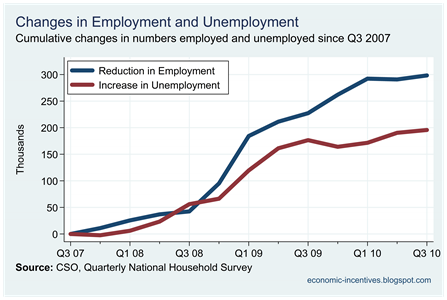

Although both exports and imports fell in the month to October, the figures do little to belie the perception that Irish goods exports have shown remarkable resilience during the current crisis with imports falling significantly. In October, in seasonally adjusted terms, exports fell 1.9% and imports fell by 11.2%.

This resulted in a further widening of the trade surplus.

The seasonally adjusted trade balance for October was a record €4.153 billion. It should be noted that this increase in the trade balance is a result of the drop in imports rather than an increase in exports.

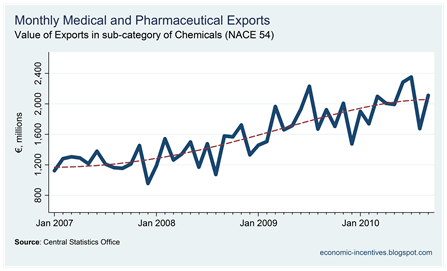

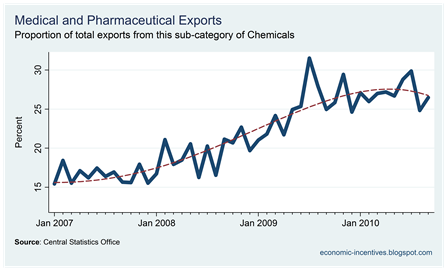

On the export side the importance of medical and pharmaceutical products remains. We now have the breakdown of exports by category to September. Here are medical and pharmaceutical products exports.

Exports in this category have increased to an average around €2 billion a month in 2010, up around 66% from the average of €1.2 billion a month seen in 2007. Medical and pharmaceutical products now make up around one-quarter of total Irish merchandise exports.

In fact, total exports in NACE Category 5 chemicals are now around €4.5 billion a month and make up nearly 60% of total goods exports from Ireland. Graphs of the amount and proportion of exports from this category are behind the links. Here we see the proportion of exports from all ten main NACE categories. Click graph to enlarge.

The dominance of ‘Chemicals and Related Products’ is visibly clear and outside of ‘Food and Live Animals’, ‘Miscellaneous Manufactured Goods’ and ‘Machinery and Transport Equipment’ the remaining categories are largely insignificant.

Next we consider the performance our merchandise exports excluding the high value chemicals sector.

Outside of Chemicals, Irish exports dropped markedly during 2007, 2008 and 2009. The performance of Irish exports in the recession has been masked by the strong performance in the Chemicals category, and in particular in the Medicine and Pharmaceuticals sub-category.

It must be noted that there has been something of a turnaround in 2010 and in September these exports recorded their highest monthly level since October 2008. In fact, if we consider the Balance of Trade for all goods except NACE Category 5 Chemical and Related Products we see that the rest of the economy is moving to surplus after a persistent deficit.

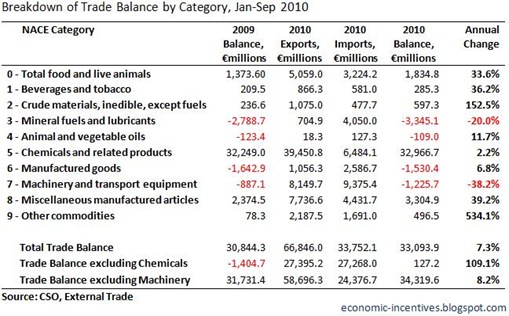

Here are the trade balances broken down by the main NACE categories.

Excluding Chemicals there is only a trade surplus of €127 million. However this is a turnaround from the deficit of €1.4 billion recorded to the same time last year. As with the improvement in the overall trade balance the increase in the trade balance excluding chemicals is down to a fall in imports but for 2010 there also has been a general increase in exports. The following table shows how all export categories have been performing this year. It is a good news table!

In the first nine months of the year exports are ahead of 2009 levels in all categories except Machinery and Transport Equipment. For the same period exports are now only 0.5% behind the peak recorded in 2007, though this is mainly due to the 20% increase in the Chemicals and Related Products category in that time. Most of the other main categories are showing double-digit declines on their 2007 levels. See table here.

Although several categories are down on their 2007 levels the main drag on Irish exports over the past four years has been the ‘Machinery and Transport Equipment’ category. Exports in this category have fallen by almost 50%, and are almost €1 billion a month lower than they were at the start of 2007.

Although there are several sub-categories in this group most of the decline can be attributed to the collapse in the exports in the ‘Office Machines and Automatic Data Processing Machines’ (i.e. computers) sub-category. Exports in this category have fallen by almost 65%.