As of the end of December, domestic Irish banks had total liabilities of €742.5 billion. Here is the list of banks included in this total.

ACC Bank plc

AIB Mortgage Bank*

Allied Irish Banks plc*

Anglo Irish Bank Corporation plc*

Anglo Irish Mortgage Bank*

Bank of Ireland Mortgage Bank*

Barclays Bank Ireland plc

Danske Bank A/S

EBS Building Society*

EBS Mortgage Finance*

ICS Building Society*

Investec Bank plc (Irish Branch)

Irish Life & Permanent plc*

Irish Nationwide Building Society*

KBC Bank Ireland plc

Northern Rock plc

Rabobank Nederland

The Governor and Company of the Bank of Ireland*

Ulster Bank Ireland Limited

Credit Unions

55% of the banks on the list are covered by the bank guarantee scheme but the Central Bank do not provide data on what proportion of the total bank liabilities are due by the guaranteed institutions. It could be more than 55%, but we don’t know. The only thing we can really say is that 100% of the liabilities in these figures are not against the guaranteed (and likely nationalised) banks.

To give some insight into this at the time the blanket guarantee was introduced in September 2008, the total liabilities of domestic banks was €787 billion. We know that that guarantee covered approximately €440 billion of liabilities. This suggests that 56% of the total banking liabilities were covered by the guarantee. We do not know what has happened to this ratio since then and the scale of the guarantee was subsequently reduced.

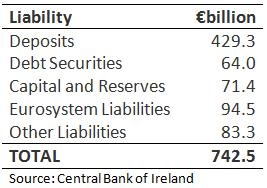

Here is a breakdown of the current €742.5 billion of liabilities on domestic banks’ balance sheets.

The money owed to the Irish Central Bank under the Emergency Liquidity Assistance programme is under ‘Other Liabilities’. The smallest liability category is ‘Debt Securities’ which includes the much maligned bondholders. Here is how total liabilities of domestic banks have changed over the past three years.

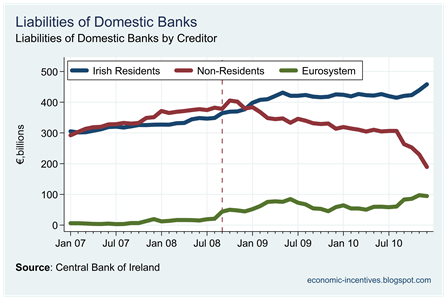

What is also important is who is actually owed this money. First up we can divide it between Irish resident, non-resident and Eurosystem liabilities.

Of the total liabilities of Irish banks, 63% are now owed to Irish residents. There has been a number of claims that the “Irish bail-out” has been orchestrated to save “big European banks”. Looking at the above does suggest that it is non-residents who are getting out (unscathed?) from the Irish banking market, with liabilities to non-residents dropping from around €406 billion in October 2008 just after the guarantee was introduced, to less than €190 billion now. But how much of this was owed to European creditors?

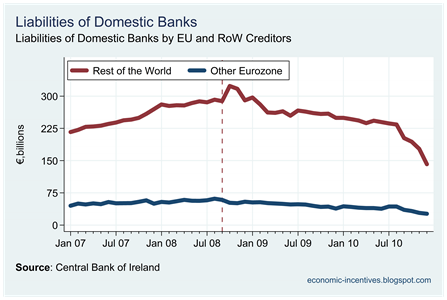

We can breakdown deposits and debt securities into holdings by Other Eurozone and Rest of the World residents. We cannot do the same for the capital and reserves or other liabilities categories but these only make up €21.5 billion of the total of €189 billion of non-resident liabilities in domestic banks. So how is the remaining €168 billion distributed? Is this the money that needs to be paid back to rescue “big European banks”?

Erm, it appears not.

Of the liabilities included only 15.6% are owed to other Eurozone residents. The greatest bulk of it is due residents from the rest of the world (€26.3 billion versus €141.6 billion). Liabilities to Other Eurozone residents have dropped by €32.3 billion since the €58.6 billion that was outstanding at the time of the guarantee.

This is dwarfed by the €182 billion drop in liabilities to rest of the world residents since October 2008 this stood at €323 billion. The accelerated decline since August 2010 is once again noticeable. The inclusion of the €21 billion of capital and reserves and other other liabilities for which the Eurozone/RoW breakdown is not available is not large enough to change this.

Of course, this is not a firm conclusion and the money could be arriving here from “big European banks” via international markets and placed under the Rest of the World category. As London is outside the Eurozone and classified as Rest of the World this could be an important consideration.

No comments:

Post a Comment