As it stands Ireland’s public debt is made up of five distinct types (estimated size at 30th June 2011)

- Government Bonds (€89.7 billion)

- Retail Debt (€13.7 billion)

- EU/IMF & Bi-lateral Loans (€22.4 billion)

- Promissory Notes (c. €28 billion)

- NAMA Bonds (c. €28 billion)

These all come with different costs and interest rates. The interest coupons on the €89.7 billion of outstanding bonds can be seen here and ranges from 3.9% to 5.9%. The retail debt pays prizes to winners in the case of Prize Bonds and fixed interest rates in the case of Savings Certificates and Bonds.

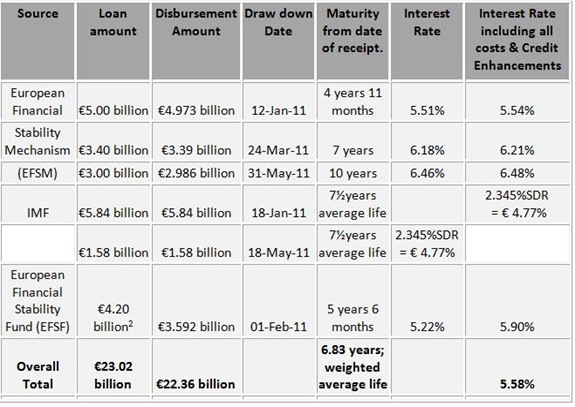

The concern here is with the costs of items three and four. Here is a very useful table which was provided via an interested reader. (HT: Kevin). This table shows the drawdown amounts and interest rates on the EU/IMF loans at the end of June.

The outcome of the Brussels summit on the 21st July was that our borrowings under the EFSF would be reduced to something close to 4%. As we can see from the above table we have drawn down around €3.6 billion at an interest rate of 5.9%. In total we are due to borrow €17.7 billion from the ESFS so there will be some savings.

It remains to be seen if the interest rate reduction will also apply to our borrowings from the EFSM. As we can see above these funds carry on interest rate of up to 6.48%. Under the programme it is expected that we will borrow €22.5 billion from the EFSM so substantial savings will be earned if (or when) the reduced interest rate is applied.

The other €4.8 billion of the €45 billion in loans from the EU is being arranged through bi-lateral agreements with individual countries and we already know that the UK has committed to reducing the rate on the loan it is providing. It is not expected that there will be any change on the €22.5 billion of loans from the IMF.

Yesterday’s statement from S&P takes account of this uncertainty.

Following the Heads of State or Government of the Euro Area and EU Institutions statement of July 21, 2011, we expect the interest rate on the European Financial Stability Facility portion (€17.7 billion) of Ireland's €67.5 billion external support package to decrease to about 4.5%, from about 6.0%. We estimate the saving to the Irish government on interest payments will be around €0.9 billion (0.6% of GDP) cumulatively over 2012-2015. The maturities on EFSF loans are also expected to be lengthened as part of the Heads of State agreement. Meanwhile, it is also possible that interest rate reductions will be extended to Ireland's European Financial Stability Mechanism (€22.5 billion) and bilateral borrowings (€4.8 billion).

When thinking about these rate reductions a sudden thought flashed across my mind that maybe these would have some impact on the interest rate charged on the Promissory Notes provided to Anglo and INBS. I briefly hoped that the interest rate might be calculated from some blended average of other government borrowing rates. Hopes were soon dashed. From the Information Note provided by the DoF last November.

The interest rate charged is based on the long term Government bond yield appropriate to when the amounts will be paid.

The interest rate on the Promissory Notes has nothing to do with government interest costs but is directly related to the yields on governments bonds in the secondary market. Pretty quickly my hope had turned to fear. These are not very low.

Information provided by the DoF shows the interest rates chargeable on the Promissory Notes. This is not new information and was provided by the then Minister for Finance, the late Brian Lenihan, back in January. See here.

The interest rate on the first three tranches is not out of line with our other borrowings. However, the €9.1 billion that makes up tranche four has an annual coupon equivalent to 8.6%. This is by far our most expensive debt.

We were up in arms at the 6% being charged to us by our EU partners, but we ourselves are paying nearly 9% to the two zombies that now make up the Irish Bank Resolution Corporation (IBRC).

We have been told that this new entity will not need any further capital injections from the State. This must be considered in the light of the €17 billion interest cost the Promissory Notes will impose on us during their lifespan. This is an implicit injection by the State.

Should we just payoff this €9 billion of 9% Promissory Notes with extra money borrowed at 4% from the EFSF? This would generate an annual interest saving of around €350 million. Of course we would actually have to pay the interest if we borrowed it from the EFSF rather than just rolling it up as accrued interest in the Promissory Notes.

This would eliminate the possibility of ever reneging on this portion of the Promissory Notes, but according to the current Minister for Finance we have no intention of doing so anyway.

No comments:

Post a Comment