Since the middle of 2008 there has been €20.6 billion of budgetary adjustments untaken. By the end of the current “four-year plan” a further €9.8 billion of adjustments are planned. These are huge changes. However, we must not confuse adjustments with cuts or savings. Adjustments are just changes. Whether they lead to expenditure reductions or savings depends on the nature of the adjustment and the environment in which they are enacted.

Here we provide an update of government expenditure using the 2011 projections. First up, here is gross government expenditure.

Gross government expenditure in 2011 is forecast to be €68.1 billion. This will be about 44% of GDP. And this is central government expenditure. A further €6 billion of local government expenditure would have to be added to get total government expenditure bring government expenditure to around 48% of GDP.

Looking at the graph it can be seen that the reduction seen in 2010 does not seem to be continuing into 2011. Were the €6 billion of adjustments in last December’s budget just a spook story? After €20.4 billion of adjustments gross government expenditure is back to 2008 levels. However, this doesn’t tell the full story.

The first thing we can do is break expenditure into voted and non-voted. Voted expenditure is the money spent by various government departments providing goods, services and transfer payments. This must be “voted” through in the Dail. Non-voted expenditure does not require an annual vote as it is required under existing legislation.

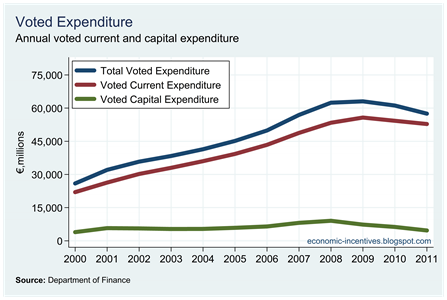

We can see that voted expenditure has continued to decline and has been falling since 2009. Voted expenditure at €57.5 billion is now back to 2007 levels. Voted expenditure in 2011 will be about 38% of GDP. In 2007 it was 30% of GDP.

The “levelling-off” of gross expenditure in 2011 is due to changes in non-voted expenditure. We will return to this shortly. The next distinction we can make is between current and capital expenditure.

This shows that current expenditure has been largely unchanged over the past few years with the changes in gross expenditure actually caused by capital expenditure, even though it is only a fraction of current expenditure. However, these totals are again a bit misleading. It is important to break these totals into voted and non-voted expenditure. Again voted expenditure represents the provision of goods and services by the government.

Here is the breakdown of current expenditure. Voted current expenditure is estimated to be €52.8 billion in 2011. This is just below the level recorded in 2008.

By departments this expenditure goes on Social Protection (39%), Health (27% ), Education (16% ), and Other Departments (18%). Although Health and Education make up a large proportion of voted current expenditure most of this actually goes on pay. Across all voted expenditure pay, pensions and transfers make up 74% of the total.

The reason that current expenditure has not fallen has been because of the increase in non-voted current expenditure. This is mainly interest on the National Debt which has been increasing for obvious reasons. Most of the reduction in voted current expenditure has been offset by increases in non-voted current expenditure.

These changes are even more pronounced for capital expenditure.

The biggest proportion change in expenditure has been in voted capital expenditure through the huge scaling down of the public capital programme. Voted capital expenditure in 2011 will be almost 50% lower than it was in 2008 and is now back below the level seen in 2001. A lot of the expenditure adjustments have been on voted capital expenditure but the limits of this are now being reached.

Non-voted capital expenditure has exhibited unusual volatility since 2009. This is explained by the banking crisis. In 2009, there was a €4 billion payment to Anglo Irish Bank. While there was no payment in 2010, in 2011 the first of the promissory note payments occurred with €3.2 billion paid to Anglo and INBS. Again, a lot of the reductions in voted expenditure are being offset by increases in non-voted expenditure.

The final two graphs just give the voted and non-voted expenditures on the same graph.

When it comes to voted expenditure, the total in 2008 before the current austerity programme began was €62.4 billion. In 2011, after three years of austerity, it is forecast to be €57.5 billion. Government expenditure in the economy is forecast to be €4.9 billion lower than it was in 2009. This is 3.2% of GDP. Of this reduction, €0.5 billion has been from current voted expenditure and €4.4 billion has been from the voted capital budget.

The final graph gives non-voted expenditure. The changes in non-voted capital expenditure have been explained. The increase in interest payments leading to the rise in non-voted current expenditure is evident and this expenditure is now more than double the 2008 total.

No comments:

Post a Comment