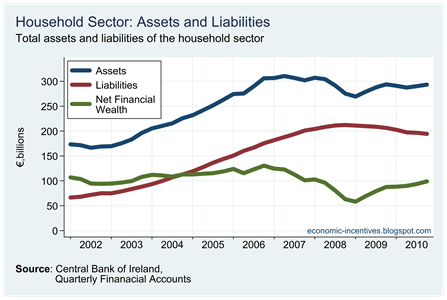

The Central Bank has released the Q4 2010 data for its Quarterly Financial Accounts series. The release is here and the data is here. The numbers give an insight into the improving balance sheet of the household sector in Ireland.

Net financial wealth in the household sector has been increasing since the beginning of 2009 but is largely unchanged from where it was in 2002 when the series begins. This has been brought about by a combination of increases in financial assets and decreases in financial liabilities.

Although the total amount of financial assets held by households increased from 2002 to 2007, this increase was offset in net financial wealth by a similar increase in liabilities. The graph below gives the largest of those household financial liabilities: loans.

The total amount of loans owed by households has been falling since end of 2008. This is the result of a huge slowdown in the drawdown of new loans, particularly mortgages, and repayments of existing loans. The amount of outstanding loans in the household sectors peaked at €203 billion in Q4 2008. In the eight quarters since then it has fallen to €186 billion.

At 120% of GDP this is still very high but the data show that it is declining as households undergo significant deleveraging. The vast majority of this reduction will be the result of loan repayments rather than loan write downs. Most of the loan write downs applied by the banks to the loans books so far have been as a result of the transfer of their developer loans to NAMA.

No comments:

Post a Comment