The tax system and its nuances is a frequent topic in the public discourse. A fertile area for such discussions are the headline, marginal and effective income tax rates. In particular, emphasis is put on the Personal Income and Corporate Income tax rates.

The headline rates of Personal Income Tax are 20% and 41% and the headline rate of Corporation Income Tax is 12.5%. The top marginal tax rate, including USC (7%) and employee PRSI (4%) is 52% for individuals. Non-PAYE earners face a marginal rate of 55% as there is an additional 3% USC levy on self-employed income over €100,000, while public sector workers above €60,000 have a marginal tax rate of 63.5%, inclusive of the ‘pension’ levy.

The Annual Statistical Reports from the Revenue Commissioners provide lots of useful information on effective tax rate. These are taken from the Income Tax and Corporation Tax elements of the 2011 report which provide figures for the 2010 tax year.

The figures for Personal Income refer just to Income Tax paid at the 20% and 41% rates and exclude PRSI and the Income and Health Levies which were also paid in 2010 as well as other Income Taxes such as DIRT.

The pattern of effective Personal Income Tax rates with income are reasonably well understood. The effective Income tax rate is zero up to around €17,000 and remains below 10% up to €40,000. As income rises it rises to around 25% for incomes above €125,000 with the highest effective income tax rate around 30%. (PRSI and USC are additional to this.) Details using preliminary 2011 data are in this table.

Here is a table that shows the pattern of the effective Corporate Income Tax rate through the range of Net Trading Income, which is found after certain allowances (losses carried forward, capital allowances and other deductions) have been subtracted from Gross Trading Profit.

Aside from companies with negative or very small net trading income (< €25,000), the lowest effective corporation tax is for companies reporting a net trading income of €10 million or more.

There are around 45,000 companies in total in the figures and 32,000 are in the first two categories above. There are around 500 in final category and 1% of companies paying corporation tax contribute 77% of the total amount paid. These companies pay an average amount of €7.5 million of Corporation Tax.

Why does €70.0 billion of gross trading profits (and another €0.8 billion of balancing charges) yield only €4.2 billion of corporation tax? There are various adjustments that are made to gross profit from any year to get the taxable profit for that year. Here is a summary of the tables from the Revenue’s release.

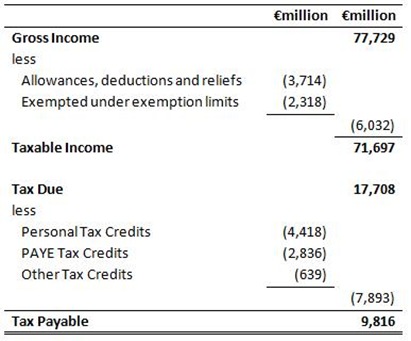

Any proposals to raise the effective Corporation Tax rate without changing the headline rate of 12.5% need to address the deductions set out above. Here is a similar table for Personal Income Tax, this time from the Revenue’s report on Income Tax.

No comments:

Post a Comment