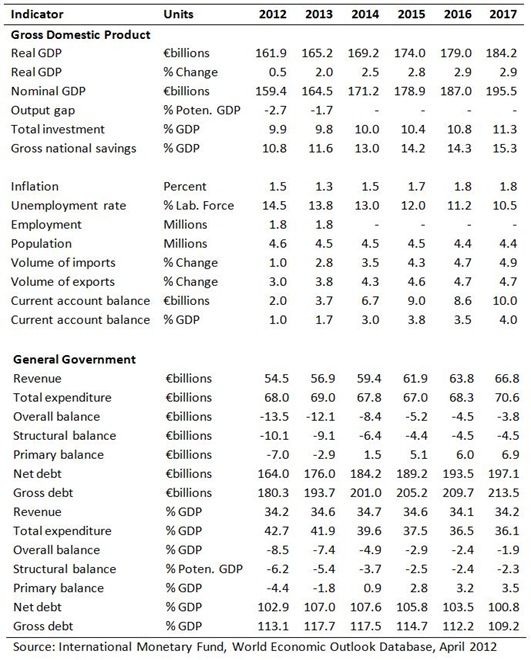

“The underlying (structural) budget balance […] respects the terms of the Stability and Growth Pact, and is consistent with a medium-term objective of keeping the budget close to balance”This document set Ireland’s medium term budget objective as a structural budget balance of 0% of GDP, i.e. balanced. This document was the December 2005 Stability Programme Update published with Budget 2006. The quote is from page 5.

It is nearly six and a half years since Ireland first announced the target of a budget with a structural balance of 0% of GDP. In fact, most EU countries set similar targets in 2005. This table is taken from page 47.

The range of medium-term budget objectives is from a low of –1.0% to GDP for four countries to balanced or “close to balance” for Ireland and eight other countries, up to a high of +2.0% of GDP for Sweden. These are all in line with the provisions in the Fiscal Compact component of the Treaty on Stability, Cooperation and Governance agreed in January of this year.

As part of the 2005 revision of the Stability and Growth Pact, Council Regulation 1055/2005 was introduced in June 2005 which augmented the original Stability and Growth Pact with the following:

“Taking these factors into account, for Member States that have adopted the euro and for ERM2 Member States the country-specific medium-term budgetary objectives shall be specified within a defined range between – 1 % of GDP and balance or surplus, in cyclically adjusted terms, net of one-off and temporary measures.”The original SGP from 1997 merely said that countries were “to adhere to the medium term

objective of budgetary positions of close to balance or in surplus” (Council Regulation 1466/97). The structural deficit variation of the rule was introduced in 2005.

There is nothing new in the ‘balanced-budget rule’ in the Fiscal Compact. Of course, just because something is already in place does not mean it is correct. But if it is wrong why has it taken seven years for those who object to the balanced budget rule to voice their concerns? A short chronology of the changes to the Stability and Growth pact is provided here.