The dramatic rise of Irish bond yields seen towards the end of last week, continued on Monday. The rise has been greatest for bonds due to mature over the next few years. Here the the two-year yield constructed by Bloomberg.

In less than a week the yield has gone from 13% to nearly 18%.

The current EU/IMF deal is designed to provide Ireland with sufficient financing to cover the annual deficit and roll-over of debt until the end of 2013. That is still two and a half years away. The yields on bonds supposed to be covered by the EU/IMF deal is shooting up.

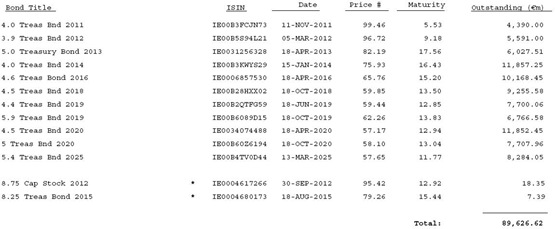

Whether we can actually get to the end of 2013 is another thing, but if we look a the daily outstanding bonds report (reproduced below) from the NTMA we see that the riskiest bond has shifted from that maturing in January 2014 to the bond maturing in April 2013. Click image to enlarge.

On 18th April 2013 we have a €6 billion bond maturing. The current design of the EU/IMF deal suggests that at that time we would have enough money to pay this bond. Markets do not believe that the deal will get that far. At the close yesterday this bond was trading with a yield of 17.56%, the highest of all Irish bonds.

I posted some further thoughts on these numbers over on the Independent Blog.

EURO CRISIS: Where will it all end? Follow the bond yields to find out ...

No comments:

Post a Comment