We have previously looked at the mortgage proposal from the New Beginning group (here and here). Revised details of the proposal have been circulated. Following our previous analysis the key peace of information is that the interest rate on the example we worked through is 3.55% rather than the 4.29% that was assumed in the previous posts.

“Compound interest” is the answer attributed to Albert Einstein when apparently asked what he thought mankind’s greatest invention was. Just three-quarters of a percentage point may seem like a small change but in a mortgage such a difference can have a massive effect.

Our initial assumption came from the fact that Ken’s repayment was given as €1,450 per month and that he had borrowed €315,000 over 35 years. If you plug these into a mortgage calculator the required interest rate is 4.29%. This was further supported when the starting payment of €840 was the interest-only payment on the non-shelved mortgage of €215,000 at 4.29% but this appears to have been nothing more than a remarkable coincidence.

The updated information indicated that Ken’s actual mortgage payment is €1,387.61 per month rather than €1,450, that the interest rate is 3.55%. It is still assumed the case that the €315,000 is to be paid off over 31 years.

If the interest rate was 4.29% it would take total payments of €570,000 to repay the full amount over 31 years under the conditions of a typical mortgage. If the interest rate is 3.55% the same mortgage can be repaid with €520,000.

The New Beginning proposal is that Ken’s monthly payment be immediately reduced to €840 and that this is applied to a mortgage of €235,000. Ken monthly payment increases by 3% per year and the €80,000 of the mortgage that is “shelved” is repaid in instalments beginning in year 10.

First up here is what happens to the €235,000 loan using the New Beginning figures. The actual annual payment increase is 3.0595% rather than just 3% and this continues until the payments reach €1,135.48 from the start of year 11.

The €235,000 is paid off over the 31 year term of the loan (with eight months to spare). This requires payments of just over €402,000. Again it should be remembered that the loan can be paid off for less if a standard mortgage repayment schedule is applied. However, in this case a typical mortgage of €235,000 at 3.55% over 31 years would require €388,000 of repayments. The difference is only €14,000 and the benefit of the reduced payments early in the term is likely to be useful to someone who is having temporary difficulty in meeting their mortgage commitments now.

What about the €80,000 that was put on the shelf?

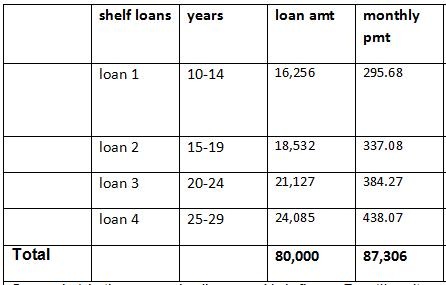

This is repaid in four short-term loans beginning from year ten. These are five-year loans where some of the €80,000 is taken off the shelf and repaid at 3.55%. The rest of the money stays on the shelf and no interest is charged. The proposed repayment schedule is

Essentially Ken the borrower gets €80,000 interest free for ten years (cost €34,034 at 3.55%), €97,778 (equal to €80,000 + €34,034 – €16,256) interest free for a further five years (cost €18,961), €98,207 interest free for a further five years (cost €19,044), €96,124 interest free for a another five years (cost €18,640) and €90,679 interest free for ever more but the cost for the final six years of the mortgage is €17,584.

All told the bank has foregone €108,263 of payments over the 31 years of the mortgage. The interest costs of this will continue into perpetuity.

All told the borrower will have made €402,000 of payments on the mortgage and €87,000 of payments on the shelved loans over the 31 years of the plan. If this €489,000 had been used to repay a standard mortgage over the same time it would repay a mortgage of €296,000 at 3.55%, just €19,000 below the original loan of €315,000.

How much of the €315,000 if the New Beginning repayment schedule was applied to the full amount of the loan? In this instance the repayments will be around €103,000 short of repaying the mortgage in full.

The benefit of the New Beginning scheme to the borrower is just over €100,000. This can be shown as either the benefit of having borrowed money put “on the shelf” at no interest cost or the amount that would be left on the mortgage if the New Beginning repayment schedule was applied to the original loan.

It should also be remember that most of the benefit accrues to the borrower from having money borrowed from the bank for longer. The total amount of repayments are very similar: €520,000 to repay a standard €315,000 mortgage at 3.55% over 31 years versus €489,000 to repay under the New Beginning split mortgage scheme.

The borrower gains around €30,000 from making lower repayments, but because more of the payments are made later the actual benefit is north of €100,000. The power of interest rates is shown when compared to our previous analysis. With an interest rate of 4.29% the benefit of the scheme was estimated at around €280,000 for Ken.

A truer measure of the benefit of the scheme to the borrower (and hence the cost to the bank) is just over €100,000. The overall cost of implementing such a scheme depends on how many “Ken’s” there are. For every 10,000 that enter the scheme the cost to be covered is €1 billion.

The scheme is not as off the wall as the original analysis indicated. €100,000 is a lot of money but it may be a price worth paying as a solution to the current crisis. The scheme has some merit and it could be adapted so that some of the costs incurred early in the term can be recouped with higher payments later in the term of the loan – 31 years is a long time.

Still, though if we are going to reduce the mortgage burden on some people why make it so complicated? If we want to save someone €100,000 on their mortgage why not just reduce the balance upfront. Ken would save €100,000 on repayments over 31 years if his current mortgage was simply reduced from €315,000 to €255,000 – it’s just debt forgiveness.

As we said above the borrower also benefits from the reduced payments early in the term so the reduction will be less, probably to around €275,000. So we could follow the New Beginning repayment scheme or just knock €40,000 off the mortgage now. There is no difference.

No comments:

Post a Comment