As explained in the previous post it is not the size of the government debt that has a direct impact on the public finances; it is the interest cost it generates (though the size is obviously a big factor in that)

What was in play with yesterday’s restructuring was a €25 billion Promissory Note debt. It was a €25 billion debt on Wednesday, it is a €25 billion debt today and it will be a €25 billion debt in 2053. But because of inflation not all €25 billions are created equally.

Anyway, the debt in question generates two interest costs for the State:

- The interest on the central bank funding which carries an interest rate equals to the ECB’s main refinancing rate.

- The interest on the borrowings used to pay down the central bank liquidity.

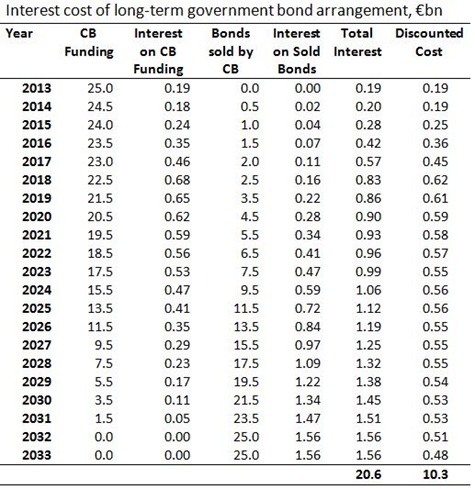

Here are two tables that showing some hypothetical the interest costs of the old Promissory Note and new Long-Term Government Bond arrangements until 2033.

These are only hypothetical scenarios designed to gauge the relative difference in the cost of each approach rather than a definitive estimate of the cost of each. There are a number of simplifying assumptions made.

- The ECB interest rate is expected to rise from 0.75% to 3.00% over the next six years and stay at 3.00% thereafter.

- The ‘margin’ of Irish government borrowing over the ECB rate is assumed to be constant 3.25%.

- All interest is paid from current revenue.

- Borrowings are only made to fund capital payments. This only impacts the Promissory Note arrangement and from each €3.1 billion annual payment the Central Bank profit is subtracted as it is returned to the Exchequer and also the external interest cost of the ELA as it is assumed that is paid from current revenue. This keeps the borrowing at €25 billion in both cases so we can assess the interest cost.

- The discount rate used is 6%.

As we are looking for relative differences the assumptions are not hugely significant as both scenarios are played out under the same set of assumptions.

First the Promissory Notes:

And the new Long-Term Bond arrangement:

The interest mix of both changes. In the first case it is because the Promissory Notes/ELA costing the ECB rate is paid off with new government borrowings at the “market rate”, while in the second case the Central Bank funding at the ECB rate is reduced through the Central Bank selling the bonds it holds thereby making the interest payable to a third party. By 2034 both arrangements are identical in this setting - a debt of €25 billion with an annual interest cost of €1.56 billion (assumed interest rate by then is 6.25%) - as all the Central Bank funding is repaid

So what do we find in? In nominal terms the interest costs are

- Promissory Notes: €27.0 billion

- Long-Term Bonds: €20.6 billion

Getting the present value of the interest payments gives:

- Promissory Notes: €14.3 billion

- Long-Term Bonds: €10.3 billion

The interest cost under the new arrangement is around 30% lower. This is a gain to the State of the new change which arises from having access to borrowings at the lower ECB rate for longer. It increases from c.7 years to c.15 years.

The are other gains from the new arrangement. The above just reflects the interest cost of each arrangement. The accounting treatment of the Promissory Notes meant they had a very large impact on the deficits over the coming years. That has now been reduced. Also the new arrangement means that the debt doesn’t have to be rolled-over until the first of the new bonds matures in 2038 significantly reducing the medium term funding needs of the State.

The is little doubt that the new arrangement is anything other than a gain for the State. And unless your expectations were incredibly unrealistic (or more accurately based on fantasy), yesterday’s announcements were pretty much as good as could have been hoped for given the institutional constraints faced.

No comments:

Post a Comment