There has been a huge amount of comment on Irish public debt over the past few days. The debate was raised up a notch by the €250 billion figure that was thrown into the pot by Prof. Morgan Kelly in his most recent article in the Irish Times. We took that to task here and all our contributions to the public debt debate can be followed here.

On Wednesday night there was a further debate on the National Debt on Tonight with Vincent Browne on TV3. You can watch the show here and the debt discussion is from the start until about 20 minutes in. In this piece we focus on the contributions of Dr. Constantin Gurdgiev to the show. This is not because of any wish to attack Dr. Gurdgiev but rather because his contributions allow us to focus on many of the popular misconceptions that have arisen in the recent debate about our public debt.

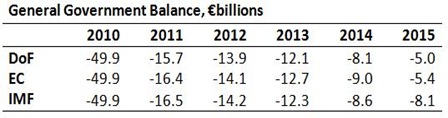

To begin let’s reiterate what our projection of the 2015 public debt is:

This means that by the end of 2015 the General Government Debt will be in the region of €205 billion. As €15 billion of the promissory notes will have been paid out, the total amount actually borrowed will be €190 billion. These are huge sums of money and puts the country right of the border of sustainability.

As with all projections there is an element of uncertainty involved. When it comes to projecting Ireland’s future public debt these uncertainties are significant. When making the above projection we noted that:

There are other issues related to the banking collapse that are not included. These are the final outcome of the NAMA process, whether the shutdown of Anglo and INBS will require further injections of capital, and how to unwind the €140 billion of liquidity the banks have taken from the European and Irish Central Banks. There is also the long-term hope that we will be able to sell off our stakes in the two ‘pillar’ banks to recoup some of the money swallowed by the bailout. There is a great deal of uncertainty about all of these.

Most of these are covered in the commentary that follows. Anyway on with the show. Here in a nutshell is what Dr. Gurdgiev said. Transcripts of the segments that provided these gems are also provided below.

- Start with a 2015 public debt prediction of €225 billion from the IMF

- Add in €31 billion for NAMA (but the final losses could be more)

- Add €16 billion for loan losses in the banks that are not covered by the €24 billion recapitalisation.

- Add €4 billion of bank recapitalisation not covered by the State's €20 billion contribution

- Add €25 billion as a 16% risk weighting on the central bank liabilities of the banks

This “sound-bite analysis” cannot be countered with simple “sound-bite responses”. T0 reply to this we need the facts and they need to be provided carefully. This post is long. If you want to see a factual presentation of our projected debt position you’re best to go here rather than plough through this. If you want to see why the above commentary is wrong read on.

This IMF projection of a €225 billion debt by 2015 must be very important.

Constantin Gurdgiev: I don’t buy this. I looked at Morgan Kelly’s figures and I don’t care what the ESRI frankly says I look at the IMF and I look at their forecasts. IMF clearly forecast 2015 figure of €225 billion in terms of debt. That’s the government debt.

You toss into it €31 billion that the NAMA is issuing in terms of the bonds. That is debt as well. You can call it a Special Purpose Vehicle. You can call it whatever you want. Off balance sheet accountancy. I don’t care. It’s a taxpayer guaranteed debt which has been written by the government agency. So that is our debt as well.

We are €256 billion in. Bingo! Morgan Kelly is correct in terms of the figure. 2015 simple numbers. €225 billion in terms of the government debt. IMF forecast. NAMA €31 billion. €256 billion in total. That is €142,000 per each working person in this country as of today.

This €225 billion figure is directly referenced on six occasions in the first 20 minutes of the show, and forms the underpinning for much of the “analysis” that followed. Unfortunately, it is wrong and even the IMF tell us that it is wrong.

The number can be found in the World Economic Outlook Database which gives the projected Gross General Government Debt of €224.904 billion for Ireland in 2015. This is 123% of the IMF 2015 GDP projection and is an extremely dangerous level of debt. Or it would be were it actually to come about and the IMF tell us that it won’t.

The projection comes from the IMF Report that followed the setting up of the EU/IMF rescue package for Ireland last November. Here are the projections from page 36 of that document

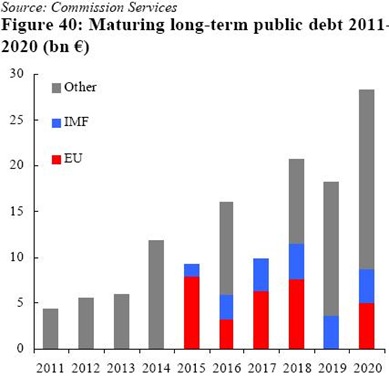

This confirms the 123% debt level for 2015 which in itself confirms the €225 billion figure. However, this was last December and the IMF had to make certain assumption about what would happen in 2011, especially about the stress tests for the banks. To make the above projections they assumed that all of the €35 billion “contingency fund” to recapitalise the banks set up as part of the deal would be used. As we know the banks require €24 billion of additional capital, with between €18 billion and €20 billion coming from the State. The IMF acknowledge this in the ‘Debt Sustainability’ Appendix on page 43.

The debt dynamics will depend on the amounts drawn down for bank recapitalization. Although it is anticipated that the notional amount designated for bank support under the program (€35 billion) will not be used, the baseline scenario incorporates the cautious assumption that €17.5 billion available to the authorities under the overall EU-IMF program is drawn for this purpose (with the other half provided from the authorities own resources). The baseline thus defines the most conservative debt trajectory.

Debt dynamics would improve if the stress tests (and diagnostics) or liability management lower the financing needs for bank recapitalization. Thus, if €25 billion were used, debt would peak at 119 percent of GDP in 2013, and if only the initial €10 billion were used, debt would peak at 109 percent of GDP.

Each of these scenarios assumes notionally that one half is financed by the authorities’ liquid assets, and the remainder from the resources available under the overall EU-IMF financial package. The implication also is that if the amounts needed for recapitalization are smaller, the government can use its liquid assets to cover the budgetary financing need or repay debt.

None of these numbers are right and the IMF were just guessing what the outcome of the stress test process would be. We now know that the banks will be consuming around another €20 billion of the State’s resources rather than the full €35 billion that the €225 billion figure is based on. Half of this will come from the further destruction of the NPRF and half from borrowed money as part of the IMF deal.

Using the actual €20 billion injection into the banks means that the IMF projections are that the debt would peak at some amount below 119% of GDP in 2013. What does our own Department of Finance think it will be in 2013. See here for the answer, which is 118.3%. The IMF and Department of Finance projections are virtually identical. Let’s not be getting excited that the IMF have found a load of debt that the rest of us cannot see. They haven’t.

There is no €225 billion debt projection from the IMF. The only way that can happen is if you think 20,000,000,000 and 35,000,000,000 are the same number. For those who might be confused they are not. Once we subtract the difference between these figures and the interest that will no longer accrue on the difference it is very clear that the IMF is forecasting a general government debt of around €208 billion for 2015. This is much closer to our estimate of €205 billion than the €225 billion attributed to them on the show.

We are then told that if we add €31 billion for NAMA to this (incorrect) figure of €225 billion then “bingo! Morgan Kelly is correct”. This is not what Morgan Kelly did. He added an unspecified €30 billion to a €220 billion estimate from namawinelake. This €220 billion was also based on the assumption that the banks would require the full €35 billion. Take off the fact that it will be €20 billion and bingo! “the best source on the Irish economy” thinks our forecast of €205 billion is pretty much correct.

Anyway, Morgan Kelly added €30 billion to the €220 billion and it wasn’t just the total bonds issued by NAMA that got him there. He got to his figure by “subtracting off the likely value of the banks and Nama assets”. Kelly’s imaginary gross debt figure was actually €270 billion. If Morgan Kelly was adding bingo calls he might be right but he is not right on our public debt.

A figure of €205 billion looks good to me and I’m pretty sure it does to most reasoned commentators. Let’s go through some of the significant uncertainties that surround this projection. First up, is the bank recapitalisation process.

Constantin Gurdgiev: The ESRI said the banks’ debt are factored. According to the latest exercise from the Central Bank which was issued on the 31st March, €24 billion worth of that debt is not factored in to these figures at all because they are yet to come. On top of that if you look into the numbers deep inside, BlackRock estimates that it will be actually €41 billion, not €24 billion and the reason why is because the Central Bank of Ireland is looking only through 2013 and BlackRock is looking beyond 2013. The peak of mortgage defaults mortgage defaults according to BlackRock assumptions is going to happen in 2017 not in 2015. So all those debts are not factored in.

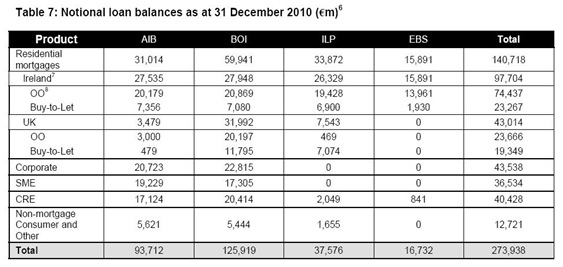

There is some merit to this. The numbers are a little out though as can be seen from the stress test document. BlackRock Consultants estimated that there would be €40.1 billion of lifetime loan losses in the adverse scenario on the loan books presented to it by the banks. The Central Bank forecast that €27.7 billion of these losses would either crystallise before 2013 or result from defaults that occur before 2013. So there is €12.4 billion of loan losses excluded from the current recapitalisation process.

So why are we not covering these losses? One reason is that they are not due to materialise until 2014 and beyond. Why would we give money to the banks now for losses that could occur five, eight or even ten years into the future? If we gave money to cover the future projected losses to the banks now, they would earn interest on that money and we would actually have given them too much money. The banks would be making a profit off the bailout.

Secondly, the banks themselves will be generating an operating profit that will cover some of the losses. The banks have huge losses on their balance sheets but on a day-to-day basis they remain very profitable. In the three years from 2011 to 2013 BlackRock estimate that in the adverse scenario the four banks will earn an operating profit of €3.9 billion. These profits are earned on performing loans, current accounts, bank charges and other services provided to customers.

When compared to the total loan losses that is expected to materialise on the banks’ balance sheets this is a relatively small amount, but it cannot be ignored. By 2015, the annual loan loss provisions will be much smaller than they are now and the assumption is that they can be covered by the banks’ operating profits.

There are some concerns about this process but not enough to suggest that we should be pumping more money into the banks to cover the full €40.1 billion of losses that BlackRock are forecasting. In fact under the “base scenario” BlackRock have total lifetime losses of €27.5 billion so the full lifetime loan losses under the base scenario are being covered.

We are covering €27.7 billion or 70% of the €40.1 billion of adverse scenario lifetime loan losses and that is plenty for now. In fact between existing capital and reserves in the banks, existing loss provisions on their balance sheets and the expected operating profit over the next three years the amount of capital required to cover these losses is and meet the capital requirements is €18.7 billion. There is also an additional €5.3 billion “capital buffer” going into the banks and this will be there to meet any losses above €27.7 billion should they arise.

The €18.7 billion capital requirement and the €5.3 billion capital buffer give the €24 billion recapitalisation required by the banks. From page 9 of the stress test document.

There is no expectation that capital requirements should be set to cover remote lifetime stress losses (which may have offsetting income). However the capital buffers that are in place have been designed to provide comfort concerning post 2013 losses in the years immediately following the assessment period, as an additional layer of conservatism.

When it comes to mortgages BlackRock estimate total losses of €16.9 billion. The recapitalisation is covering €9.5 billion of them. This is 56% of the total. I can find no evidence that BlackRock think the peak of mortgage defaults will happen in 2017 but there are significant losses that happen after 2014.

Again, putting money into the banks now for losses than will happen five years down the line is not sensible but there is the concern that the significant operating profits of the banks will not be enough to cover them. The €12.4 billion of losses outside the three year horizon also have the €5.3 billion capital buffer to cover them. Between future operating profits and the capital buffer there is no need to expect that this €12.4 billion will have to be met by the State. On to NAMA.

Constantin Gurdgiev: NAMA is a debt that is issued. NAMA assets are not owned by us, yet the debt is held by us. It is held against us. It is my name as a taxpayer on the debt signature. I have no control over NAMA assets and NAMA is not accountable to me or to anyone else.

Yes, they are worth something. So far, what we have is a declared loss on the first year of operations. You have to factor in the risk. You have to look on the underlying assets that they carry. You also have to look at the cost that NAMA is carrying and also on the activities that NAMA is planning to engage. Let’s look then into all the possibilities and all the possible scenarios can lead to actually greater losses than €31 billion.

I’m not saying that they’re worth nothing. Today on the books they might be worth an X amount. That is not the value that will be realised down the road itself. It can be much less. It depends on your overall projections. If you look at the overall economy how can NAMA factor in any sort of the uplift in the property market into 2015. I don’t know.

NAMA is not promising to pay us anything right now and it cannot guarantee to pay us anything right now as the taxpayers in 2015. We’re talking about debt in 2015. €225 billion is the estimation by the IMF.

I’d like to know who owns the NAMA assets so? We own the liabilities but not the assets. Ah hear. And then there is the suggestion that NAMA can make a loss greater than €31 billion. This could only happen if NAMA collects virtually nothing on the €71 billion of loans it has acquired.

NAMA’s most recent quarterly report states that “the percentage of performing loans in the €71.4 billion portfolio at December 31st 2010 was 23%”. That means that €16.5 billion of the loans are performing. If only those loans are repaid and zero is collected on the remaining €55 billion of loans then NAMA would make a loss of €14.5 plus the cost of servicing that money.

It is also important to believe that around €20 billion of the NAMA loans are outside Ireland. These are mainly in the UK where commercial and residential property markets are performing much better than they are in Ireland. It is likely that NAMA will collect a significant proportion of the money lent into the UK market. There will be losses (Irish property developers do not have a good track record) but the performance of these loans should be reasonable.

Next note that NAMA will be trying to recoup to full €71.4 billion that is due on these loans and not just the €30.5 billion it paid for them. To this end NAMA has reached agreement with 16 of top 30 developers as it states here, with two more close to agreement. Negotiations continue with five and seven have already been forced into receivership. NAMA will be pressing on guarantees and other collateral to try and recoup the money. It is not clear how much this will be, and there will likely be significant legal roadblocks, but NAMA is not entirely dependent on the value of the assets tied directly to the €71.4 billion of loans it acquired to try and recoup the €30.5 billion it paid for them.

Using those assets the ‘best source on the Irish economy’ estimates using current property prices that NAMA would make a €3.5 billion loss and needs a 12.9% weighted average increase in property prices in order to break even. It is hard to tell where property prices will go but a €3.5 billion loss is a long way from being “greater than €31 billion”.

I would like to see NAMA included in gross debt figures as it would significantly reduce confusion. NAMA does not put any cash obligations on the Exchequer. However, NAMA does increase the amount of accrued interest our debt generates but because it is self-financing it does not change the amount of cash interest payments we have to make. NAMA would add to the debt/GDP ratio but it would not change the interest payments/government revenue ratio which is crucial for sustainability. Anything over 20% here is of huge concern. We are going to be below that and adding NAMA to the gross debt would not change that.

If the NAMA liabilities are to be included in the debt then the assets that NAMA holds must also be given fair consideration. Simply ignoring them because “we do not have control of them” is disingenuous. Now on to the ECB money.

Constantin Gurdgiev: But let’s not forget that there roughly €110 billion which the Irish banks owe to the ECB which is clearly also in some line a liability of the taxpayer. And there is a very direct liability of the taxpayer to the €50 billion that the Irish banks owe to the Irish Central Bank. That is directly in line because the taxpayer is the first line of fire there.

No economy is operating on the basis of just one year projection. You have to have an outlook for 2015 and what I am telling you is that IMF says in its outlook €225 billion. It looks to me pretty much on the money. It is pretty consistent with my own projections as well.

Then we are arguing about so called quasi-sovereign debt which is the NAMA debt in total. That’s what Morgan Kelly does correct in his article. He takes their number and adds to it the €31 billion of the NAMA debt.

But Morgan mentions but doesn’t do any allowance for the debts of the banks which we can actually say there is an assumption made that there about 17% average losses on the banking book which is going forward for the six institutions.

We can assume apply the same 16% percent as a possible risk weighting for the €50 billion that they owe to the banks. Bang! Another €8 billion is gone. You can apply the same amount to the European Central Bank as well. Bang! €17.6 billion gone as well on top of that. That is not in this figures. That is also a risk to the downside. And if you are planning an economy.

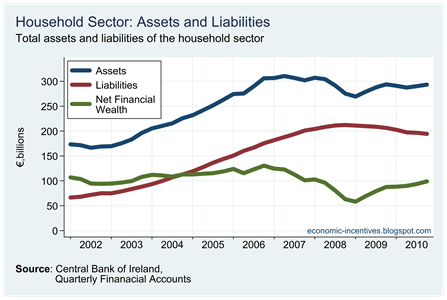

This is complete nonsense. We are not on the hook for any of the money the banks owe to the ECB or the Central Bank of Ireland and creating €26 billion of debt here is a little more than disingenuous. This money the banks owe to the ECB and CBoI is a liability. The problems we have with the banks is that their assets, primarily customer loans, are not worth what was originally lent out.

There has never been a problem on the liability side, and there never will be. The problem with banks is that they are suffering huge losses on their assets. It is an accounting impossibility to make a loss an a liability.

If I owe you money how I can make a loss. You can only make a loss on a asset. You don’t stress test liabilities, you stress test assets. The only way we will be liable for any of the money the banks owe to the ECB and Central Bank of Ireland is if they make additional losses above what has already been accounted for. Looking at the liability side of the banks’ balance sheet and we might be liable for it is nonsense.

You have to look at the assets side and we know that banks are going to make huge losses. BlackRock Consultants and the stress tests told us that. We are putting money in to cover these losses. This money to cover loan defaults, and the repayments from performing loans, will allow the banks to repay in time, or replace somewhat more quickly, the liquidity the banks have taken from the ECB.

The figures quoted for the central bank funding are also wrong. There has been an update since Wednesday, but on that date the correct figures are that the banks had borrowed €79 billion from the ECB and about €65 billion from the Central Bank of Ireland for a total of €144 billion rather than the €160 billion figure given.

We are then told to multiply these numbers by some loss rate and that then “Bang! Another €25 billion is gone”. To repeat myself you cannot make a loss on a liability. It is impossible. And why is this only applied to the liability the banks owe to central banks? Why is this the only liability that this “risk weighting” applies to? The banks have other liabilities as we can see from their balance sheet.

The banks owe €170 billion to customers from deposits and still owe about €60 billion to bondholders. The customers and (senior) bondholders all expect to get their money back. What happens if the banks can’t pay? Surely we will be on the hook for them as well and then its “Bang! Another €37 billion gone.” Of course this is complete nonsense. If you want to look at how much the State will be on the hook for because of the banks you have to look at the asset side, not the liabilities. We can only be forced to cover losses that materialise on the assets the banks hold. Looking at the liabilities is rubbish.

It is useful to consider how the banks have obtained a lot of this funding. They have done it with state-backed instruments. Anglo and INBS are the main users of the Central Bank of Ireland’s Emergency Liquidity Assistance and they have accessed this by giving €28 billion of Promissory Notes as collateral. These Promissory Notes form part of the €205 billion debt forecast we have provided here.

If we paid out in these Promissory Notes immediately, Anglo and INBS would simply repay the €28 billion to the Central Bank. They have sufficient liquidity now so if we paid out on the Promissory Notes they would not need the same level of Central Bank funding. One payment of €28 billion would reduce the liability created by the Promissory Notes and the liability created by the ELA. It makes no sense to add them both in as we will only have to pay the money once. To do so is just double counting and is wrong.

The same holds for the NAMA bonds that the banks have used to access ECB funding. When the NAMA bonds are paid off (by the assets that NAMA has) then the banks will use the money they get to reduce their reliance on ECB funding. One payment on the NAMA bonds reduces both the NAMA liability and the central bank liability. They cannot be added in twice and to do so is again wrong.

The banks have also used sovereign bonds to acquire ECB funding. These bonds are already in out debt figure and if we pay out on these the ECB funding will again fall. More double counting. There is one set of collateral that is a bit dodgy and that is the self-issued bonds the banks have used to get additional funding from the ECB. These bank bonds come with a government guarantee and if the banks can’t honour them the State will have to.

Of course, it is not expected that the banks will have to pay out on this bonds. As they get recapitalisation money, sell off non-core assets or see their loan books fall through repayments, their need for central bank funding will fall. They will use this money to repay the ECB and the self-issued bonds will disappear into the hole they can out of. That’s the plan anyway. Any problems will emerge on the asset side of the balance sheet not the liability side.

The asset side of the banks balance sheets are a mess. There have been and will be huge losses. This is why we are pouring money into the banks. The most pessimistic of estimates suggest the banks could be carrying loan losses of around €110 billion on their €370 billion of loans. This is a loss rate of 30% and is truly staggering. It is these losses that have to be covered.

So far there are three groups who have contributed to the banking collapse and here are the amounts they committed to providing:

- Equity holders completely wiped out (c. €25 billion)

- Junior bondholders taking up to 90% haircuts (c. €14 billion)

- State contributions through recapitalisation (c. €66 billion)

All told some €105 billion has been committed to cover the loan losses in the banks. And this excludes the money the banks have provided themselves through their operating profits over the past few years and through the sale of international assets and operations that the banks previously held.

The asset side of the banks’ balance sheets are a disaster but the money is being provided to meet these losses. If the money owed to central banks is going to become a debt of the State than loan losses in excess of those covered above will have to materialise. There are very few who are suggesting that the loan loss rate will be above 30%. There will have to be loan losses above this to this liability to be a problem. A “risk weighting” of 16% of a selected liability is complete nonsense. I have no idea where this 16% figure come from. Or is it 17%?

Anyway, BlackRock have gone through the banks’ loan books and forecast a loan loss rate of 14.6% in the stress scenario. There is also the 58% loan loss that the NAMA transfers have imposed on the banks. Between the stress tests and the NAMA process €85 billion of loan losses have been accounted for. Other provisions have accounted for even more. There is little evidence of the additional losses that will be necessary in order to mean that the central bank liquidity will be a debt for the State.

And why are we giving out about this money. The €79 billion of ECB funding is being provided at 1.25%. The money from the Central Bank has a rate of around 3%. There is no way the banks could borrow at anything close to those rates from market sources. The low rates on this money is a subsidy to the banks that could be worth €5 billion or more on an annual basis. No mention of this, but some ridiculous loss calculations on liabilities.

Constantin Gurdgiev: I’m not been paid been paid to do any of this work at all. Peter Mathews was not paid to produce any of this work. Paul Sommerville wasn’t paid. Brian Lucey is not paid. And yet we are producing the balance sheets. We are putting them in the public domain.

Nobody can dispute it and then we get the forecasts which are coming out in line very much with Department of Finance as well. IMF now. I am telling you. IMF says €225 billion 2015 is the date for which they are projecting it. That’s general government debt. Gross general government debt. Exclusive of NAMA at all.

Thank God nobody is paying for them. They’re rubbish. I am disputing them. The IMF has not forecast that the GGD will be €225 billion in 2015 and if that is your starting point the ground is rather unsteady. Finally we have the €24 billion recapitalisation for the banks.

Constantin Gurdgiev: You know the borrowing for the banks. You are assuming here, for example, the Exchequer Balance of €18.25 billion. Does that include banks? How much have you factored in? Ok, €20 billion this year and what about the €4 billion they are projecting they need to put in you haven’t put anywhere? No, well there we go.

The €16 billion gap between what the Irish Central Bank is projecting for 2013 and what BlackRock is projecting through 2017 is that anywhere else? No, ok Bingo! That’s €20 billion. So you’re €196 billion is very rapidly getting closer towards…

If you are running an economy especially at the time of a crisis you are better off taking conservative downside assumptions rather than constantly trying to chase down.

The banks will need an additional €24 billion of capital based on the recent stress tests. Of this €18 to €20 billion will come from the State. The other €4 billion that the ESRI did not “put anywhere” will not come from the State and has no business in a measure of public debt. This €4 billion will come from haircuts to junior bondholders in the banks. And they seem to be going pretty well. There will also be the sale of assets such as Irish Life which could reduce the State’s contribution even more

As we pointed out above there is a €12.4 billion difference between the lifetime loan losses predictd by BlackRock and the three-year estimates used by the Central Bank to calculate the capital requirements of the banks. There should be a difference between these numbers for the reasons we outlined above. If the full lifetime loan losses are covered now.

- The banks would be able to earn a return on the bailout money for themselves and

- The banks would not have to use any of their operating profit to cover the losses.

There is also the €5.3 billion capital buffer in place if it is required. There is no adding of €4 billion and €16 billion to get anything. This needs a level of analysis beyond that required to fill out a bingo card. We are not getting that analysis here but it seems part of the problem is that policy makers are using “rational analysis” to underpin their decisions.

Constantin Gurdgiev: Of course it all depends on many things. In Ireland we have a very volatile economy. But we are not factoring in the volatility into these projections. We are actually basing it on rational analysis. And there is a difference exactly. The policy makers should not be taking the possibility of the extreme events into the direct account. It should be behind as a kind of background. So if things turn out to be very rosy and we able to repay the debt out of the very significant uplift. Happy times, great, that’s a bonus to the nation if you want. If things don’t turn out rosy you have to be prepared to deal with a debt overhang at these proportions.

The problem is we are basing the projections on “rational analysis”. Ah hear. This is one of the most extreme economic crisis this country has faced (it is not the most severe), yet any attempt to resolve our difficulties is decried because it is based on rational analysis.

What we need is rational analysis not the sort of mumbo jumbo dished out above. If we take the litany of incorrect figures lashed out above we get the sort of nonsense analysis that attempts to undermine the credible attempts to get us out of this hole.

- Start with a phantom debt prediction of €225 billion from the IMF

- Add in €31 billion for NAMA and say the losses could be more and completely disregard the assets

- Add €16 billion for loan losses that will appear after 2015 with no pr0vision for the earnings of the banks

- Add €4 billion of bank losses that will be covered by junior bondholders

- Add €25 billion for some “risk weighting” on the central bank liabilities of the banks.

This gives a running total of €301 billion and this is supposed to be the analysis we need of the debt legacy from the crisis we face. There is no one that believes that the 2015 public debt will be €300 billion yet we are expected to believe commentary like this which is provided on a regular basis. Every single element of this commentary is wrong. Not some of it, all of it. It is all wrong.

It starts with the wrong number, includes no allowance for assets, does not know the difference between an asset and a liability, adds in costs that will be covered by someone else and in general is very loose with the actual figures. It is nonsense and should be treated as such.

Ireland debt level in 2015 will be between €205 billion and €210 billion. This will be about 115% of GDP. We face some huge problems. Figuring out the numbers should not be one of them. We should be figuring out the solutions.

Anyway here is a summary of my projection for the 2015 debt.

All numbers marked with an asterisk are forecasts with NAMA figure will still only be provision by 2014 so the actual General Government Deficit (GGD) will be €205 billion. What should be added to this sum? And, please, no nonsense.