Last Friday the Department of Finance published the Exchequer Statement for June. The gives us a picture of tax returns for the first half of the year. It appears to me that the rate of decline in tax revenues has eased dramatically and we may not be too far from some real stabilisation. Prepare for death by tables in the following analysis! The usual graphs are also produced.

The source documents are:

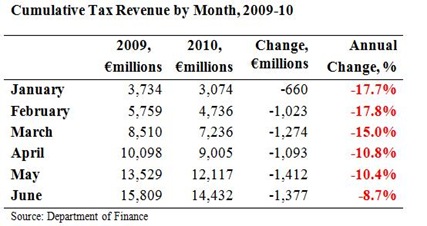

Most of the mainstream commentary focused on €227 million or 1.6% shortfall relative to the Department of Finance forecasts. This is only a small part of the picture. What is of more interest is the performance of tax revenues in the first six months of 2010 relative to the same period in 2009.

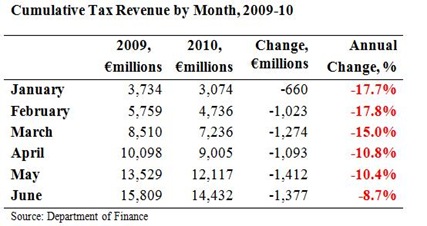

Comparisons of cumulative tax revenues are given in the first table below. Here we see that by the end of June tax revenue is almost €1.4 billion or 9% below tax revenue from last year. Just because most of this deterioration was expected does not detract from the nature of the decline.

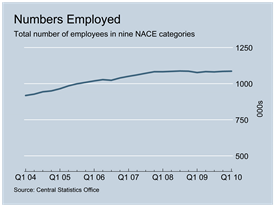

This deterioration is seen across all the main tax headings. Only the relatively insignificant Capital Acquisitions Tax shows an improvement in performance relative to last year. All other taxes are down. Most significant are the large drops in Income Tax and VAT, both of which are down almost half a billion euro on last year.

If we look at the more immediate figures and look what has happened in June alone we see that tax revenue in June was slightly up on the same month last year. This is the second time in three months that this has happened.

It should be noted that April and June are non-VAT months, and the fall in May means that revenues for the second quarter are still 1.4% below those from the same quarter last year.

Again the standout figure is the poor performance of Income Tax. And we see that for four of the eight tax headings the quarterly comparison is positive. The 1.4% drop for Q2 is a major improvement from the first quarter when tax revenue was 15.0% behind the 2009 figure (€7,236 million versus €8,510 million) and the comparison for all eight tax headings was negative. Is this a sign of stabilisation after all?

So far in 2010, tax revenue is €1,377 million behind revenue in the same six months of 2009. However €1,275 million or 92.6% of this drop occurred in the first three months of the year. The second quarter only accounted for €103 million or 7.4% of the total drop. The first three months of the year were catastrophic in terms of tax revenue but there does appear to have some degree of relative stabilisation since then.

If we return to the monthly revenues for June and examine the individual tax headings we can see that the 1.5% increase relative to June 2009 was driven entirely by a 16% jump in Corporation Tax revenues. Companies paying preliminary Corporation Tax in June are those who have a year end of the 31st December. It remains to be seen whether this is a precautionary move on the part of these companies or whether they actually will have a higher Corporation Tax liability in 2010. Again we see the continuing poor performance of income tax relative to last year. Most other tax headings are relatively unimportant in June.

The Department of Finance had been predicting a slightly better June, and tax revenue came in €80 million or 3.3% below the Department’s June forecast. However, this was actually the best of the Department’s forecasts of the year so far.

Looking at the individual tax forecasts we see that the Department’s forecasts for June held up quiet well in all cases, except one. The Department forecast most of the jump in Corporation Tax but continued to underestimate the fall in Income Tax receipts. Excluding income tax the forecasts were close to accurate but the Department expected 10% more Income Tax to be collected.

The information note published with the returns may suggest that the Minister is relatively satisfied with the Department's forecasts and that “Budget Day targets remain valid”. However, after almost coming in on target in April (only 0.1% below target) the gap between cumulative tax revenues for 2010 and the Department’s forecasts of same has been widening. It was 1.2% in May and was 1.5% in June. And remember these are targets that already forecast a 6% drop in the annual tax take.

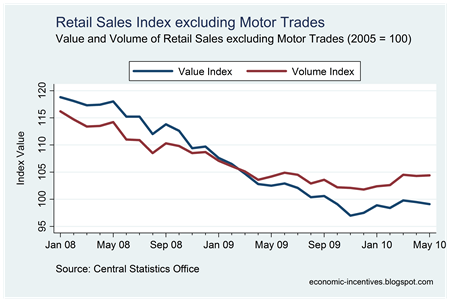

It will be interesting to see what will happen over the next few months. Without doubt the poor performance of Income Tax receipts will continue. July is a VAT month and one wonders whether the improvement to a drop of only 1.3%, compared to the same month last year, seen in May will persist.

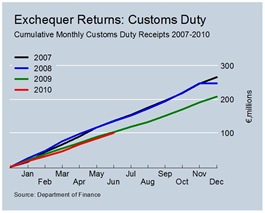

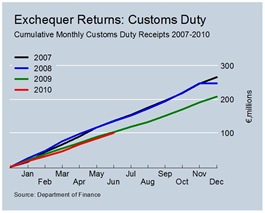

For those who prefer a visual representation of the figures here are some graphs that show the pattern to tax revenues for the past three years. First, here’s total tax revenue. The red line showing 2010 tax revenues continues to slip below the green line showing 2009’s dismal tax revenue when compared the 2007 and 2008 figures.

Here are the same graphs for the individual tax headings. Click individual graphs to enlarge. Constantin Gurdgiev provides some analysis of these exact graphs

here.