This week has seen the release of three separate outlooks on the Irish economy.

- ESRI: Irish Government Debt and Implied Debt Dynamics

- IMF: Third Review under the Extended Arrangement

- EC: Economic Adjustment Programme Summer 2011 Review

The nominal GDP forecasts until 2015 are largely consistent.

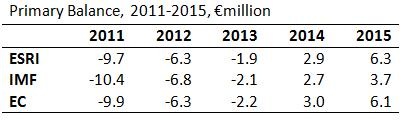

The forecasts of the Primary Balance (the government balance excluding interest costs) are also fairly consistent. It should be noted that these forecasts are all dependent on substantial budgetary adjustments (expenditure cuts and tax rises) being introduced over the next few years continuing with Budget 2012 in December.

Apart from the IMF’s forecast for 2015 there is little to separate them. We have looked at the IMF 2015 forecast in more detail before. The cumulative primary deficits to 2014 are €15 billion for the ESRI, €16.6 billion for the IMF and €15.5 billion for the EC.

The remaining part of the General Government Deficit is the annual interest cost incurred by the State. It is here that a divergence begins to emerge.

Both the IMF forecast that the cumulative interest bill over the next five years will be around €47 billion. The total from the ESRI is €39 billion. The ESRI’s forecast is based on a 2% interest rate reduction on all €45 billion of our borrowing from the EU as part of the rescue programme. The IMF and EC have not factored in savings on the full amount.

In fact when compared to the last IMF Review in May, they have increased their forecast of the interest bill for the next five years from €45.7 billion to €47.4 billion. The EC has also increased it’s forecast of the cumulative interest expenditure from €45.2 billion to €46.7 billion since it’s last review also in May.

All indications are that our interest bill will be reduced but the assumptions used by the IMF and EC and the fact that they have yet to account for the July 21 interest rate changes has resulted in their forecasts of this expenditure item increasing. We can expect this to fall in subsequent reviews.

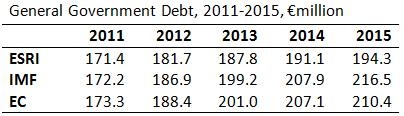

Here are the General Government Debt forecasts. First in nominal terms.

And as a percent of GDP

All show the debt stabilising by 2013 though it is worth repeating that this is based on the implementation of continued budgetary cuts over the coming years. All of the projections are that the debt to GDP ratio will stay below 120%. Previously the IMF has been forecasting that the debt would peak at 125% of GDP. This peak forecast has been, and continues to be, revised down as this graph in the IMF review shows.

When the EU/IMF programme was initiated the IMF were projecting that Ireland’s 2015 GGD would be around 122% of GDP and a very gradual rate of decline. Using preliminary estimates of the impact of the lower EU interest rate is now forecast to be around 114% of GDP which a slightly accelerated rate of decline.

This is still a huge debt level but if we were still projected to follow the full blue line above it is difficult to see how our debt would ever become sustainable. The green dotted line shows that the debt ratio is now projected to peak at a lower level and fall slightly faster.

No comments:

Post a Comment