Monday, May 24, 2010

Monday, May 17, 2010

Geographic distribution of new car sales

For the four months to April, SIMI’s figures give an increase of 38.3% on new car sales in the same four months last year. The Central Statistics Office also produce data on new cars on registrations. This is much more detailed than the SIMI data but the cost of this is a delay in the release of the figures. The CSO have two datasets of interest

- Vehicle Registrations collected from VRT returns to the Revenue Commissioners

- Vehicle Licensing collected from license plate numbers issued by licensing authorities

The Vehicle Licensing figures indicate that for the first four months of the year there was a 35.1% increase in the number of new passenger cars licensed compared to the same four months last year. This is broadly in line the the SIMI figures.

However using the CSO’s data we can get a breakdown of this by region. The top five areas for the first four months of the year are:

Four of the top five licensing authorities are in the south-east of the country. On this list Kilkenny is also eighth with an annual increase of 46.8%.

Four of the top five licensing authorities are in the south-east of the country. On this list Kilkenny is also eighth with an annual increase of 46.8%.The bottom five licensing areas are:

The two things to note here are the inclusion of Dublin in the bottom five, the country’s largest licensing area, and the negative figure for Limerick City, the only recorded drop in the country. By contrast Limerick County ranked 14th with an increase in car licensing of 42.2%.

Although in the bottom five, the increase of 2,214 in new passenger car licenses in Dublin City and County is greater than the combined increase of 1,751 recorded for the top five licensing areas in the first table.

A table of the data for the first four months of the year for all 30 licensing authorities is available here.

Finally, in percentage terms April was the best month of the year so far with an increase of 72.7% in new passenger car registrations on the same month last year. Limerick City continues to be the poorest performing area with a drop of 56.8% on last year. Waterford City and Roscommon also recorded drops. At the other end, nine licensing areas had an increase of more than 100%. Included here is the region of Cork City and County (+133.2%) which accounted for more than one-eighth of total licenses issued. Full table here.

Friday, May 14, 2010

Core Inflation remains unchanged

- Energy Products make up 7.8% of the overall index and rose from 2.7% in the month and are up 9.1% in the year.

- Mortgage Interest makes up 6.7% of the index and rose 2.9% in the month and is down 0.7% on the year.

The overall index is being pulled up because of increases in energy costs (prices and taxes) because the huge drops in mortgage interest after the ECB rate cuts took place more than 12 months ago and are now out of the 12 month measure of inflation.

Wednesday, May 12, 2010

Industrial Production drops back slightly

The CSO have revised the slight increase shown in the provisional figures for February to a slight decrease. The initial 1.2% monthly increase has been revised to a 1.3% decrease. There was also a monthly decrease of 2.6% in March. Even with these drops, the huge increase in January means the annual change in industrial production is still positive.

However it could be that the one-off monthly increase of 20% that occurred in January is masking the actual trend. If we look at the monthly changes, these have been negative for five of the past six months.

Industrial production has shown monthly decreases for 15 of the past 24 months. While the annual change remained positive in March, as it has for the first three months of the year, if the recent month on month trend continues (excluding the January blip) we could find industrial production dropping back below the levels seen last year. The release of the April figures in a month’s time will shed light on this.

Monday, May 10, 2010

Retail Sales climb again

The annual change by volume has been positive for the past two months. The annual change by value remains negative, because of price effects and possible bargain hunting, but has eased for the sixth month in a row to –1.6%. We are a long way from the rates of decline seen 12 months ago.

Of course, the caveat is that the all-businesses index is heavily weighted towards the motor trades. Motor trades make up 29% of the index in March and with new car sales in March up 78% on the same month last year, according to SIMI, this is bound to have a big effect on the all-businesses index.

Here we look at the index excluding motor trades.

Here we see that the annual declines have yet to unwind. Excluding motor trades, retail sales by value (-5.3%) and volume (-1.2%) are still lower than this time last year. Looking at the more recent monthly changes we see a more positive picture. When compared to February both value (+0.7%) and volume (+0.6%) have increased.

By volume, the monthly change in retail sales excluding motor trades has been positive for the first three months of the year with increases of 0.5%, 1.0% and 0.6%. We previously thought that the monthly change by value had been positive for February, but the preliminary estimate of +0.2% has been revised to –0.1% in the current release.

Looking at the actual index values we can see the slight upswing in the volume index represented by the above monthly increases. For the value index, it does appear that the index has ‘bottomed out’ but the signs of growth following a jump of 1.2% in January eased somewhat with the 0.1% drop in February. The 0.7% increase in March puts us back in a positive direction again.

Markets don’t work!

OK, I really don’t believe that and actually think that markets can be used in virtually all situations if properly designed and market forces are harnessed correctly.

However, last Thursday for about 10 minutes, at 7.45pm our time, the New York Stock Exchange did not work. This fed to other exchanges. In a few manic minutes the DJIA fell about 900 points or about 10%. There was little that could explain the precipitous drop.

Here is the few minutes as they played out on CNBC. This is one instance in which the irritating Jim Cramer seems to have been right on the money.

While there obviously was a stroke of luck that they put up the Procter & Gamble chart, there were other stocks that had even more dramatic falls. Some stocks that were trading at between $40 and $60 at 7.45pm fell to a fraction of a cent for a few seconds. See here.

The major exchanges came out later that day and said that trades that resulted in a move of more than 60% of the value of the share would be cancelled. Owners of shares on the list linked above that sold for 0.1 of a cent were undoubtedly pleased with that. With P&G falling by ‘only’ 30%, the trades that caused the swings in the above clip stand. As Cramer said a few lucky people are after making a lot of money very quickly.

Although not official yet it seems likely the drop was caused by automated selling rules that kicked once a particular level is broken. If a few major institutional investors have the same automated rule in place the market can become flooded with sell offers, that swamp the few bid offers that exist.

The automated sell trades looked for buyers at any level and probably found at few automated bid offers at ridiculous low levels. A trader who had bid offers inputted at very low levels suddenly struck it lucky. On 99.99% of days these low-ball offers would be ignored. Last Thursday was the 0.01% of days when the machines went haywire and those one-a-million prices came up – if only for a few seconds. Pretty quickly the traders would have seen what was happening (though probably not understood it) and would override the automatic trades. By then the damage was done.

Maybe a few of them should buy this t-shirt.

CAP payments and a small parish

Details of payments made to Irish farmers under the EU Common Agriculture Policy are made available on the website of the Department of Agriculture, Fisheries and Food. The link is here but the search feature is not very user friendly. The top 100 recipients have been extracted from the database and can be seen here.

There were 137,748 payments under CAP in 2009 to Irish recipients. The average payout was €14,020. The total payout was €1,931,253,085 (€1.93bn). I don’t really know much about the scheme and it’s overall effect. Natural curiosity brought me to examiner the figures from my home parish.

Here I saw that there were 150 recipients in the parish who received an average payout of €12,142, slightly below the national average. The total monies received by residents of the parish under the scheme was €1,821,339. It’s like the parish wins a lotto jackpot every year – guaranteed!

The highest payment was for €53,541 and the average of the top ten was €35,925. The lowest payment was €172 and the average of the bottom ten was €670. The median payment was €11,164. Details of the payments can be seen here.

The parish is Cappamore in Co. Limerick. According the associated Wikipedia page the population in 2006 was 1407 (669 in the village of Cappamore and 738 in the environs). This means the parish received €1,294 on a per capita basis if the total population is included (and is unchanged since 2006). The equivalent national figure is an average payout of around €430 per capita, around three times smaller.

The 2006 Census gives data on occupations. The lowest-level geographic area available from the Census are District Electoral Divisions. The Limerick DED of 057 Cappamore had a 2006 population of 1,400. This is not the same as the parish of Cappamore and includes parts of other parishes. Parts of the parish of Cappamore are not in the DED of Cappamore and are in the DEDs of 132 Bilboa and 062 Doon West. Although not analogous we can view the figures from the Cappamore DED as being generally representative of the area.

According to the 2006 Census data there were 26 males and 5 females with recorded occupations of ‘Farming, Fishing and Forestry Managers’ in the Cappamore DED. There were also three males and one female recorded as ‘Other Agricultural Workers’. This would suggest there is a maximum of 35 people employed as farmers in the Cappamore DED. The parish of Cappamore had 150 recipients (131 males and 19 females) under the CAP scheme. I am sure the difference can be accounted for by a number of factors but I cannot be certain which.

Wednesday, May 5, 2010

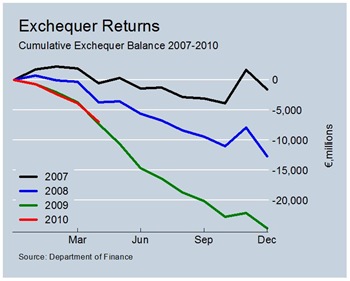

Exchequer Balance improves but..

Looking at the Current Budget Deficit we see that the cumulative deficit is still worse than last year, though the gap is narrowing. The current account was running a deficit of €6,428 million by the end of April last year. Even with the tax increases, social welfare decreases and public sector wage cuts introduced for this year the current account has run a deficit of €6,932 million to the end of April. This is an increase in the deficit of €504 million.

It should be noted that the deficit for April was less than the deficit for the same month last year. In April last year the current account ran a deficit of €3,797 million for the month. This year the equivalent figure was €3,226 million. This €571 million improvement was driven by both increases in taxation and reductions in expenditure.

Tax revenue in April was €182 million more than in the same month last year. Voted current expenditure in April was €164 million less than in the same month last year. The remainder of the improvement was due to non-tax revenue and non-voted expenditure. While it is likely that reductions in voted current expenditure will continue for the rest of the year we will have to wait to see if the increases in tax revenue seen in April will be maintained.

Tax Revenue Rises!

In an Information Note to accompany the release the Department state that:

Tax receipts are on target to end-April 2010. Overall €9,005 million in tax receipts were collected by the end of April, against a target of €9,012 million. The end-April year-on-year decline is 10.8%, at end-March it was 15%.I think this is understating what has happened in April. Here is the pattern in cumulative tax revenues the Department are commenting on.

The decrease on last year has eased for the past two months and we are now ‘only’ 10.8% behind the tax revenue collected last year.

The decrease on last year has eased for the past two months and we are now ‘only’ 10.8% behind the tax revenue collected last year. However, if we look at the actual annual change we see that in March revenues were €1,274 million behind last year while for April this decrease has fallen to €1,093 million. This means that more tax was collected in April of this year than in April of last year. The increase was actually €182 million or an increase of 11.5% for the month. This follows equivalent decreases in the first three months of the year.

The Department should be singing that tax is increasing but their monthly forecasts are proving ever more inaccurate. After a few months of high forecasts the DoF forecast for April was 17% below the actual outturn as can be seen here. Forecasts for the individual tax heads were even more erratic with corporation tax coming in over 250% ahead of target for the month!

The Department should be singing that tax is increasing but their monthly forecasts are proving ever more inaccurate. After a few months of high forecasts the DoF forecast for April was 17% below the actual outturn as can be seen here. Forecasts for the individual tax heads were even more erratic with corporation tax coming in over 250% ahead of target for the month!The monthly forecasts may be wide of the mark but the cumulative forecast is virtually perfect with €9,005 billion collected versus a target of €9,012 million. The Department are singing this one even if their forecasts for the individual taxes are also wide of the mark.

The 11.5% jump in monthly revenue for April is not down to one or two tax heads. If you look at the monthly revenues for the major tax heads here you can see that all except one were higher than the same month last year. The only tax that is down is Capital Gains Tax and that only makes up 1.2% of this year’s tax take.

The annual picture is still bleak, but a couple of more months like this should see things quickly improve. Whether this will happen is hard to know.

The annual picture is still bleak, but a couple of more months like this should see things quickly improve. Whether this will happen is hard to know.It is still too early to declare the collapse in tax revenue over. The monthly tax revenues are subject to many fluctuations. Also April is the least important month for tax revenues in the year. It is not a VAT return month and last year April accounted for less than 5% of the revenue collected. The increase of €182 million can be attributed to the increases in VAT and Corporation Tax. April is not a VAT return month and is usually not important for Corporation Tax so these increases could just be down to timing issues rather than indicative of any general upswing.

We will delay holding firm convictions on the stability of tax revenues until we see next month’s figures, which will include a VAT return with March-April VAT due by the 19th May, and will also provide a better indication of the amount of preliminary Corporation Tax being paid.

EU Commission changes tack

Just seven weeks since the EU Commission admonished Ireland for using “favourable” macroeconomic growth forecasts in our budgetary policy documents.

Back in March the Commission published their opinion on Ireland’s Stability Programme Update published in December 2009. In the update the Department of Finance laid out the figures detailed how Ireland will get our budget deficit back under the 3% of GDP limit by 2014. This is the table that shows us getting back to the magic 3% level.

The Commission’s Opinion concluded that these projections were vague and overly optimistic. They said

The budgetary outcomes could be worse than targeted throughout the programme period, mainly due to

- The fact that the consolidation efforts planned after 2010 are not underpinned by broad measures and are of an indicative nature only;

- The programme's favourable macroeconomic outlook after 2010; and

- The risk of expenditure overruns in 2010 and also beyond, to the extent that the still to be spelled out strategy should rely on expenditure restraint.

This, together with the likely need for further support measures for the financial sector, implies that also the debt ratio could turn out higher than planned in the programme.

Today the Commission releases their Spring Forecasts for the EU Economics. The report on Ireland can be seen here with their main forecasts shown below.

The EU’s 2010 growth forecast is now better than the –1.3% included in the SPU and the 2011 forecast has jumped up to +3.0% just below the +3.3% used in the SPU. Who is using favourable figures now?

The SPU has forecasted an average growth rate of 4% from 2012 to 2014 and the EU does not provide fresh forecasts for these figures. Back in March they cast doubts on these but now they seem to have jumped on the ‘glass is half full’ bus.

Is this what the EU Commission actually believe or are they just trying to get some positive news out there in the midst of the Greek debt crisis and fears of contagion to the other PIIGS. The final paragraph in the Irish section should be enough to inform us of the validity of these projections.

On 30 March 2010, the authorities announced the transfer of a first tranche

of loans to NAMA and the likely need for further capital injections into some banks. An effect of such capital injections on public finance developments within the forecast horizon cannot be excluded. However, in the absence of detailed information on the nature and size of these operations, the forecast does not include any impact.

One sentence after saying that the recaps “cannot be excluded”, the Commission admit that the they “do not include any impact” of NAMA and the recaps from their projections. Billions of euro are committed to these ‘projects’ but the EU have decided to leave them out. This comes only three weeks after the EU decided that the €4 billion Anglo Irish Bank recapitalisation should be included as part of the 2009 Budget Deficit. This brought the deficit to the 14.3% of GDP figure seen in the table above.

Even excluding the banking commitments we have made the EU are projecting a budget deficit in 2010 of 12.1%. Thus it may appear that our deficit is declining. Now is seems the EU are in on our attempts to cook the books!

The Minister announced the details of the bank package back in March. Surely this “was detailed information on the nature and size of these operations” that would have allowed these figures to be included. If they were (as they should be) the projected budget deficit for Ireland would be close to 20%.

Are the EU afraid of spooking bond markets if they tell the truth?

Tuesday, May 4, 2010

Car sales up by almost 100% in April

Month | 2009 | 2010 | Change | % Change |

January | 15,799 | 16,595 | +796 | +5.0% |

February | 8,883 | 12,306 | +3,423 | +38.5% |

March | 7,764 | 13,813 | +6,049 | +77.9% |

April | 4,373 | 8,544 | +4,171 | +95.4% |

Total | 36,819 | 51,258 | +14,439 | +39.2% |

We can see that annual changes have increased for each of the first four months of the year. For the year to date 14,439 (or 39.2%) more cars have been sold than in the same four months of 2009 according to the SIMI data.

Although there is an improvement, sales are still substantially below the levels seen prior to the current downturn. Year-to-date sales are 52.0% below the 2008 levels and 56.4% below the 2007 peak. This is shown in the graph below with an alternative representation of the data to April available here and full-year data here.

These numbers will provide a strong boost to retail sales figures. The March Retail Sales Index is due to be released by the CSO later this week. The 77.9% annual increase in new car sales seen in March will provide strong boost for the All-Businesses Retail Sales Index with motor trades making up 29.0% of the March Index. What will be more interesting will be the performance of the Retail Sales Index excluding motor trades.

SIMI also claim that ‘only’ 5,000 of the almost 51,000 new car sold have seen buyers avail of the €1,500 VRT scrappage scheme rebate. They also say the following:

An additional €60m in VAT and VRT for Government coffers has been generated from new car sales even after subtracting scrappage refunds.It is hard to believe that is additional €60 million in VAT and VRT is due to the scrappage scheme. To generate €60 million in revenue the 5,000 cars sold under the scrappage scheme would have to contribute €12,000 each VAT and VRT and €13,500 if we were to account for the €1,500 rebate.