One of the stand out features of the political commentary on our economic woes has been references to our ‘strong export performance’.

If we look at the most recent set of figures from the CSO’s Quarterly National Accounts this seems to be supported.

There is little evidence of a contraction here. Ireland’s export performance in 2009 was comfortably the best in the EU. Figures from Eurostat in table here. Ireland’s exports in 2009 were very favourable in comparison to Germany (-16.9%), the UK (-18.3%), France (-15.4%) and non-EU countries such as the US (-9.7%), Japan (-21.3%) and Norway (-22.3%). Ireland’s exports for the first half of 2010 are about 6.7% ahead of the 2009 figure.

In response to the latest National Accounts figures, Brian Lenihan said

“The figures for exports are strong and I am encouraged by this, the necessary competitiveness improvements are working. We must export our way out of our current difficulties, there is simply no other way."

So is our export performance as strong as the headline figure suggests and is this the way out of our current difficulties?

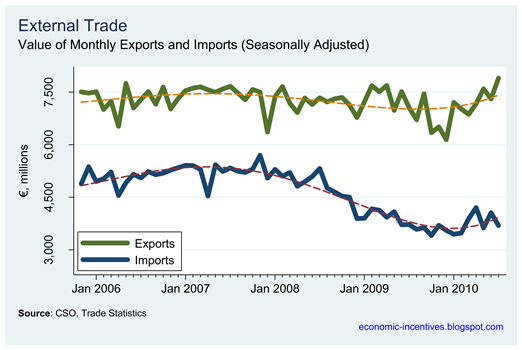

Our exports are approximately made up of 55% merchandise and 45% services. See table here. We can get details of our merchandise or goods exports from the monthly Trade Statistics bulletin produced from the CSO. Here are our monthly imports and exports since 2006.

The pattern of the goods exports above is little different from the pattern of the total exports in the first graph. The Trade Statistics give details on the type of goods being exported according to the NACE classification.

The importance of the Chemical and Related Products category to Irish exports is clearly visible. In 2009 this sector made up 57.5% of total merchandise exports and grew by 8.5% while seven of the ten categories showed double-digit declines. This category itself is dominated by two subcategories; organic chemicals (21.2% of total goods exports) and medicinal and pharmaceutical products (25.5% of exports).

One quarter of all Irish exports are derived in the medicinal and pharmaceutical products category. Even in the face of the global downturn in 2009 this sector managed to show a 26.8% increase on the 2008 figure. Here is the monthly pattern of pharmaceutical exports since 2006. The “strong” performance is very evident.

One quarter of all Irish exports are derived in the medicinal and pharmaceutical products category. Even in the face of the global downturn in 2009 this sector managed to show a 26.8% increase on the 2008 figure. Here is the monthly pattern of pharmaceutical exports since 2006. The “strong” performance is very evident.

Over the last few years the relative importance of this category to Ireland's exports has increased from just over 15% of total goods exports to over 25% now. Graph here. I may be mistaken but I cannot recall the project announcements, facility extensions and new jobs that have allowed our pharmaceutical exports to increase from about €1.2 billion a month to close to €2 billion a month.

If we exclude this one category from a graph of Irish exports what pattern do we see?

This is much more representative of the export pattern that has been seen in most countries. Excluding medicinal and pharmaceutical products, Irish exports in 2009 were down 9.2%. Exports for the first six months of 2010 are down 4.6% on the equivalent six-month figure for 2009. The performance of the medicinal and pharmaceutical products sector is masking the true reflection of Ireland’s export performance.

However the drop in 2010 compared to 2009 is driven by a fall in one category – machinery and transport equipment. For the first six months of 2010 this category is down almost €2 billion or 27% on the equivalent figure for 2009. The 2010 figure for all other categories is ahead of their 2009 levels. Exports may have fallen during 2009 but a recovery of sorts seems to be underway in 2010 supporting claims by Enterprise Ireland that “70% of orders lost in 2009 have been recovered”. See table here.

The drop in machinery and transport equipment has been ongoing for a number of years and is been driven by a rapid fall in computer exports. See graph here. At one stage this category comprised over 25% of total goods exports. For 2010 the relative importance of the chemicals and related products category has now risen to nearly 60% of our total goods exports.

One final issue worth considering before finishing on our merchandise exports is the number of jobs in these sectors. These can be roughly approximated from the CSO’s Industrial Production releases which give some details of employment in the "modern” sector. The data is not very precise but we can look at employment numbers in two categories.

The sector which includes chemicals and pharmaceuticals has seen a 12.3% increase in employee numbers between 2008 Q1 and 2009 Q2. The sector which includes computers has seen a 33.5% reduction in the number of employees in the same time.

Between the same quarters exports of pharmaceuticals have increased by 29.8% while exports of computers have decreased by 38.3%. It seems the reduction in jobs in computers is closely related to the reduction in exports. However, the large increase in exports in pharmaceuticals has not been translated into an equivalent increase in jobs. In fact the 5,600 increase in employment in first sector above is more than offset by the 8,300 decrease in employment in the computer related sector.

Chemical and pharmaceutical exports have been keeping our export figures looking “strong” but are having little impact on employment figures. A sector which now makes up nearly 60% of our total goods exports (by value) and has increased by more than a third in the last couple of years, has added very few jobs. In the face of an unemployment total of 293,600 this cannot be the “way out of our difficulties”.

We now turn to our service exports which make up about 45% of our total exports. Details of our service exports can be found in the CSO’s Balance of Payments releases. Here again the overall export position appears strong.

The pattern of the services exports above is little different from the pattern of the total exports in the first graph of this post. The Balance of Payments give details on the type of services being exported.

In this instance we can see that the dominant sector is Computer services which made up 36.4% of our total service exports in 2009 and grew by 1.5% on the 2008 figure. Overall, our total service exports declined by 1.9% in 2009 with declines reported in seven of the 11 reported categories.

Mirroring the situation with pharmaceutical products in our goods exports, computer service exports have been the stand out performer among our service exports.

The proportion of our service exports coming from computer services has also been increasing though not to the same extent as pharmaceuticals in our goods exports. In 2007 computer services comprised 32.0% of our service exports. By 2009 this had risen to 36.4%. In the first six months of 2010 computer services comprised 38.7% of service exports, though there does seem to be a seasonal drop in computer service exports in the third quarter. Graph here.

In total Ireland’s service exports in 2008 were virtually unchanged on the 2007 figure. However, if we exclude computer services, the total for the remaining categories was down 4.6%. For 2009, service exports excluding computer services were down 3.8% compared to the total services drop of 1.8%. Graph here.

There are some similarities between the impact of the pharmaceutical sector on Ireland’s goods exports and the impact of computer services on Ireland’s services exports, however the impact is far more pronounced on our goods exports. There are a range of services included in “computer services” (see background notes here) and the hardware and software support areas may be labour intensive. The inclusion, and increasing returns to scale, of computer software sold electronically suggests that some of the increases in computer service exports may not be generating extra jobs.

Brian Lenihan may feel that “we must export our way out of our current difficulties, there is simply no other way”, but our export figures have held up and have been of little use in getting us out of our difficulties. An export-led strategy is worthwhile, but not one that is masked by the high-value output from the pharmaceutical and computer software sectors.