November is always key month for tax revenues and today’s Exchequer Returns were always going to be read carefully ahead of next Tuesday’s Budget. The relevant documents are:

As per usual much of the focus will be the performance of tax revenues relative to Department of Finance forecasts. We’ll come to that, but we’ll start with a real comparison to last year’s figures.

The rate of decline continues to ease and we are now ‘only’ 4.1% behind last year’s tax revenues. In fact we have now had three months in a row where tax revenues are above last year’s levels.

Although the decline in tax revenue is easing if we look at the causes of the €1.3 billion decrease on last year, we see that all bar two relative minor tax heads are still behind last year’s levels.

The largest falls have been in Income Tax and VAT reflection the continuing lethargy in the labour and retail markets. These two tax heads are now down €1.1 billion between them, which accounts for most of the decline we have seen this year. The best performing of the four key tax headings is Excise Duty which is only €8 million or 0.2% behind last year.

Although this year-on-year comparison paints a pretty grim (red!) picture if we confine this to the last three months (i.e. September to November) things look a good deal better.

Compared to the first three months of the year, this three-month period is nearly a complete turnaround. On this comparison one could argue that tax revenue is rising! Of course, it is a very selective snapshot and is mainly driven by Corporation Tax, but bar CGT every tax head is now performing better (or at least performing less worse) than it was at the start of the year.

Returning to the November returns in more deal we will now consider the €127 million year-on-year increase for the month.

The notable features are the continued poor performance of Income Tax and the greater than 10% rises in Corporation Tax and Excise Duty. Corporation Tax has now been ahead of 2009 levels for the past three months. See here. In fact, for these three months Corporation Tax has been almost €500 million up on the 2009 figures. For the full year Corporation Tax is still down €83 on last year but this decline was running at €582 million in August.

Income Tax has been behind the 2009 receipts for 10 of the 11 months so far this year. See here. Income Tax is now running 5.9% or €646 million behind last year. Similar monthly and cumulative tables can be seen for the other main tax heads, VAT and Excise Duty.

Excise Duty has performed relatively well this year. It has been ahead of 2009 for five of the 11 months so far this year and is only €8 million behind on the cumulative total. For all six of the VAT return months this year (Jan, Mar, May, Jul, Sep & Nov) VAT receipts have been behind the equivalent figures from 2009 though this deficit has eased considerably and was only a €1 million decrease in November. Cumulatively, though VAT is still €487 million behind last year.

As everyone else gives them coverage we may as well examine how taxes have performed relative to the Department’s forecasts.

Tax revenue has been ahead of target since October and is now close to €0.5 billion up. When looking at the monthly totals we see that revenue has been ahead of target for the past four months.

For the last four months tax receipts have been €717 million ahead of target. The Department predicted that tax revenue would be €452 million lower than 2009 but it actually turned out to be €265 million higher. By the end of November seven of the eight tax heads are “ahead of target”.

For most of the tax heads to surplus over target is relatively small. The notably exception is Corporation Tax which is now running €589 million ahead of target. Although predicted to fall by 2.6%, Income Tax is actually 5.7% down on last year.

November was a pretty amazing month for the monthly tax forecasts of the Department. All eight tax heads were ahead of forecast with Corporation Tax again providing the biggest jump.

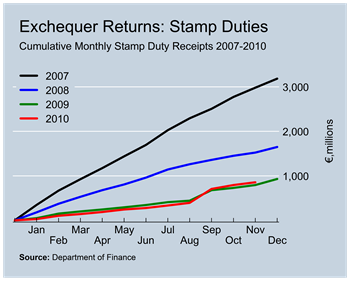

Here are the graphs. Click all images to enlarge.

One final issue to consider is the relative contribution of each tax to the total tax take.

The relative increase in the proportion of tax collected from Income Tax, VAT and Excise Duty is evident. In 2006 they made up 68.6% of tax revenue. This year they comprise 82.6% of tax revenue. Some of the features of the recently released Four-Year Plan suggest that it is intended to at least maintain this.

Income Tax will be increased with the reduction of the relief on pension contributions to the standard rate and the reduction in tax credits. The VAT rate is being increased from 21% to 23% while the doubling of the Carbon Tax will add to excise duty receipts.

This increase in sales taxes has important implications given the regressive nature of these taxes.

No comments:

Post a Comment