It’s been a while since we looked at the CSO’s monthly External Trade data for Merchandise Imports and Exports. We will get our first look at Services Imports and Exports for 2011 when the Balance of Payments is released with the National Accounts on Thursday.

Here we will examine the March External Trade Release with provisional overall figures for April.

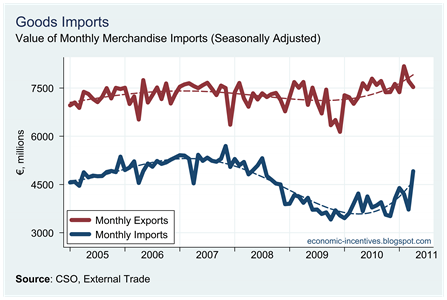

The provisional figures for April show a rise in imports and a fall in exports, though the trend for both series remains positive. Not surprisingly, these monthly changes mean that the balance of trade declined markedly in April with a fall to its lowest level in 16 months.

As the April figures are only provisional we do not have a breakdown by category that would allow us to explore the drop in exports and rise in imports in April. The current release does give us the breakdown for March so we can have a look at the trade performance over the first three months of the year.

First up here are exports for the first quarter of the last five years. Click the table to enlarge.

The figures for 2011 are remarkable and for all the named categories, exports are ahead of the 2010 levels. In fact the only category that is behind on its 2010 performance is the generic “Other Commodities” category which only makes up 0.1% of the total but has shown a rather alarming 96% fall. In categories making up 99.9% of the total exports are showing an annual increase. There may be some classification issues at play here.

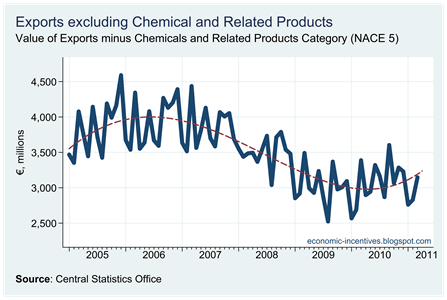

As per usual caution must be exercised when looking at aggregate merchandise trade data from Ireland such is the dominance of the Chemical and Pharmaceutical sectors in the figures. For the first three months of 2011, exports from this category made up 62.6% of the total and are up 13.5% on 2010. Of the €1.8 billion increase in exports, €1.7 billion can be accounted for by the Chemicals and Related Products category. Excluding chemicals, exports are showing some annual growth but it is a much more modest 1.1%.

Compared to pre-crisis levels from 2007, exports are also showing positive performance with a 3.1% increase. Again, however, this is largely down to increases in chemicals and pharmaceuticals. Excluding Chemicals, Irish exports are still 24.6% behind those levels recorded in 2007 with most of this attributed to the Machinery and Transport Equipment category, and within that most of the drop is as a result of the fall in computer exports.

Some categories are up on their 2007 levels, most notably Food and Live Animals and Miscellaneous Manufactured Items which between them make up about one-sixth of our exports.

Next we turn to imports. Again click the table to enlarge.

As per exports, imports are showing growth on their 2010 levels and this can be seen across all the main categories. We will return to imports in a few minutes when we look at the figures on imports by use.

The final table by category is for the Balance of Trade. Click to enlarge.

The trade balance for 2011 is at record levels and is 82% higher than that recorded in 2007 but it must be remembered that nearly 90% of this rise is due to the fall in imports rather than a rise in exports.

A second noticeable element is the dominance that the chemicals sector plays in determining our trade balance. In fact, excluding Chemicals the balance of trade has been continually in deficit. Up to 2010 this deficit had been declining but this was reversed in 2011.

The role Chemicals play in our export data cannot be overstated. Over the past five years chemical exports have grown from about €3.5 billion a month to €4.5 billion a month with a large spike in March 2011 to €5.5 billion.

Excluding chemicals, the exports performance is not as “robust” or “resilient” as the first graph above would indicate, though there was a stabilisation from early 2010 and some tentative signs of improvement later in the year.

No comments:

Post a Comment