(but could have been part of the solution)

The issue of bank bondholders continues to garner significant attention with articles such as this which proclaims:

IN THE LAST of over €20 billion in bonds paid out this year by Irish banks, Bank of Ireland has paid out €37.3 million to senior unsecured bondholders today.

It seems there are attempts to put some significance on the amount of bond repayments made by the banks. For some reason, no significance or detail is provided of deposit redemptions made by the banks. Both give money to the banks and expect it back at some stage. Deposits can be withdrawn at any stage or after a short notice period. The money given for a bond can only be withdrawn from the bank on maturity of the bond.

The interest earned on a bond will usually be greater than the interest earned on a deposit because of this restriction. Deposits tend to be non-transferable whereas somebody providing money to a bank via a bond will be issued with a saleable security. Although, the money for the bond cannot be withdrawn until maturity the holder can choose the sell the bond in the secondary market at the prevailing market price.

Before Christmas, Stephen Donnelly wrote:

Ireland is borrowing €67.5bn from the Troika. To date, we have given €64.1bn to the banks. The banks have in turn passed this on to the bondholders. At the time of the bank guarantee, Irish banks held €124bn in senior debt. All of this is being paid out in full.

Had the market been allowed to work, the banks would have been declared insolvent, and a creditors meeting would have been called. At this, an agreement to pay out less than the face value of the bonds would have been reached.

It is impossible to know what haircut would have been applied to the senior bondholders, but we do know this -- many of them sold on their bonds at a 50 per cent discount. In other words, they took a voluntary haircut of 50 per cent. It is not unreasonable therefore to suggest that a haircut of 50 per cent could have been agreed. In this case, the senior bondholders have been overpaid by €62bn.

So let's join the dots. First, €67bn goes from the Troika to the Irish Government, then €64bn (so far) goes from the Irish Government to the banks, and then €62bn in unnecessary payments goes from the banks to the senior bondholders.

Give or take a few billion, the Troika money essentially went straight from the troika to the bondholders.

At a reading this seems very plausible. This second last paragraph has a sequence of numbers the seem connected. In reality they are not. The piece confuses the reason why the banks were provided with €64 billion. They were not provided with €64 billion because they had billions of bonds; they were provided with €64 billion because they issued billions of loans that will never be repaid.

Conflating the size of the losses the banks have and the amount of bonds they are have issued is muddying the issue about where the problems in our banks emerged – on the asset side of their balance sheets.

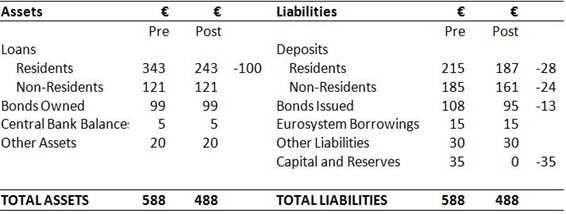

Here is a stylised version of a bank balance sheet (in billions).

It is based loosely on the most recent figures (Oct 2011) from Table 4A: Covered Institutions Aggregate Balance Sheet (xls) from the Central Bank’s Money, Credit and Banking Statistics, though the following analysis is only hypothetical rather than real.

As with all balance sheets it must balance. The balancing item is included in Capital and Reserves as ‘Shareholder Capital’ – the difference between the bank’s assets and its liabilities. Capital and Reserves also includes subordinated bonds, preference shares so this is where the money the state has put into the viable banks (AIB/EBS, BOI & PTSB) is recorded. Here is this item since the start of 2008.

The big jump in July 2011 is the recapitalisation money provided by the State following the March 2011 stress test carried out by BlackRock Consultants. As can be seen the level of capital in the banks was largely unchanged in 2012. The capital provided to the viable banks is still there – it is not eroded by bond redemptions no matter how big they are.

So what happens when a bond falls due for repayment? Assume that with the above balance sheet the bank has a bond it has issued of €3 billion falling due. The bank can use some of its existing assets to repay the bond: have loans repaid, sell some loans, sell some of the bonds it owns or use its central bank balances. This will keep the balance sheet balanced – a €3 billion reduction in liabilities is matched by a €3 billion reduction in assets.

Alternatively, the bank could create an an additional liability elsewhere to repay the bond, that is, borrow off someone else to make the repayment. This keeps the overall size of the balance sheet the same. Let’s assume that the bank can’t access €3 billion of deposits or issue a new bond for €3 billion so turns to the ECB for the money.

In the post-redemption situation the amount of bonds issued has fallen by €3 billion and the amount of Eurosystem Borrowings has increased by €3 billion. The overall balance sheet is unchanged and, more importantly, the level of Capital and Reserves is unchanged. Banks don’t lose money by repaying bonds (or deposits for that matter). Banks lose money by lending it out to people who will never pay it back.

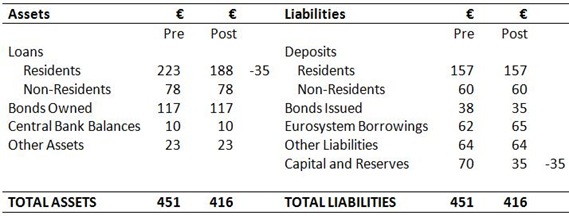

Here is the equivalent balance sheet from August 2008 (the month before the guarantee). It should be noted that the figures provided by the Central Bank in Table A4.2 are non-consolidated and only represent the Irish-resident operations of the banks. Intra-company balances to non-resident elements of the banks are included. We are just using this to illustrate a point. Anyway, here is the position from August 2008.

The problems that have emerged in the banks have very little to do with the right-hand side of the above table though we could have done without the banks availing of this money. The problems in the banks are from the left-hand side, what the banks did with the money when they got it – lent it to people who couldn’t pay it back.

Let’s assume that of the €460 billion of loans in our hypothetical bank that €100 billion won’t be repaid. The asset side of the balance sheet will have be written down by €100 billion. We will assume that this happens all at once. In order for the balance sheet to balance there must be some offsetting moves on the liability side.

The first port of call will be shareholders and subordinated bondholders and they will be wiped out. The problem is that they don’t have enough equity and capital in the bank to absorb all the losses. Once the €100 billion of loans are written off and all the capital and reserves are written off the balance sheet looks like this (click to enlarge):

Unsurprisingly, the bank is bankrupt, its liabilities exceed its assets, €553 billion versus €488 billion. This bank can no longer operate and a way must be found to balance the balance sheet with a €65 billion change to the liabilities. One way to do this is to continue the write-down that began with shareholders and subordinated debt-holders through senior bondholders and depositors.

In a very simplistic setting this can be achieved with a 13% “haircut” on all deposits and bonds giving rise to the following balance sheet.

The balance sheet is once again balanced but with no capital the bank is in no position to function. Alternatively a 60% haircut on bonds would achieve the same result:

The actual process doesn’t matter. What is required is a write-down of liabilities sufficient to allow the balance sheet to be balanced (or in the case of a wind-down, sell-off the assets and let the creditors divide the proceeds between them).

While the proximate problem is dealing with the bank’s creditors, the ultimate problem is that the bank has lent out €100 billion that will never be repaid. Once the €35 billion of shareholder equity and subordinated bonds are written off, there is a €65 billion hole to be filled. This has little to do with the amount of deposits the bank has accessed or the value of bonds it has issued. The problem is the profligate lending.

As we know the use of a bank failure as a response to the crisis in Ireland was ruled out in the autumn of 2008 and this culminated in the introduction of the two-year guarantee of all deposit, bond and even some subordinated liabilities of the banks. This ruled all the possibility of creditor write-downs for two years. So how do you fill a €65 billion hole if you can’t write down the liabilities – the bank must be recapitalised.

And we are back to the balance sheet we started with:

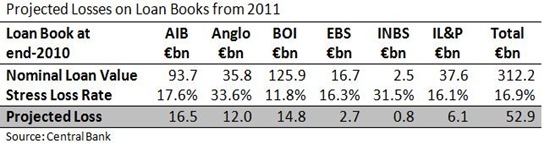

Although the BlackRock stress tests on AIB/EBS, BOI & PTSB and separate CBoI analysis of Anglo & INBS projected around €53 billion of life-time losses on their loan books the banks have made provision for around one-third of that.

In the above balance sheet it is projected under the stress-case scenario that the banks could face around €35 billion of further loan losses. It is the acknowledgement of these losses that will erode the capital that has been put into the banks by the State. If these losses do materialise then the balance sheet is

And the bank is back to the Capital and Reserves it had in August 2008 – the money put in to recapitalise it is gone. But the point is that the money did not go to repay bondholders, the money will go to cover the lending losses of the bank.

Now, there is no doubt that bondholders (and depositors!) could have covered those losses but that is a solution that was ruled out rather than the source of the problem.

The amount of bonds being repaid by the banks now doesn’t really matter. It was never the amount of bonds that was the problem. In fact, the banks had too few bonds! If the banks had raised more of their funding from bonds, the run-up t0 end of September 2008 may not have been so fraught. It was depositors pulling their money that precipitated the crisis.

And it was depositors who got bailed out with the guarantee. On the night of the guarantee Anglo Irish Bank had €11 billion of senior bonds in issue. The bailout of Anglo has seen €29 billion committed to it by the State. Even if the senior bonds were cut to zero there would still have been an €18 billion shortfall on the balance sheet of Anglo. Depositors could have picked that up but there was no scope to do so.

In total, the covered banks did have €124 billion of senior unsecured bonds is issue on the night of the guarantee. Here is what was covered by the guarantee from page 77 of The Nyberg Report.

These total €375 billion. The full €440 billion covered by the State at the time is reached when the €65 billion of deposits covered by the existent €100,000 Deposit Guarantee Scheme are included.

If it could be applied, the 50% haircut suggested by Stephen Donnelly would have covered most of the capital shortfall injected by the State. Among many problems with this proposal, one is the location of the bonds. More than one-third of the bonds were in Bank of Ireland. See page 104 of the 2009 Bank of Ireland Annual Report.

That is €50 billion of the total amount of bonds and €25 billion of the haircut suggested by Donnelly. This is a multiple of the money the State has injected into Bank of Ireland which is less than €5 billion. Suggesting the haircutting of bonds in one bank because of losses made in another bank is not a sensible position to take.

The attention given to bondholders does give a useful bogeyman at which to direct our ire but is slightly misdirected. The ultimate source of the problems in the banks was the madcap lending they engaged in. Focussing on bondholders also lets depositors off the hook.

Since the expiry of the original guarantee in autumn of 2010 around €200 billion of deposits have left the covered banks.

This is lots of angst against bondholders, but almost none against depositors. While some of the deposits were withdrawn by Irish residents (mainly monetary financial institutions) as much again were withdrawn by ‘Rest of the World’ residents.

In the context of the banking data produced by the Central Bank of Ireland ‘Rest of the World’ includes London. In the six months following the end of the guarantee ‘Rest of the World’ residents withdrew around €75 billion of deposits from the covered banks in Ireland. Some of this could be changes in intra-company balances but not a lot – it was a massive depositor flight.

There is no reason to doubt that the large international depositors are a different set of people to the international bondholders in the banks. They are people with money. The depositors were able to withdraw their money with barely a whimper. The maturing of a bond is treated as an almost cataclysmic event. And where have the banks got most of this money to repay these deposits and maturing bonds? The ECB and CBoI.

The Irish bank bailout has been a massive bailout of wholesale and interbank depositors. Small retail depositors were already covered by the €20,000 per person Deposit Guarantee Scheme which was expanded and extended to €100,000 per person per bank on the 20th of September 2008.

NOTE:

Although the covered group balance sheet from the Central Bank is used above it should not be taken that the balance sheets reflect what has happened to the covered banks. They are merely used to make the points. For example, the Promissory Notes were not provided as capital to prop up the liability side of the Anglo/INBS, they are counted as a loan asset on the asset side. Also no recognition is given to deleveraging, provisioning and other developments in the interim.

No comments:

Post a Comment