The CSO have released the December 2012 Retail Sales Index. There is something missing from the data – the much heralded “surge” in retail sales that apparently took place around the Christmas period. Here is the core retail sales index which excludes the Motor Trades.

There was an increase in December but only marginally. The trend in retail sales is up but this data do not reflect what was feted as “the best Christmas for retailers since 2007”. Here it might be a little instructive to use the unadjusted series that just looks at the amount of retail sales without taking seasonal factors into account. This chart has the unadjusted series for core retail sales (with December 2008 equal to 100).

Unsurprisingly there is a spike in retail sales each December. At 94.2, this year’s December peak was higher than each of the last two years (92.5 in 2010 and 93.3 in 2011 using the base in the chart) but was below both 2008 (100) and 2009 (94.7).

Maybe we are not looking in the right place. It would be great if the CSO provided a resource that allowed us to create selected sub-indices from the categories provided. The retail sales shown in the above charts include fuel, furniture, hardware, medicines and other categories which were likely excluded when Retail Excellence Ireland were making their seasonal claims. These items only make up about one-fifth of the indices shown above so their effect is unlikely to be significant.

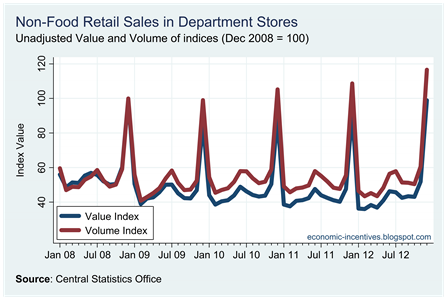

Although limited we can use one of the indices to check for the retail surge. Non-food sales in Department Stores are only about 1/12th of the above indices but might be expected to reflect the broader pattern in Christmas shopping. Here are the unadjusted series.

That seems more like it. The volume of non-food sales in Department Stores in December 2012 was indeed the highest since 2007. In fact, volume was nearly 20% higher than 2008. However, the value index was identical. See here. The adjusted series also shows a jump last month.

And this also shows that the trend in sales in Department Stores has been positive since about April of last year. However, apart from Department Stores it is hard to find evidence of the Christmas surge. Sales in bars did jump 5% in December but the underlying trend in this sector is unmistakeable.

The retails sales of electrical goods (computers and peripherals, televisions, radios and DVD players, games consoles and software and telecommunications equipment) has been positive in recent months (in volume terms at least).

The recent jump was due to the digital switchover in October rather than any pre-Xmas exuberance. Even still, the volume in this category in December was up 4% on last year, though the value of sales was down by around 1%.

It looks like the warning at the end of this post that “the plural of anecdote is not data” is borne out by the above data.

No comments:

Post a Comment