The last week or so have seem the claims move to faux outrage to the impact of the structural deficit rule. As per the Treaty, this will require Ireland to move to a structural deficit of no more than 0.5% of GDP over a timeframe to be agreed with the European Council.

The largest party of the ‘No’ campaign regularly claim:

“The Governments campaign is based on fear and evasion. They are asking us to sign up to new rules and regulations that will cost every single voter but refuse to tell us how much. They are asking us to write a blank cheque knowing that the cost will be at least €6 billion.To ensure that this is quoted accurately you can see more here, here, here and here:

“The Government has a responsibility to explain to people the cost of a Yes vote. If the Treaty is passed we will have to reach a structural deficit of 0.5% after we exit the current Troika austerity programme in 2015.The figures come from the Stability Programme Update released a few weeks ago. The projections of the structural budget balance are on the last page which has a table which shows that using the methodology applied by the European Commission it is projected that there will be a structural deficit of 3.5% of GDP in 2015. Just a few pages earlier it can be seen that the projected nominal GDP for 2015 is €178,850 million.

“According to the Department of Finance’s own Spring Forecast published last week the structural deficit in 2015 will be 3.5%. The gap between this figure and the new 0.5% rule is equivalent to approximately €6 billion.

It can be seen that the 3 percentage point gap is equivalent to €5,365.5 million. There must be some imprudent application of the rounding rule being used to bring this to the €6 billion figure used above.

At this remove it is impossible to know what the structural deficit will be in 2015 (will we ever know?) and suggesting that there is a €5.4 billion gap to be filled may be an accurate representation of the situation. This is not what is being claimed though and there is repeated reference to “€6 billion of cuts” but the claim that this is based on the upcoming referendum are very wide of the mark. We cannot just vote away the necessity to reduce the budget deficit.

The structural deficit can be reduced through a combination of three factors:

- economic growth

- structural improvements in labour and capital

- fiscal consolidation

In December 2005 the Department of Finance decided that Ireland would set itself a Medium Term Budget Objective (MTO) in terms of the structural deficit that would be “close to balance”, that is 0% of GDP.

The Stability Programme Update released with Budget 2010 in December 2009 contains the following useful section on page 32:

Review of Ireland’s medium-term budgetary framework and proposed reforms

In considering improvements, it is important to note the procedures already in place. Ireland’s budgetary process is already conditioned by various rules and requirements:

Under the Stability and Growth Pact,This was published two and a half years ago and clearly states that Ireland has the “obligation” to move to a “structural balance” after we exit the EDP (which was subsequently extended to 2015). This is actually more stringent than the –0.5% of GDP limit placed on the structural deficit in the Fiscal Compact.Under the Excessive Deficit Procedure,

- There are ceilings of 3 per cent of GDP for the general government deficit and 60 per cent of GDP for gross government debt.

- Medium-term budgetary objectives for the structural balance of the public finances.

- The Irish authorities have made commitments aimed at reducing the general government deficit below 3 per cent of GDP by 2014 – with implicit strictures on taxation and expenditure.

- The EU’s fiscal surveillance process calls for improvements in national fiscal governance arrangements capable of improving the sustainability of public finances.

- There is an obligation to make annual improvements of 0.5 per cent of GDP towards structural balance after the excessive deficit has been corrected.

In the April 2011 Stability Programme Update (which is still seven months before the Fiscal Compact came into being) the Department of Finance announced a revised Medium Term Budget Objective on page 39:

In October 2007, the ECOFIN Council agreed that long-term fiscal sustainability, notably the future impact of ageing, should be better taken into account when Member States are determining their medium-term budgetary objectives (MTOs). The subsequent EU Commission document “Modalities for the implementation of the new MTOs” set out the methodology for doing so. In the Irish case, the findings suggest an MTO of -½ per cent of GDP, which allows for 33 per cent of the likely cost of ageing to be covered.In April 2011, without any recourse to a treaty, the Department of Finance announced that we were changing our MTO to –0.5% of GDP. We were obliged to achieve what is set out in the Fiscal Compact long before this campaign begun. How come it took until the announcement of a referendum to generate such interest in something the Department of Finance have been discussing and committing us to for six and a half years?

This was re-emphasised on page 31 in the most recent Stability Programme Update a few weeks ago:

As discussed in last year’s SPU, Ireland’s ‘medium-term budgetary objective’ (MTO) currently stands at -0.5% of GDP. This objective was set well in advance of the Inter-Governmental Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (the ‘Stability Treaty’). Ireland is making progress towards the achievement of its MTO, with further progress to be made in the post-2015 period on a phased basis, in accordance with a timeline to be agreed.The “timeline to be agreed” will be in line with the Code of Conduct of the Stability and Growth Pact as revised by Council Regulation 1055/2005 and the application of this will not be changed by the referendum result. The regulation states that:

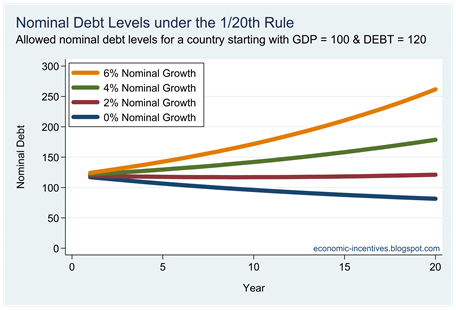

The Council, when assessing the adjustment path toward the medium-term budgetary objective, shall examine if the Member State concerned pursues the annual improvement of its cyclically-adjusted balance, net of one-off and other temporary measures, required to meet its medium-term budgetary objective, with 0,5 % of GDP as a benchmark. The Council shall take into account whether a higher adjustment effort is made in economic good times, whereas the effort may be more limited in economic bad times.This means we could have up to six years to move from a structural deficit of 3.5% of GDP to under the 0.5% of GDP limit. As we are a high-debt country we will probably be asked to achieve that more quickly but even four years would give plenty of opportunity for economic growth and structural improvement to contribute to the effort.

The fiscal rules in the Treaty are not “new” and we cannot avoid them by voting ‘No’ in the referendum. There maybe reasons for rejecting this Treaty but a claim that it will cost €6 billion in extra cuts and taxes has very little going for it. In fact, you could say that compared to what were committed to in December 2009, the Treaty will actually save us something.