I have been watching a lot of the analysis on Thursday’s stress test announcements and, to be honest, a lot of it has been cringe inducing. The banking crisis is catastrophic but it is not terminal. Last week was actually a relatively good week in the context of the crisis. Yes, a further €24 billion has to go into the banks but it seems likely we will have to borrow very little of it. And the ECB has indicated that the emergency funding provided to the banks will continue to be available at the base rate.

This is a bit of an unnecessary rant but here are some contributions discussing the stress test results and my take on them. This was as much me getting my thoughts on this straight rather than making any contribution. In some cases it is an issue of facts, in which case the difference is clear. In others it is just a difference of opinion, which can make the distinction a little vague.

The banking crisis is one of the most destructive events ever in the Irish economy. It is bad and will continue to be bad. But, the evidence now suggests that we can get through it using the current strategy. Some people need to realise this and provide alternatives to the strategy rather than simple saying “it can’t work”.

There is a lot to this post so I’ve put it below the fold.

Contributor One: Unfortunately, when I read through the actual assessment documents themselves, I see that they moved in the right direction with it, but they haven’t arrived there. If you look for example, in terms of being more conservative on the capital side, he is talking about 10.5% Core Tier One capital for the Irish banking system.

The Financial Regulator said 12.0%, so there is a gap there which has to be closed there after this so on top of €24 billion the Irish banks will have to go out on the market, apparently, and try to raise additional capital, which is not a snowball’s chance in hell that they can raise any capital on the markets, so that is not really a conservative assumption.

The four banks don’t need any additional capital. They do not have to go to the markets to raise any additional capital. It is more likely that there is a “snowball’s chance in hell” than the banks will need any more capital.

In fact to achieve the target of a 10.5% Core Tier One capital the banks “only” need €18.7 billion as this sentence on page 11 of the stress test document reveals.

The table below presents the minimum amount of capital the banks will be required to raise, a total of €18.7bn, in order to meet the new ongoing target of 10.5% Core Tier 1

The Central Bank has decided that the banks require an additional capital ‘buffer’. They estimate this to be €5.7 billion and this is where the final €24 billion figure comes from. The stress tests reveal that the banks need an additional €18.7 billion. The current process will actually see their capital increase by €24 billion. The banks don’t need “to go out to the market to raise additional capital”. They are being over-capitalised.

Contributor One: If you look at the tough approach. If you look at the core figures, and we have no answer on it, the big issue is the Blackrock estimated that there is €40.1 billion in losses total. The Central Bank of Ireland in its exercise only takes into account €27.7 billion out of those losses. So in other words, €12 billion odd is somewhere lost miraculously.

It is true that the total losses estimated by Blackrock are €40.1 billion. But this is over the entire lifetime of the current loan books on the banks’ balance sheets – probably about 30 years. The figure of €27.7 billion is “the cumulative 2011-2013 crystallised losses plus losses attributable to 2011-2013 loan defaults that crystallise later”. These are the losses that will materialise over the next three years.

The Central Bank did not omit “€12 billion odd” of losses. It is just that they will occur so far in the future they do not form part of the current recapitalisation process. Why would we put money into the banks now for losses that will come about in 15 years time? But in a sense we are doing so through the additional capital buffer. There is also another factor that has not been mentioned very often over the course of this banking crisis – operating profit. Here is the last paragraph from Box 1 on page 11 discussing the losses that occur after 2013.

Besides, any such losses are spread over a quarter century, allowing a lot of time for provisions to be set aside out of normal profits in what would then be a recovered and downsized banking system operating in a non-stressed situation. The proposed cash buffer together with the deferred contingent buffer amounts are therefore ample to deal with this prospect. The capital injection for the buffer will be met partly through equity and partly through contingent capital instruments.

So ease up about the €40.1 billion of losses. We’re covering €27.7 billion up front and that’s plenty. In the three year period 2011-2013 BlackRock estimate that the four banks will generate €3.9 billion of operating profit on their day-to-day operations. There might be €12.4 billion of losses to come over the 30 years after 2013 but the banks will be able to absorb these themselves with need to require additional capital.

Also this total of €40.1 billion is the “stress” of worst-case scenario. Under the “base” scenario the total lifetime losses are estimated to be €27.5 billion (see Table 10 on page 27). I’m glad they’ve chosen the stress scenario to work with but it does show that the figures are used are the worst estimates of the possible losses in the banks. The Central Bank say that the “stress” losses are “not considered likely to materialise; they are merely an input designed to ensure the associated capital requirements are fully convincing to the market as being sufficient to cover extreme and improbable losses”.

Finally, on the losses it is important to note that the BlackRock estimates are over and above the loan loss provisions the banks have already made on their balance sheets. The banks had already allowed for €9.9 billion of losses. This figure is included and the loss estimates of Blackrock are in addition to that. So the total lifetime losses are actually €50 billion.

The €24 billion recapitalisation also covers an additional estimated loss of €13.2 billion of losses the banks will incur due to the forced sale of non-core loans over the next three years. These are large, and in some ways, unnecessary losses for the banks to incur.

Huge potential losses have been incorporated into the stress tests. What will the final cost of this bailout be? Back to contributor one.

Contributor One: In my estimate the final cost of the banking bailout, net of all recovery of assets will be around €105 billion. We are heading there right now. They are more or less on track except that they are not recognising the additional €15 billion that Anglo has said that they will require and they are not recognising the additional €3 to €4 billion that will be required in terms of the funding for the INBS.

This €105 billion is made up of four elements:

- Money used on recapitalisation to date (€46 billion)

- Money now to be used on recapitalisation (€24 billion)

- Projected outcome of the NAMA process (unknown)

- Further recapitalisation for the four "live” banks and the two “zombie banks” (unknown)

Number 1 is correct. Number 2 is the figure released on Thursday but we know that the State will not have to provide all of it. €2 billion will come from the assets in Irish Life and €5 billion from haircuts to subordinated debt holders. Thus the known cost of the bank bailout to the State is €63 billion. Can we find another €42 billion?

The final outcome of the NAMA process is unknown. From this report we know that “as of today [2nd March], the Agency has acquired €71.2 billion of loans for a consideration of €30.2 billion – a discount of 58%”. If all the assets turn out to be worthless then NAMA would lose €30.2 billion plus its operating expenses. The loans already have an average loss of 58% built into them. The final outcome could be lower and could be higher.

The “central scenario” of the NAMA business plan envisages a €1 billion euro profit. I cannot vouch for these figures but given the buying discount and the composition of the loans purchased it is not unreasonable to expect the NAMA process to break even. Why we moved rubbish loans from one set of State-owned entities (the banks) to another State-owned entity (NAMA) is another question.

For the sake of argument, let’s just say that the NAMA process is a complete disaster and the loans have to be written down to an average of 75% of their original value. Note that on the 30th of September last, one quarter of the loans by value in NAMA were deemed to be “performing”. For the 75% write-down to hold in this scenario the other three quarters of the loans on NAMA’s books would have to be worth zero – no repayment, zilch and the assets backing those loans would have to be worth zero, nada. This is unlikely. Anyway this implausible 75% write-down would see NAMA make a loss of €13.4 billion plus operating expenses.

Adding this unlikely outcome to the known €63 billion brings to the total to about €78 billion.

We now know that the four “live” banks are unlikely to need additional capital and are being over-capitalised. There still are the two “zombie” banks, Anglo and INBS. These are covered in Appendix One (pp. 80-81) of the stress test document. Here is a short extract.

Capital requirements of new entity

The capital requirements of Anglo and INBS were assessed by the Central Bank in September 2010. As a result of this assessment, new capital of €6.42m for Anglo and €2.7m for INBS was injected by the Government in December 2010, bringing the total amount of State capital the two institutions have received since 2009 to €29.3bn and €5.4bn respectively. Anglo and INBS were not included in the stress testing exercise carried out in Q1 2011 as the institutions are in the process of implementing the restructuring plan.

Once merged, it is forecasted that group will have a Total capital ratio of 14.1% and a Core Tier 1 ratio of 12.5%. This will consist primarily of equity already injected by the State. The remaining regulatory capital will consist of the small amounts of preference shares and subordinated debt remaining after recent liability management exercises. The plan submitted to the Commission in January forecasts that this capital level will be sufficient to maintain a Total Capital Ratio above 8% until the loan management exercise is completed, given the planned reduction in the new entity’s required capital as its assets are worked out, and the existing levels of provisions on the Anglo and INBS balance sheets.

Future loan losses at Anglo Irish Bank

The Anglo loan book has been subject to a number of third-party reviews over the last year, detailed in Box 4. Based on these reviews, the Central Bank estimates that the current capital levels held by the Bank are adequate to cover future loan losses, in a base scenario.

It is noteworthy that the capital levels only cover losses in the “base” scenario. It would be better if the capital covered the losses in the “stress” scenario as is the case for the other four. But we are subsequently told that

Significantly, the riskier elements of Anglo book relating to development loans have already been transferred to NAMA. The remaining loans are in relatively less risky categories relating to investment, office and retail, with over 50% in the United Kingdom and the United States.

In addition, 2010 outcomes at Anglo corresponded more closely to the stress test base case scenario, rather than the adverse scenario.

So it seems we are fairly well covered on Anglo. We have allowed for another €5 billion to go to Anglo. When the €29 billion bill for Anglo was announced by Brian Lenihan last September he said it could be as high as €34 billion, and provision has been made for an additional €5 billion of promissory notes to be provided, though the Central Bank thinks that Anglo will not need this funding. There are no suggestions that Anglo will need an additional €15 billion. Now turning to INBS in the stress test document.

Provisions at Irish Nationwide Building Society

INBS’s loan portfolios were also reviewed in late 2010 as part of a full assessment of the Bank’s capital requirements.

In March 2011, the Central Bank benchmarked the loss rates assumed for INBS in the 2010 review against an even more conservative stress case lifetime losses for other banks forecast by BlackRock in Q1 2011. This benchmarking exercise showed that, unlike for Anglo, the loan losses assumed for INBS portfolios were slightly lower than the stress lifetime loss of the worst of the four stress test banks.

However, even if loss rates comparable to those of the BlackRock stress case worst bank were realised on all portfolios, the resulting increase in provisions would be relatively small (estimated at up to €195m). Significantly, a large portion of the losses on mortgage portfolios would likely not be realised until after 2015.

Here, there may be some additional loses if the stress scenario comes to pass. These are estimated to be €195 million (It’s nice to get to use the word million in all of this!). But the Central Bank says that once Anglo and INBS are merged that this can be absorbed by the new entity.

The Central Bank estimates that by this time, the surplus capital of the new merged entity (in excess of the requirement of an 8% Total capital ratio) would be more than adequate to absorb such additional losses.

Anyway, we will know more about Anglo and INBS when details of the wind-down process are published in May. When discussing this week’s announcements, Minister for Finance, Michael Noonan, did say that the government would be looking for burden-sharing with senior bondholders in Anglo and INBS as these are non-viable institutions. There currently is above €7 billion of bonds outstanding in these institutions.

Anyway, at a pure guess let’s say the worst that can happen is that this wind-down needs an additional €10 billion (say €7.5 billion for Anglo and €2.5 billion for INBS). The State may not have to pick up the full tab on this bill and even if we add of this amount to our running total we come up with a total cost of the bank bailout of €88 billion, and this is only based on extremely negative assumptions of a €15 billion loss for NAMA and an extra €10 billion for the Anglo-INBS wind-down. The total cost of €63 billion seems entirely more plausible.

Of course, the total cost of the banking crisis has been far more than €63 billion. There are four groups who have suffered losses in the crisis.

- The State

- Bondholders

- Shareholders

- The Banks themselves.

The State will have contributed €63 billion (plus or minus the final outcome on NAMA). Junior bondholders have so far taken haircuts totalling €10 billion, with a further €5 billion announced this week.

Shareholders in the banks have taken ferociously losses but these are hard to quantity. The banks had a total market capitalisation of about €55 billion at the peak but you would have to know the initial purchase price of each shareholder to know the actual losses. Regardless, these holdings have been almost entirely wiped out.

The banks themselves have had to come up with some of the money to cover their losses. AIB has sold its stake in Polish and US banks for around €4 billion, and Irish Life will be broken off from PTSB generated around €2 billion to cover some of the losses there. As with the shareholders it is difficult to know how much the bank is actually losing by selling off these assets to cover losses.

Still, it would not be a huge stretch to suggest the following contributions of each group to the bailout:

- The State - €63 billion (actual)

- Bondholders - €15 billion (actual)

- Shareholders - €20 billion (guess)

- The Banks - €5 billion (guess)

This comes to €103 billion which is a huge sum for a banking crisis in such a small country. The only group that can see any return on these contributions is the State. The State will be the owner of the four “live” banks which are estimated to generate €3.9 billion of operating profits between now and 2013. If their balance sheets can be cleaned up, the potential to sell on these banks will emerge and the final cost to the State of this fiasco that be reduced from the current €63 billion. And back to our contributor.

Contributor One: They are also not recognising any of the funding costs for the bank in itself which over 3 years will be about €6.1 billion in itself. There is no way without a financial solution we can get back on track on growth.

I’m not quite sure what this is. My best guess is that it is interest the Central Bank will have to be pay on the money it is using to provide Emergency Liquidity Assistance (ELA) to the banks. All we need to note here is that the Central Bank is not giving away this money for free and the interest it charges for the money will cover the funding costs of getting the money. If this is the case, then there is nothing to see here. Move along, folks. Nothing to see here.

Next we move briefly to a second contributor to Thursday’s discussion:

Contributor Two: Well, unfortunately it’s a very depressing day. I’m mean, this is what I most feared. We are shoving money into a black hole, €24 billion this time. We have got no explicit commitments from the ECB. It is a really, really bad day. The reason being is, they keep talking about getting confidence back into the marketplace. I work in that marketplace and the market place will have no confidence tomorrow and the reason being is – just think of it logically. Is there more of a chance of a sovereign default in 2012 for Ireland or less chance? And the answer is unequivocal there is more chance of a sovereign default in the second half of 2012 now than there was yesterday. So the markets will take that on board and that will be it.

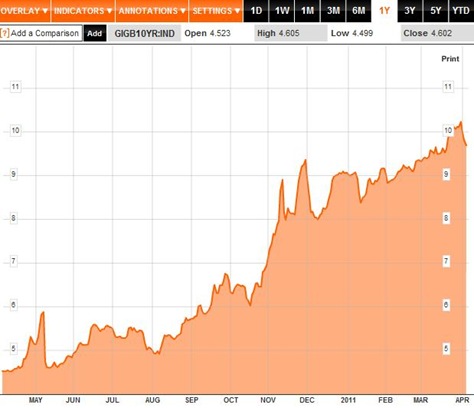

How did the “market” respond to Thursday evening’s announcement? Here is the yield on 10-year Irish government bonds for the week. Taken from Bloomberg.

At the close of Thursday the yield on Irish government 10-year bonds was 10.223%. The markets took that evening’s announcement “on board” and at the close on Friday the yield was 9.978%. The yield had dropped! We better edit the second last sentence above, “there is” less “chance of a sovereign default in the second half of 2012 now than there was yesterday.”

Of course, the rates are still in the stratosphere and in relative terms Thursday’s announcements have hardly moved them. This is because Thursday’s announcement has more to with the banks and less to do with the borrowings of the State. Potentially, we may not have to borrow any of the €24 billion as we said here.

How did the rest of the world react the to stress tests? They gave them the thumbs up! Here is the rationale for the S&P downgrade and their reasons for removing the negative outlook on Irish government debt. Read it all. Read it slowly. Look for the negativity of Ireland.

The downgrade reflects our view of the concluding statement of the European Council (EC) meeting of March 24-25, 2011, that confirms our previously published expectations that (i) sovereign debt restructuring is a possible pre-condition to borrowing from the European Stability Mechanism (ESM), and (ii) senior unsecured government debt will be subordinated to ESM loans. Both features are, in our view, detrimental to the commercial creditors of EU sovereign ESM borrowers.

We have removed the ratings on Ireland from CreditWatch, where they were placed with negative implications on Nov. 23, 2010. The outlook is now stable, reflecting our opinion that the assumptions underlying the stress test (The Financial Measures Programme, comprising Prudential Capital Assessment and Prudential Liquidity Assessment Reviews) conducted by the Central Bank of Ireland--in conjunction with the IMF, European Central Bank (ECB), and European Commission--are robust and that the expected €18-€19 billion (11.5%-12.0% of GDP) net cost to the Irish state of additional recapitalization, plus the contingency buffer for the banking system, is within our range of expectations, albeit at the upper end.

Of this net cost, we understand that €10 billion will be funded by a contribution from the National Pensions Reserve Fund, while the remainder will be financed via €7 billion in cash balances at the Treasury, implying a €1-€2 billion (0.6%-1.0% of GDP) increase in gross debt. This would still leave an estimated €9 billion (5.6% of GDP) in cash balances at the Treasury.

Our understanding is that the anticipated gross cost of the state's further participation in the financial system would be €23.8 billion (15% of GDP) of which €3 billion is a contingency. The outcome of the Prudential Capital Assessment and Prudential Liquidity Assessment Reviews stress tests does not include, however, any discount for tax-loss carryforwards of the Irish banking system, which we anticipate are equivalent to less than 2% of GDP. We consider that tax-loss carryforwards have weak capacity to absorb losses.

Standard & Poor's is of the opinion that the sharp contraction in Ireland's nominal GDP and gross national product since 2008 has reached an end, and that the Irish economy is now set to gradually recover. We believe that the Irish economy has stronger growth prospects than the Portuguese and Greek economies considering its openness (Ireland's exports are forecast at 107% of GDP for 2011 compared with Portugal's 30% of GDP), its flexibility, and its competitiveness. We anticipate that Ireland's current account will post a full-year surplus of more than 2% of GDP during 2011, for the first time since 2003, while net exports will continue to be the major contributor to headline GDP performance.

Standard & Poor's expects that Ireland's emergency liquidity assistance advance of €65 billion will gradually be repaid with proceeds from the disposal of non-core assets of Irish banks as part of the deleveraging process. That said, we also anticipate that the repayment of €88.7 billion in ECB advances to domestic credit institutions will be more difficult to achieve during the lifetime of the EU-IMF Extended Fund Facility Arrangement, which

expires in December 2013. In our view, despite the announced capital injections, the Irish banking system's liquidity position remains weak and we do not expect that its earnings prospects will recover any time soon.

What negativity? The downgrade was the result of an EU decision. The view on Ireland is generally positive. Lads it’s time to change the tune. You might disagree with the plan but it looks like it can work.

Contributor One: If you look at the cost of funding our debt right now, and I’m not talking just sovereign debt, €49 billion, more than a quarter of the entire GDP of this country, almost a half of the entire GNP of this country, is flying out in terms of interest payments, on the debt at the current valuations of the government debt itself – and that disaster is going to continue as long as we have the debt not restructured.

I’d love to what this figure is. €49 billion of what? That’s nearly as much as the entire banking crisis is costing us. It could be related to our €1.6 trillion of external debt but most of that has little to do with the domestic economy as it is a function of IFSC activities. If it is an annual interest cost of some sort it is 31.8% of 2010 GDP and 39.3% of 2010 GNP.

In the Balance of Payments there are three income flows that contain interest elements in them (2010 total in brackets). These are:

- Direct investment income on debt (€1.9 billion)

- Portfolio investment income on debt (€16.5 billion)

- Other investment income (€15.5 billion)

The Balance of Payments indicates that up to €34 billion of interest income left the country in 2010. What they also reveal is that under these three categories €40.5 billion of interest income flowed into the country. More interest flows in than out!!

We have a huge and growing debt and it will generate large interest costs. However the sum of public and private debt is unlikely to rise much above €450 billion. Unless all of this was borrowed externally and unless the interest rate is above 10% that will never generate an interest cost of around €50 billion. If this isn’t an annual interest cost, then it’s hard to know why it is being compared to annual national income figures.

When discusses the following day’s newspaper the Irish Examiner headline “€70 billion the total cost of banks to the taxpayer of the bank bailout but ” was covered and one contributor was asked “what is missing from that €70 billion?” The reply:

Contribution One: It doesn’t include a helluva lot. It doesn’t include the €12.4 billion that the Central Bank somehow miraculously lost between the estimate that BlackRock submitted as their worst case scenario and what they accepted as their own scenario. It also doesn’t include Anglo’s €15 billion additional capital demand, which the Anglo management has flagged already. It doesn’t include three to four additional billion that INBS will need. It doesn’t include the funding costs for the banks right now. It’s well over a €100 billion.

We have gone through most of these. They don’t stack up at all. The Central Bank didn’t lose €12.4 billion of losses. They happen over a 30-year period beginning in 2014.

Here is an important one. Anglo’s management have not flagged that they will need an additional €15 billion. This figure probably comes from Anglo chairman, Alan Dukes’ guess that the entire banking system would need €50 billion. This is €15 billion more than the €35 billion contingency fund set up as part of the EU/IMF deal. When questioned about the bank he chairs, Dukes said “his bank will not require any further capital beyond the €29-34 billion range as outlined last year by the Central Bank” as reported here. (You can also actually listen to what Alan Dukes said at the same page.)

We now know that Dukes’ €50 billion guess for the entire banking system was too pessimistic by a factor of two. If his pessimism also holds for Anglo then we probably have poured our last euro in that black hole and throwing figures of €15 billion around is completely disingenuous.

We have no reason to believe that INBS will require additional State funding and I’m not sure what this “funding costs for the banks right now is” but I would be pretty surprised if Governor Honahan, Elderfield and their staff have left it out.

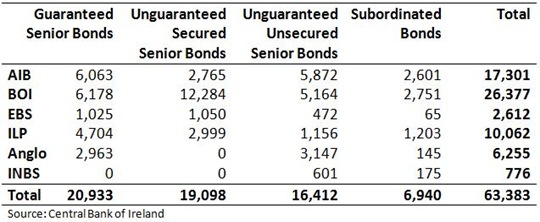

Discussion facilitator: There is €35 billion of unguaranteed bonds in the banks. Why should this country pay?

It is true that there is about €35 billion of unguaranteed senior debt in the banks as can be seen from this table we have used a number of times.

It is clear that €26 billion of the unguaranteed bonds are in the main “pillar” banks of AIB and BOI. These are the banks we want to survive and we need them to be able to raise capital at some unknown future date. The strongest of the banks is BOI and that has more than €17 billion of the unguaranteed debt. How can we default on €17 billion of debt in a bank into which we are only putting €5.2 billion per the recent stress test and €8.7 billion in total. Bondholders in BOI are sure to have a strong case if they are forced to bear losses that occurred in banks that they didn’t even invest in! That would be like your bookie not paying out on a winning bet because a half-brother of the horse you backed lost in an earlier race.

Another important thing about the €35 billion is the composition of it. More than half is unguaranteed but secured. This €19 billion is secured against assets. If the banks try to renege on paying these bonds, the creditors will be able to claim the assets that have been used as collateral for these bonds. It will be difficult to effectively burden share with these bondholders as they have rights to assets of the banks. These are customer loans so that the repayments on these will go to the bondholders rather than the banks. Defaulting on these bonds will see the banks lose whatever gain they made by not paying the bondholders.

Burden sharing could occur with the €16.4 billion of unguaranteed unsecured senior bondholders. A 40% haircut on this debt would save €6.5 billion. This is a huge sum. But it must be weighed against a number of other considerations. Firstly, almost €11 billion of this is in AIB and BOI. Secondly, the reputational cost of the default would lead to higher borrowing costs for all banks in the future. The future cost of this additional interest must be netted against the immediate savings of €6.5 billion. With ongoing total funding of about €300 billion required by the banks it would not take long for even a slightly higher interest rate to completely erase the gain made by the immediate restructuring of unsecured unguaranteed debt.

I better stop now.