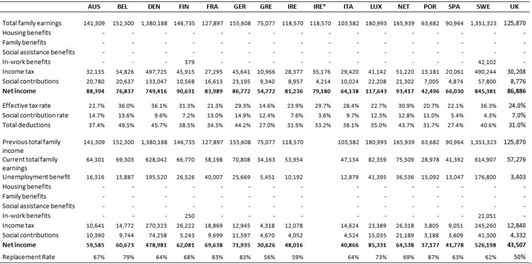

First here are the details for the double-income no-child couple with incomes of 200% and 167% of the average wage. The first net income refers to when both incomes are earned. The second net income shows the position one month after the loss of the larger income. Click to enlarge. All data is 2010 except IRE* which is 2011.

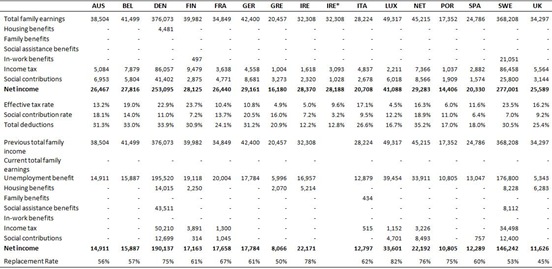

And here are the details for a single-income no-child couple with an income equal to 100% of the average wage. Again click to enlarge.

No comments:

Post a Comment