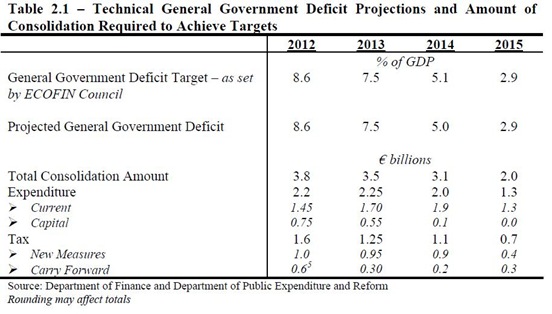

The forthcoming budget will contain a €3.5 billion set of expenditure cuts and tax increases with a rough breakdown of 2:1. The objective is ensure the general government deficit is below the limit set out under the Excessive Deficit Procedure. The table below refers to these are targets but the ECOFIN decision clearly states that they are limits which the deficit “does not exceed”.

There has been much debate about the composition of the expenditure cuts and tax increases to be introduced. Much has focussed on whether the balance is too heavily weighted in favour of expenditure cuts and that more of the necessary burden of closing the deficit be carried by taxation, particularly tax increases on the “rich”.

Let’s assume that the pre-announced reductions to capital expenditure for 2013 of €0.5 billion are persisted with but we look to income tax to achieve the €3.5 billion total required for the budget. This is unrealistic but as an exercise it should give an insight into what can be achieved.

Back in October 2010, John O’Donoghue set the following PQ for then Minister for Finance, Brian Lenihan:

To ask the Minister for Finance the amount the tax rate for those earning over €100,000 would have to be increased by for the Exchequer to save at least €3 billion.

The answer provided at the time was that the top rate of income tax for those earning over €100,000 would have to be 84%. Once Universal Social Charge (7%) and PRSI (4%) are included the marginal rate of tax on incomes over €100,000 would have to be 95%.

For the self-employed it would be 98% because of the 3% USC surcharge on self-employed earnings over €100,000 and for any public sector workers earning over €100,000 the marginal rate would have to be 105% once the 10% public sector pension levy is factored in.

It should be pretty clear that any suggestions that the budget deficit can be closed simply by “taxing the rich” are not realistic. For reasons unknown it is generally taken that the “rich” are those earning more than €100,000. However, there are just not enough of these people and they do not earn enough to raise the tax revenue necessary to meet the deficit targets.

Another PQ shows that the Revenue Commissioners estimates there was around 110,000 tax cases with an income over €100,000 in 2011, with 90,000 earning less than €200,000. Tax cases with incomes over €100,000 had a combined income of €20.2 billion and paid €5.2 billion of Income Tax (PRSI, USC, PS Pension Levy are not included).

The excess over €100,000 earned by these 110,000 tax cases is €9.1 billion. To raise an extra €3 billion would require a minimum extra 33% tax to be applied. In reality it would be higher because 65,000 of these cases are married couples with both earning. It is not clear how many individual incomes over €100,000 there are. Revenue reports show that 75% of the couples over the €100,000 threshold earn less then €150,000 so it seems likely that many have these will have combined incomes over €100,000 without necessarily having one income over €100,00.

This is dealt with in this PQ in July 2011 when is was asked:

To ask the Minister for Finance the extra tax that would be raised by increasing the income tax on all taxable income over €100,000 for an individual and €200,000 for a couple by 1%.

The answer was that it would raise €59 million in a full year. To raise €3 billion as outlined above would require 51 such raises. Thus we can update the answer provided by Brian Lenihan from October 2010. To raise €3 billion from individuals with incomes over €100,000 would require a marginal income tax rate of 92%. With USC and PRSI all marginal tax rates would be above 100%!

Anyone with an income over €100,000 would face an increase in their tax bill of an amount greater than the increase in their earnings. This is not to say that Income Tax should not be increases (it probably should) but there is no money tree out there that we can shake to eliminate the deficit. Here are some other PQ answers.

- A 50% income tax on all incomes over €100,000: €490 million

- Increase the top rate of income tax from 41% to 42%: €205 million

- A 1% levy on all income over €50,000: €440 million

- A 60% income tax on all incomes over €100,000: €1,110 million

There is scope to raise income tax but raising income tax on high earners alone is not enough. Although the figures are slightly dates here is look at who earns more than €100,000

- PAYE Employees: 31,516 out of 1,515,648 (2.1%)

- Public Sector Employees: 15,278 out of 414,623 (3.7%)

- Non-PAYE/Self-Employed: 70,800 out of 437,585 (16.2%)

Almost two-thirds of the high-earners are in the Non-PAYE category so include the self-employed, company directors and the like. This is also likely to be the group that shows the greatest fluidity. That is, a person in this category could have a successful year one year and rise in the €100,000+ income category but fall below it the next year. The make-up of the PAYE and Public Sector Employees in this group is likely to be relatively static but the largest group would be much more fluid.

Finally, it is often stated that those earning more than €100,000 are “rich”. Income is a flow so technically they are “high-earners”. Knowing someone’s income does not tell you if they are rich but it can be a good proxy. Rich is a stock measure of the difference between a person’s assets and liabilities. Some previous thoughts on wealth (and taxing wealth) in Ireland are here.

No comments:

Post a Comment