The Information Note is reasonable upbeat concluding that “in overall terms, this is generally in line with Department of Finance expectations and the Budget Day targets for 2010 remain valid.”

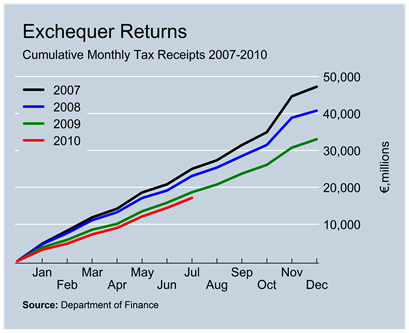

As has been our habit we will give particular focus to the patterns seen in tax revenues. The headline is that tax revenue is ‘only’ €247 million or 1.4% behind profile. Table here. Of more concern is the comparison of 2010 tax revenues to the equivalent figures from 2009. This shows a shortfall of over €1.5 billion or 8.2%.

After the substantial drops observed over the first few months of the year the annual decrease has eased since March. If the decline was to stay at –8.2% for the remainder of 2010 this would mean an annual tax revenue of €30,337 million, just over the €30 billion threshold of my bet. Any further moderation in the decline will see that annual tax take rise above this.

However, we can see that after a relatively stable Q2, where two of the three months were above their 2009 equivalents, the start of Q3 has seen a return to annual decreases. All of the VAT months so far (January, March, May and July) have seen annual declines recorded.

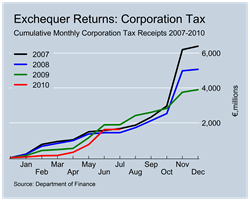

The Department’s Information Note states that “3 of the ‘Big 4’ tax-heads performed to expectations in the first seven months of the year.” This may be true (see table here) but a comparison to last year shows that three of the so-called Big 4, Income Tax, VAT and Corporation Tax, are down substantially on last year.

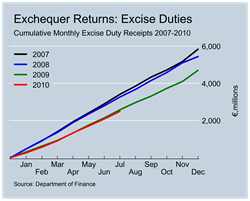

Earlier in the year Excise Duty had been performing well and was actually ahead of the 2009 figure but this has now reversed and Excise Duty, like all main tax headings, is now below the 2009 figure. Looking at July alone we see this decline continuing for Income Tax, VAT and Excise Duty. July is not an important month for Corporation Tax.

Although completely insignificant it is interesting to note that a negative amount of Capital Gains Tax was paid in July! Anyone got a plausible explanation?

For the first seven months of the year July was actually the closest the Department of Finance have got to predicting tax revenue. Their forecast was out by €19 million or 0.7%.

The Department’s forecasts for the individual tax headings for July were not quite as accurate (see table here), though Income Tax did come in ahead of target for the first time this year.

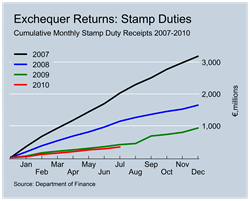

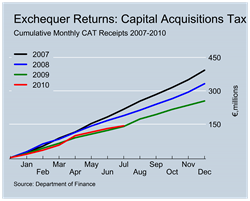

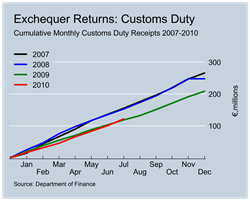

The Department’s forecasts for the individual tax headings for July were not quite as accurate (see table here), though Income Tax did come in ahead of target for the first time this year.For those who’ve had their fill and numbers and tables here are the graphs. Click smaller graphs to enlarge.

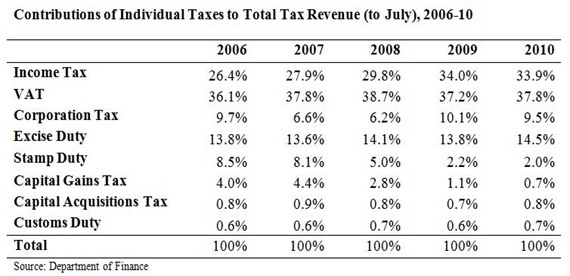

Finally let's update our analysis from May that examined the relative contributions of the various tax headings to the total tax take.

The increased importance of Income Tax can be clearly seen. Over the five years shown the combined of Income Tax and VAT has increased from 62.5% of total tax revenue to 71.7%. Over the same time the contribution of Stamp Duty and Capital Gains Tax has fallen from 12.5% to a miserly 2.7%. The contributions of Corporation Tax and Excise Duty are relatively unchanged with the other tax heads too small to be of interest.

No comments:

Post a Comment