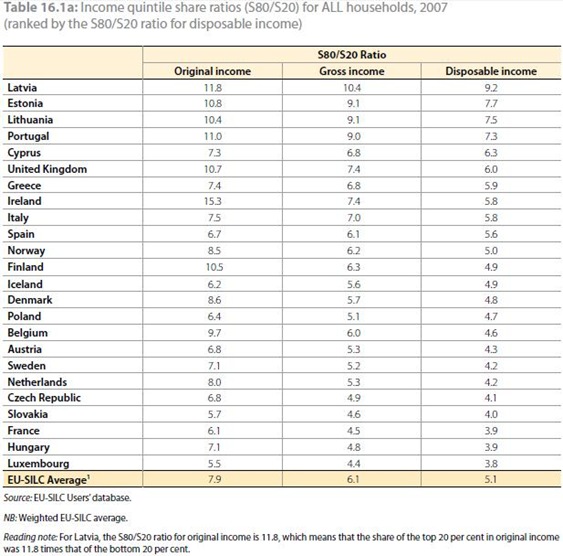

Chapter 16 of this 2010 publication from Eurostat has some interesting results based on the EU-SILC (Survey of Income and Living Conditions). The findings are based on 2007 data but are worth considering.

Original income is defined as:

Original income is income from market sources and includes employee cash or near cash income, non-cash employee income, cash benefits from self-employment, value of goods produced for own consumption, income from rental of a property or land, regular inter-household cash transfers received, interest, dividends, profit from capital investments in unincorporated business, income received by people aged under 16, pensions from individual private plans and old age benefits.

Ireland has by far and away the greatest level of inequality when it comes to original income. The level of original income in the bottom quintile is more than 15 times lower the level of original income in the top quintile. The next highest country is Lativa at 11.8 with a weighted EU average of 7.9.

The next column looks at gross income which is original income plus cash benefits where

Cash benefits are a sum of all unemployment, survivor’s, sickness and disability benefits; education-related, family/children related and housing allowances; and benefits for social exclusion or those not elsewhere classified.

The impact of cash benefits on Ireland’s inequality is significant and once cash benefits are included there are four countries that have a quintile share ratio that is higher than Ireland’s.

The final column gives the quintile shares for disposable income where

direct taxes and regular inter-household cash transfers paid are deducted from gross income to give disposable income.

Again Ireland’s relative ranking improves and Ireland is in 8th position in this final column. Ireland quintile share ratio in 2007 was 5.8 compared to an EU average of 5.1.

Using the 2010 EU-SILC Report for Ireland the equivalent figures for 2010 are

- Original Income: 19.2

- Gross Income: 10.0

- Disposable Income: 8.1

The next table provides similar analysis using Gini Coefficients.

Unsurprisingly, the results for the Gini Coefficients show a similar pattern to those from the income share quintiles. The concentration coefficients show that, in 2007, Ireland had a benefit system that was just as progressive as the EU average and a direct tax system which was the most progressive.

The next table provides a useful summary of the relative proportions of cash benefits to original and gross income.

Relative to original income Ireland had the joint-third highest level of cash benefits with only Norway and Denmark providing more. On the other hand Ireland had the joint-third lowest level of direct taxes with only Cyprus and Slovakia taxing less. In Ireland disposable income was 84% of gross income compared to an EU average of 78%.

Again here are the 2010 equivalents for Ireland

- Original Income: 82

- Cash Benefits: 18

- Gross Income: 100

- Direct Taxes: 13

- Disposable Income: 87

The final table we will consider examines the percentage of gross income that comes from cash benefits.

In each of the first three quintiles Ireland has the greatest proportion of gross income coming from cash benefits is at least twice the EU after in all cases.

The 2010 figures for Ireland are

- Bottom: 51

- Second: 49

- Third: 30

- Fourth: 16

- Top: 6

The increased reliance on cash benefits is evident and this is clearly driven by the increase in unemployment since 2007.

I’m sure there are a myriad of ways to (mis) interpret these findings and a careful read of the full chapter is necessary. (pp. 345 to 367 though at least half is tables and graphs)

It should be pointed out that these are not based on equivalised figures so no account is taken of the number of people in each household and the composition of individuals in households by quintiles is likely to differ by country (employed, unemployed, retired, student etc.). Most importantly it uses 2007 data.

To finish here is one figure from the chapter.

No comments:

Post a Comment