Here is the text of an article written last week that was published in tonight’s Evening Echo.

Our banks now just worth €12bn

In the course of the past four years Ireland has poured €64 billion into the recapitalisation of just six banks: AIB, BOI, EBS, PTSB, Anglo and INBS. Just over €1 billion was received in return for the sale of around one-sixth of Bank of Ireland so this leaves the total recapitalisation bill at around €63 billion.

Of the €63 billion that has gone into the banks, €35 billion has been provided to Anglo and Irish Nationwide. These dead banks have been merged into the Irish Bank Resolution Corporation (IBRC). The bulk of this money was provided via €31 billion of Promissory Notes issued in 2010, while €4 billion of cash was provided to Anglo in early 2009 when we were still in the notional realm of “the cheapest bailout in the world”.

Discussions to change the repayment of this money have been ongoing for months. The aim for Ireland is to try to delay the repayment at low interest rates for a very long time, say 25 years, to allow growth and inflation the opportunity to reduce the real cost of these banking failures.

The recent announcements actually mean little for the mechanics of this process but the setting of an October deadline for a decision on the Irish banking debt does mean that we now have a firm date for when these discussions should yield a tangible result.

Recent weeks have seen much more focus placed on the viable banks. The recapitalisation process over the past few years has seen the State acquire fully PTSB and EBS and own so much of AIB (99.8%) so as to be indistinguishable from full nationalisation. The sale of some equity has left the State with a 15% shareholding in Bank of Ireland.

The major shift announced at the last summit is the intention to allow the Eurozone’s permanent rescue fund, the European Stability Mechanism, to directly recapitalise banks thereby bypassing the need to have the debt added to the government’s debt.

This will not happen immediately and needs the creation of a eurozone banking supervisory structure before it can happen. It could be a year or even longer before this is in place. If it does happen the ESM could become the owner of bailed-out banks and the hope is that this can be retrospectively applied to the Irish case.

In total we have spent around €28 billion on these banks. We have spent €25 billion on shares of different types that has resulted in our ownership of them and we also bought €3 billion in subordinated bonds from the banks. This bond forms part of the contingent capital of the banks is due to be repaid in 2016 if the banks do not incur losses above those set out in the adverse scenario in last March’s stress tests.

To get back some of this money we could continue the sale process that saw €1 billion received from private investors in 2011 for some of Bank of Ireland. However, there is little hope of finding private investors willing to pay a price to take on the risks of Irish banks that would make such a sale an attractive proposition.

The avenue that has now been opened is that in 2013 or 2014 the European Stability Mechanism (ESM) could become an official purchaser of the banks and in this way could take the banks off the balance sheet of the Irish government.

The ESM is not going to cover legacy losses in banks and if it is to purchase the State’s banking portfolio it will probably do so at a fair or market price. We have spent €25 billion in acquiring these banks but they are not worth that now.

The National Pension Reserve Fund holds 15% of Bank of Ireland and 99.8% of AIB (as merged with EBS) and values these holdings at €9.4 billion. This is subject to review as there is no properly functioning market for shares in AIB that allows the value of the bank to be determined.

The Minister for Finance holds 100% of PTSB and acquired this for around €2 billion but no current value for this has been publicly provided. PTSB has problems with cheap tracker mortgages which significantly undermine the long-term profitability and hence the value of the bank.

As with any sale the price to be struck will be subject to negotiation, offer and counter-offer. Using the NPRF’s current valuation it seems likely that a price of €12 billion would be as much as could be expected if we look to transfer our ownership of AIB, BOI and PTSB to the ESM.

Assuming the €3 billion of contingent capital is not required and the subordinated bonds are repaid this means that we could expect around €15 billion to be returned on a total outlay of €28 billion. This can be viewed as either crystallising a loss of €13 billion with no hope of return or the receipt of €15 billion which can be used reduce our soaring government debt.

The transfer of the banks to the ESM means we would be shut out from the upside should their value rise above the agreed price when the ESM itself sells them on. Viewing the banks as assets with profit making potential is not something we are accustomed to.

For the last few years the banks have been considered a liability with their losses being made good by the State to allow their creditors to be repaid. Transferring the banks to the ESM would remove a significant uncertainty from the medium-term outlook for the solvency of the Irish state.

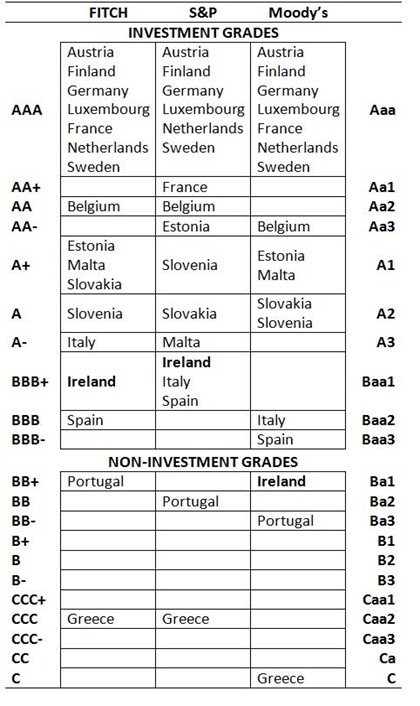

This uncertainty is that there are even more losses lurking on the balance sheets of our ailing banks and if these are unearthed the State might be required to provided even more recapitalisation money. It is likely that this uncertainty to the downside weighs on Irish government bond prices, driving up yields and potential borrowing costs.

Although this sale would eliminate the chance to benefit to the upside and will lead to foreign ownership of the entire Irish banking system, the transfer of the banks to the ESM would remove the above uncertainty and make a full return to bond markets more likely. The balance of these costs and benefits will be determined by the price.

If a high enough price is negotiated the viable banks should be sold to the ESM. If this is allied to an improvement of the terms in the money used to bailout Anglo it would be a welcome boost for Ireland.

This would not ensure a return to a functioning banking system and other problems such as the massive budget deficit, large household debt and the unemployment catastrophe will remain, but would be a important step in allowing us to move out of this crisis. Our expectations have been raised; they better be delivered on.