Much has been made of the recent movements in Irish bond yields in the days leading up to the junk status downgrade from Moody’s. We have been following dramatic graphs like the following based on the two-year yield constructed by Bloomberg. The rise in the past week has been vertiginous.

One question that emerges when looking at a graph like this is “how much volume is behind this move in prices?”. The Irish Stock Exchange can provide the answer. Here will we focus on the €11.8 billion bond due to mature on the 15th January 2014 – the so-called D-Day Bonds – which form the main constituent of the two-year yield estimated by Bloomberg.

Here is the daily closing price of this bond since the start of 2010. A price of around €100 corresponds to a yield of around 4%. The drop in price since the middle of last year has seen the yield rise.

The price drop that has given rise to the recent surge in yields is evident. The yield is now around 18%. This bond can now be bought for less than €70 – if you can find someone to sell it. Here are the daily volumes of this bond over the past 18 months.

It is pretty clear that since January the volumes of trade has been much lower. The series peaks on the 16th February 2010 when 2.4 billion of the 11.8 billion bond was traded. Just over 20% of the bond changed hands on that day.

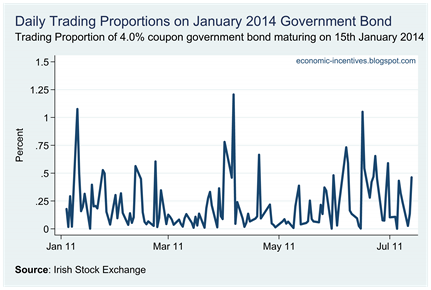

Here are the percentage volumes of the bond changing hands for each day in 2011.

There has been only three days this year when the trading volume exceeded 1% of the total volume issued. On average this year the daily trading volume has been 0.21% of the total. In 2010 the average was 1.22% – nearly six times larger.

The current precipitous drop in the price of this bond began last Wednesday. In the past week the bond price has dropped from €78.50 to €69. The cumulative trading volume over the past five trading days is 1.2%.

The surge in the yield from 13% to 18% has attracted significant attention, but for every 1000 units of this bond, the owners of 988 are exactly the same. In the vast vast majority of cases those who owned Irish January 2014 bonds last Wednesday are those who own them today. The trading volumes are very low.

Can we infer that these are true price changes when each day only 2 out of a 1000 bonds are traded? It will also be interesting to see what impact, if any, the downgrade to junk status by Moody’s has on trading volumes.

Based on yesterday’s closing price this bond with a nominal issue of €11.8 billion has a market value of €8.9 billion. We could reduce the amount of debt owed on this bond by 25% if we could buy all the bonds in issue at the current market price. Current trading volumes suggest that we would find very few bonds to buy.

No comments:

Post a Comment