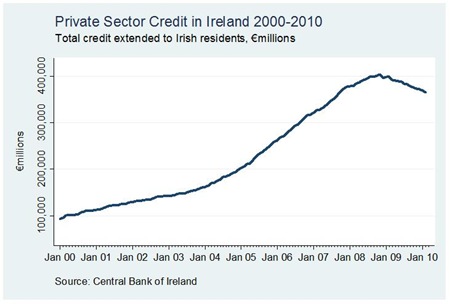

Private sector credit rose continually from €100 billion at the start of the decade to break through the €400 billion mark towards the end of 2008. This has been a fall back since then, and the most recent figure from February is €365.5 billion. This has occurred because repayments on existing debt have been more than the issue of new loans and because the banks have begun to slowly write down the value of bad debts on their balance sheets.

The huge increase in PSC from 2000 was often quoted to back up the claim that Irish households were “swimming in debt” and had borrowed huge amounts of money. Statistics were quoted which divided the total amount of debt with the total population to give measures of borrowing per capita. For example €400 billion in debt divided by a population of 4.4 million gives an average debt of over €90,000 per capita in 2008 or over €200,000 per household.

But with all the revelations about NAMA and the Irish banking collapse there must be doubt now cast on how these PSC figures actually relate to the ‘man on the street’. We are only now getting a clearer picture of the activities of bankers and developers in Ireland.

Yesterday, NAMA announced they were taking €16 billion in loans off the Irish banks in the first tranche of a total of €80 billion. NAMA have revealed that half of this $80 billion total relates to just 100 borrowers. The other €40 billion relates to some 1,400 people.

These 100 biggest borrowers are having an average of €400 million in debt transferred to NAMA. These are figures that are almost beyond comprehension.

What has this to do with Private Sector Credit? Well, it is clear that a huge amount of the credit issued in Ireland was going to a very small group of people. This had little effect (up to now) on the debt of the average person in Ireland.

If we ignore the borrowings of these 1,500 being transferred to NAMA there is €285.5 billion in private sector credit remaining. Dividing this by the current population estimate of 4.5 million people gives an average debt per capita of just under €63,000. Taking out just 1,500 people from a population of 4.5 million sees the average debt per capita fall by nearly €30,000 or nearly 33%. This group of borrowers makes up 0.03% of the population.

Of course we can’t ignore these borrowings. They may be removed from private sector credit. But they have been transferred to the public debt (even if it is off balance sheet). Public debt is debt owed by the public. This means it is now owed by ‘the man on the street’.

No comments:

Post a Comment