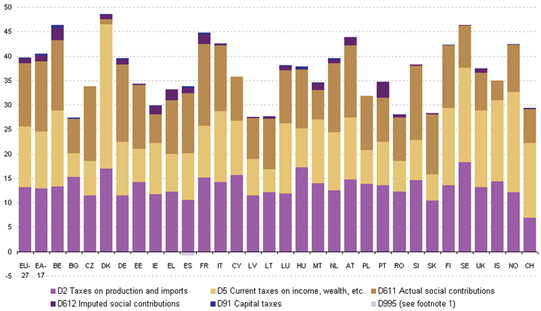

Ireland is commonly cited as a ‘low-tax’ economy with support coming from charts such as this from Eurostat based on 2010 data.

Ireland is in a class of EU countries with government revenue below 30% of GDP, 10 points below the EU average. The other EU countries in this group are Bulgaria, Latvia, Lithuania, Romania and Slovakia.

Graphs such as this are worth some closer study. For a start the graph is in terms of GDP, whereas for Ireland a comparison to GNP may be a better reflection of the tax burden, though both have merits. It may also be the case that Ireland is not a ‘low-tax’ economy but more a ‘low-insured’ economy.

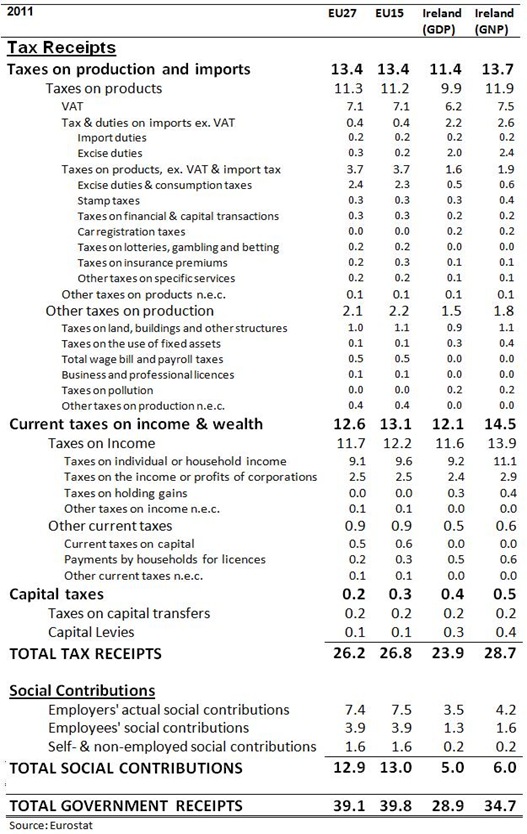

The following table includes 2011 data from Eurostat and gives government receipts as a percentage of GDP for the EU27, the EU 15 and Ireland with a GNP comparison for Ireland in the final column.

In GDP terms tax receipts in Ireland are a couple of percentage points below the EU averages, but when done in GNP terms, tax revenue in Ireland is above both EU averages. The reason Ireland appears to be ‘low-tax’ is not to do with tax at all; it is to do with social insurance contributions. Social contributions in Ireland were always well below the EU average, but with the abolition of the Health Levy in 2011, social contributions in Ireland are now less than half the EU averages.

In GNP terms employer social contributions are about 55% of the EU average, employee contributions are about 40% of the EU average and self-employed contributions are about 12.5% of the EU average.

Any intention to increase general government receipts in Ireland up to the EU average can propose to either push tax receipts further above the EU average or bring social insurance contributions up closer to the EU average.

Below the fold is a table extracted from the OECD’s Taxing Income publication which looks at effective tax and social contribution rate for different wage levels in 34 OECD countries.

Unsurprisingly, Ireland is below the OECD and OECD-EU averages at each of the income levels used. At 67% of the average wage, Ireland has the 8th lowest combined income tax/social contribution burden as a percentage of labour costs. At the average wage Ireland also ranks 8th, and then falls to 14th with the higher burden at 167% of the average wage.

The 2011 average wage figure used by the OECD for Ireland was €32,800. This puts the 67% level at €22,000 and the 167% level at nearly €55,000.

A crude measure of progressiveness is also calculated which takes the ratio of the burden at 167% of the average wage to the burden at 67% of the average wage. Using this measure Ireland has the second most progressive system for the group shown.

Relative to the unweighted average for the OECD-EU-21, the Irish levels shown in the above table for the combined income tax/social contribution burden for single people from total labour costs are:

- 67% of Average Wage: 56%

- 100% of Average Wage: 64%

- 167% of Average Wage: 84%%

All of below the OECD-EU average and the gap is greatest at lower income levels. If we limit the comparison to the income tax burden on gross wages between the OECD-EU average and Ireland the figures are.

- 67% of Average Wage: 75%

- 100% of Average Wage: 90%

- 167% of Average Wage: 121%

Ireland has a lower income tax burden than the OECD-EU average on lower wages, close to, but still below, the OECD-EU average for average wages and a higher income tax burden than the OECD-EU average for higher wages.

Finally here are Irish employee social contributions for single people from gross wages relative to the OECD-EU average:

- 67% of Average Wage: 31.9%

- 100% of Average Wage: 32.7%

- 167% of Average Wage: 35.4%

At each income level the employee social contribution is about one-third of the OECD-EU average. The changes to PRSI announced in Budget 2013 will flatten the slightly increasing pattern seen above.

All the OECD data used are available here.

No comments:

Post a Comment