New Beginning appeared in front of the Dáil Finance Committee today. It will be early next week before the transcript is released. From the details I have heard, the New Beginning mortgage proposal was compared to one of the Split Mortgage proposals in the Keane Report.

It is not clear that a fully worked example of the proposal was presented. The best example I have seen remains “Ken” as shown in a recent episode of The Frontline. Here is the description as provided by Pat Kenny that was part of a previous post on this topic.

“He borrowed €315,000 [..] Currently his full payment is €1,450 but if it was interest only and he did a deal with the bank that would be €917. If some of the interest was deferred, which the banks will do, to 66.66%, that would bring it down to €605.”

“But under the New Beginnings (sic) solution Ken would pay 35% of his monthly net income. That would be €840, which is more than the deferred interest payment. But that would be equivalent of paying a mortgage worth €235,000. Now the payment would then gradually increase by 3% a year over ten years.”

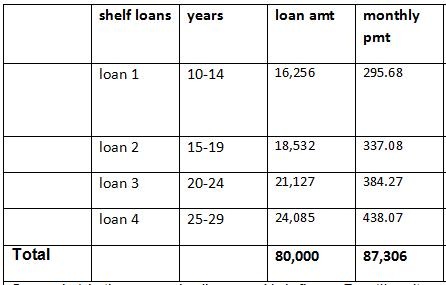

“In the meantime, the balance, that is €80,000. That is placed on the shelf. No payment on that shelf money for ten years at all, and it doesn’t accrue interest.”

“After ten years it comes into play and his repayment would have increased to, a maximum, a maximum ever, of €1,572. And the whole mortgage would be paid off in 31 years which is already the agreed term of the mortgage.”

Now there are three winners in all of this. The lender would stand to lose €225,000 today if he just walked away and handed back the keys. This way it’s all paid except the interest on €80,000 for ten years. He has the satisfaction of paying out his mortgage. And thirdly, the State would not have to house Ken if he had nowhere to go and he becomes a functioning spender in the economy.”

“So it’s win, win, win.”

What I want to do here is work through the numbers of the New Beginning plan. We are not given the interest rate but the current repayment implies a rate of 4.29% and that is what we will use here. As per the description we will apply the repayments to €235,000 and “shelve” €80,000.

The starting repayment of €840 is the interest only repayment on a loan of €235,000 at 4.29%. The payment increases by 3% per year thus allowing some of the capital to be repaid. Here is what happens to the €235,000 over the first ten years.

After ten years nearly €116,000 of payments have been made but interest has consumed €99,000, leaving a reduction in the outstanding balance of less than €17,000. In the first ten years the balance has fallen from €235,000 to just over €218,000.

At the start of year 11 we are told that the €80,000 that was shelved “comes into play” and we are told the repayment increases “to a maximum” of €1,572. Both of these are subject to interpretation. Initially I will assume that the €80,000 is added to the balance at the start of year 11 and that the repayment increases immediately to €1,572.

We now have 21 years to repay a loan of €298,105.80 with a monthly payment of €1,572. If we again use an interest rate of 4.29% how far will this get us?

After 31 years and with almost €512,000 of payments there is still nearly €92,000 owing on the mortgage. Ken still has a bit to go until he has his mortgage paid off. And this is also with the benefit of having paid no interest on €80,000 for the first ten years. The compound interest on that money for ten years is €41,273.

If this interest was considered deferred rather than written off and was added to the outstanding balance at the start of year 11, then €339,379 would have to be repaid with monthly repayments of €1,572 over the next 21 years. What would be left after 21 years in this case? Answer: €193,085. Table here.

One of the key principles of the New Beginning plan is that the borrower repays 35% of the their net disposable income. As pointed out in the comments the jump in year 11 to €1,572 would actually be 49% of net income with the assumed 3% annual growth rate from year 1.

What happens if we limit the monthly repayments to 35% of net disposable income but continue to increase them by 3% per year? To help make this a simpler calculation the €80,000 that is placed on the shelf is ignored in the following table.

As before the payments start at €840 and rise by 3% per year. This continues for 22 years by which time the payments have reached €1,563 per month. From year 23 onwards the payments are capped at €1,572.

This looks good. Here we can see that the mortgage is fully paid off four months into the 30th year. The plan works! However, there is always a ‘but’. In this instance it is “but what happened to the €80,000?” In the above table no payment is made on the €80,000 that is shelved.

There is still €80,000 of the original mortgage to be repaid. If that has been sitting on the shelf for 30 years accumulating interest it would be a huge sum. In fact, if compounded at 4.29% over 30 years, the €80,000 would have become €282,000. Calculated here. Who is going to pay that?

The New Beginning plan can pay off Ken’s mortgage but only if €80,000 of debt is written off now. The New Beginning plan combines debt forgiveness and then a graduated payment mortgage to pay off the remaining balance.

As the final table here shows New Beginning have a plan that will result in a mortgage being repaid. On a typical mortgage of €315,000 over 31 years at 4.29%, a borrower would repay about €570,000. As we can see in the table above the New Beginning plan has the mortgage paid off with payments of around €459,000.

It is worth noting that a typical €235,000 30-year mortgage at 4.29% can be paid off with monthly payments of €1,143 and a total cost of €388,000. If Ken could get his mortgage reduced to €235,000 he should ignore the New Beginning “35% of disposable income” principle and repay his mortgage in the usual fashion. This would save him a further €71,000.

The benefit to the borrower of the New Beginning plan is not the new repayment schedule they are trying to introduce. That actually costs the borrower money. A benefit only arises in the New Beginning plan because €80,000 of the debt plus interest is not paid at all.

On a cash payments basis Ken is better off by €111,000 under the New Beginning plan compared to his existing mortgage (€459,000 versus €570,000 ). As we will see below the actual benefit is much greater as Ken also benefits from a greatly decelerated capital repayment schedule. He has the money borrowed from the bank for longer but has to pay less for it.

In the description of the plan given by Pat Kenny it is said that:

“This way it’s all paid except the interest on €80,000 for ten years.”

That is not true. There is no interest ever paid on the €80,000, and the €80,000 itself is never paid off under the repayment plan that is presented.

To see the full benefit for Ken we must apply the €840 + 3% repayment schedule (up to €1,572) to the original mortgage of €315,000. To do that I combined results from the previous calculator with this calculator, which produced this repayment schedule.

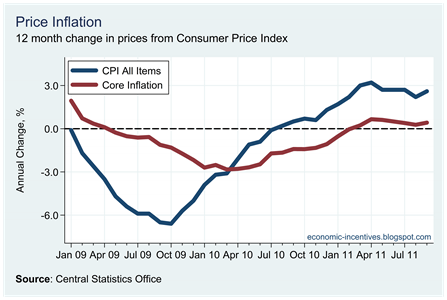

The interest-only payment on €315,000 at 4.29% is €1,126.12. By starting at €840, the monthly repayment would be below the monthly interest amount so the balance on the mortgage would actually be increasing. In fact, the monthly repayment would not get above the monthly interest amount until the start of year 14, by which time the balance due would be €343,000. After this the balance would begin to fall as the payment continues to rise by 3% per annum. By year 22 the payment would again have reached the cap of €1,572.

After 30 years the amount owing on the mortgage would be €274,000. The balance on the mortgage would have fallen by €41,000, yet €461,000 of repayments would have been made. In fact to repay the remaining balance of €274,000, the monthly payment 0f €1,572 would have to be continued for another 22 years and a half years.

If Ken applied the New Beginning repayment plan to his current €315,000 mortgage it would take 53 years to repay it. He would have to make €894,000 of payments, and would have a total interest bill of €576,000. See fairly large table here.

Ken is presented with this repayment plan on the show. As we have seen over 30 years this would see about €40,000 paid off if applied to his current €315,000 mortgage, but pays the mortgage down to zero if applied using the modifications (i.e. debt forgiveness) of the New Beginning scheme. When he is asked for his reaction he said:

I’m very impressed. [..] It seems like an excellent solution. I didn’t do honours maths in the Leaving, but if the figures add up, it looks very good.”

Of course it looks very good for Ken but the figures don’t add up. Someone else is making around €111,000 of mortgage payments he should be making. Over the 30 years of the mortgage the scheme is worth about €280,000 to Ken. We have worked out this two ways:

- €80,000 compounded at 4.29% for 30 years is €282,000

- If the €840 + 3% repayment schedule is applied to the €315,000 mortgage for 30 years at 4.29%, there will be €274,000 outstanding after 30 years. Under the New Beginning scheme the balance is zero.

If Ken can’t meet his mortgage repayments something needs to be done (and also remember that in his case his father signed as guarantor on the loan) but this New Beginning plan is not a “new way of paying a mortgage” in which everyone wins. It’s just debt forgiveness. Ken gets €80,000 or 25% of his mortgage written down right from the start.

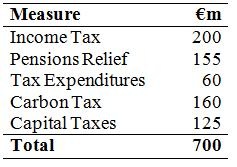

If this is a representative case and the same reduction was applied to 80% of the €17.5 billion of mortgages which are in arrears or have already been restructured then the upfront cost would be nearly €3.5 billion. If the other 20% of loans see half the mortgage written off through debt resolution the bill would be a further €1.8 billion. This €5.3 billion might be lower than some other debt forgiveness schemes, but it is still debt forgiveness.

The New Beginning plan can only work if each borrower’s mortgage is reduced so that the interest-only payment is equal to 35% of their net disposable income and the balance written off. It then depends on the borrower’s net disposable income rising by 3% per year. Finally, it needs an interest rate that does not rise above the initial level. If any of these is absent the plan cannot work and the mortgage cannot be repaid.

New Beginning deserve great praise for the work they are doing in providing legal services and support to borrowers facing legal proceedings. The benefits of this are huge and easy to see. The benefits of the mortgage solution they propose are much harder to find.