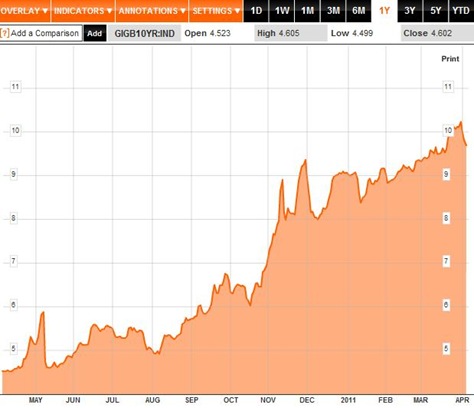

Since last Thursday’s stress test announcements yields on Irish government 10-year bonds have been falling. Here is a graph from Bloomberg.

The peak is Thursday 31st March when the yield closed at 10.22%. The stress test results were published later that evening and since the open on Friday the yields have been falling (though there has been some intra-day volatility). The yield fell on Friday, again on Monday and continued on Tuesday when it closed at 9.68%. In early trades this morning the yield has continued to fall and was at 9.64% as I write this.

The falling yields means there are buyers for Irish government bonds and the perceived probability of default is now lower than it was last Thursday. However, we are still at the top of the yield mountain and have a very long way to descend before we can consider borrowing additional money from the markets. The prospects of being able to do that before the end of the EU/IMF deal are improving but still shrouded in doubt.

Here are the yields over the past 12 months.

The recent falls have only brought the yields back to the level recorded around the 23rd March – just two weeks ago. There is a lot of distance between the current rates and those recorded 12 months ago but we are going in the right direction.

UPDATE: (2pm) They're dropping like a stone. Down to 9.31% now!

Wednesday, April 6, 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment