This is an revision to the conclusion of a previous post. The key question is how long can we last using the funds available from the EU/IMF assistance package? The five elements we need to determine are:

- How much money do we need to fund the annual deficits?

- How much money do we need to cover the maturing of existing debt?

- How much money do we have now?

- How much money can we get from the EU/IMF package?

- Can we get money from anywhere else?

Now that a consensus has emerged on Ireland’s medium term debt projections the answer to first question can be identified relatively easily. Between now and the end of 2014 the IMF forecast that the cumulative general government deficits will be €51.5 billion. The Department of Finance forecast is that they will be €50 billion.

This analysis excludes the bank recapitalisations required after the recent stress tests. The EU/IMF deal had a €35 billion contingency fund included for the banks, with half coming from the EU/IMF package and half coming from our own resources (NPRF, cash balances). This will not be used in full and the €20 billion required from the State for the bank recapitalisation will see a further €10 billion removed from the NPRF with the remaining €10 billion coming from the EU/IMF funds. The money for the bank recapitalisation is available and is not being used in full.

To get a measure of the ongoing cash requirements of the Irish government we can use the Exchequer Deficit as a proxy. This includes the gap between government revenue and expenditure, debt interest and the annual €3.1 billion repayments on the Promissory Notes. It excludes some small miscellaneous items which would likely cancel out and also the accrued interest on the Promissory Notes that will become due but will not be paid until into the 2020s. We will use the forecasts of the Exchequer Deficit provided on the last page of the recent Stability Programme Update.

We also need money to repay the money due on existing debt that will mature over the next few years. The National Treasury Management Agency provide a useful table in this regard. From this table we will use the annual totals for maturing government bonds, short term debt and other debt. We will exclude the assumed maturity profile of retail debt such as Savings Certificates, Savings Bonds, Prize Bonds and Post Office Savings Funds Accounts which have variable amounts and varying or unknown maturities. The NTMA state that:

For the purposes of constructing an overall maturity profile of the National Debt, it is assumed that 10 per cent of retail debt matures each year for the next five years and 50 per cent in the sixth year.

Using the Exchequer Deficits and Maturity Profile of Existing Debt we can construct the following table.

The second last column gives the annual funding requirement for each year and the last column gives the cumulative requirement between now and that date. To fund the Exchequer Deficits and repay existing debt between now and the end of 2015 we need just over €100 billion. How much do we have?

At the end of 2010 we had €16,164 million of cash and other liquid assets that was built up by the NTMA in 2008 and 2009. The EU/IMF package provides €50,000 million of funding for the State. This €66 billion will bring us to about the middle of 2013. After that both our cash reserves and the funding from the EU/IMF will have been exhausted and we need €73 billion to get to the end of 2013.

Would there be any more money in the kitty? After the current round of recapitalisation there will be around €5 billion of non-banking assets in the National Pension Reserve Fund. See point 2 in this Information Note. This €5 billion would bring the total up to €71 billion. With the interest earned on our cash holdings and maybe a reduced interest rate on the EU borrowings it is possible that we would be able to stretch things out as far as the end of 2013.

As we said in the initial post, the start of 2014 is a crucial time when projecting Ireland’s public finances. On the 15th January 2014, €11,857 million of government bonds are due to mature. As things stand we will not have the money to repay these bonds.

If you look at the schedule of outstanding bonds you will see that these bonds have the highest yield. At the close today (27/05) the yield on these bonds was 13.12%. The next bond redemption date after that is not until April 2016 when a further €10,168 of bonds mature and these have a current yield of 11.81%. This is still in the stratosphere but the big problem we face is the €12 billion of bonds due to be repaid at the start of 2014.

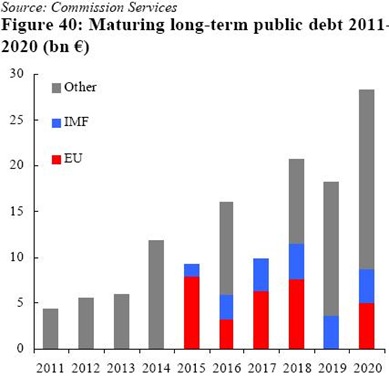

If we get over that we have nearly two and a half years until the next redemption date for government bonds falls due. However, it should be noted that repayment of the EU/IMF loans is due to begin in 2015 with about €10 billion due as can be seen in this graph from page 38 of a European Commission report from February.

In our previous post we suggested that if the €7.5 billion contribution of the EU/IMF to the bank contingency fund that is not being used was redirected to fund the State we could get through the early 2014 squeeze. This is patently not true. At current rates our cash balances and the original €50 billion from the EU/IMF will be exhausted in mid-2013. This extra €7.5 billion would keep us going until the start 2014 but we would not be able to repay the €12 billion of bonds maturing in January of that year.

Of course, there is a lot that can happen in the three years between now and 2014. The hope is that a lot of the uncertainty that currently shrouds the sustainability of Irish public debt, and also the Irish banks, will have been replaced with a realisation that the situation is difficult but not terminal, and that the domestic economy will have shrugged off the torpor of the exploding property bubble and returned to moderate growth. By 2014 these are hopes that can be achieved.

If this comes to pass it is likely we can return to bond markets to raise private funds. The current plan is that this will begin in mid- to late-2012, but with ten year yields north of 11% it is hard to imagine this coming to pass in that timeframe. It is possible but I think a timeframe of mid- to late-2013 will be more likely and the numbers above suggest that we can fund ourselves until that time.

If the additional €7.5 billion was available as a contingency it would add further support to that view. The consensus view of the DoF, EC and IMF is that the General Government Debt to GDP ratio will peak in 2013 and begin to decline thereafter. If, by 2013, signs of this are evident rather than projected then it would strengthen the view that the debt is sustainable and the possibility of raising private funds would be increased.

Proposition for the additional support we need came from the IMF last week. In a conference call following the release of their latest review of the Irish programme Ajai Chopra said:

“European partners need to make clear that for countries currently with programs there will be the right amount of financing on the right terms and for the right duration to foster success. In other words, the countries cannot do it alone and putting a disproportionate burden of the cost of adjustment on the country may not be economically or politically feasible. The resulting uncertainty affects not only these countries but through the high spreads and lack of market access it increases the threat of spillovers and creates downside risks to the broader euro area. Hence, these costs need to be shared including through additional financing if necessary.”

Of course, there are many potential downsides ready to spring up and undermine the view that we can resume funding ourselves independent of official support. These uncertainties are manifold and we do not need to revisit them here. The conclusion here is that the State has funding that can see it through until after the middle of 2013. Between then and now they key is to restore the credibility that will allow us source funds from that point on private markets.

We started the crisis trying to hide the true extent of the economic catastrophe we faced with claims such as:

- “Cheapest bailout in the world”

- “Our plan is working. We have turned the corner.”

- “The banks are floating away from dependence on the State and will be free standing.”

We have long passed the point where “others believe in us” and statements such as the above, and many more besides, have completely undermined our credibility. More recently we have moved to a position where we are much more open and accepting of the huge problems we face. The Department of Finance is now aligned with the views of the EC and the IMF. The recent stress tests have earned validity that previous attempts have not. The external view is that we may still have some skeletons in the closet as has been the case with the now beleaguered Greece.

However, I think that give or take €5 billion or so (which would be largely down to forecasting difficulties), we have put our problems out in the open. The true scale of the problems in the public finances and on the balance sheets of the banks is now accepted. We now need to deal with some domestic overshooting pessimism and external underrunning credibility.

These are deservedly reflected in the current bond yields. Over the next 18 months if it can be shown that we have finally gotten a handle on our problems (which I believe we largely have) this pessimism will dissipate and our credibility can be restored. If we achieve that we can find the €100 billion needed to keep country funded until the end of 2015, and particularly the €20 billion needed for 2014.

No comments:

Post a Comment