The release during the week of the addendum to the stress tests allows us to consider the total amount of loans losses that have been accounted for in the banking system.

First we consider the losses that the banks incurred on the transfer of their developer loans books to the National Asset Management Agency (NAMA). We have been directed to a useful summary table on page 54 (pdf) of the Nyberg Report (I thank namawinelake for the pointer to this table).

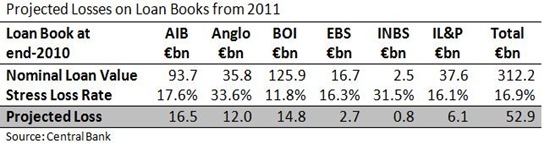

As a result of the €72.3 billion of NAMA transfers up to December 2010 the banks were forced to crystallise €41.8 billion of losses on these loans. Next we turn to the expected losses on the loans that remained on the banks’ balance sheets after the NAMA transfers. This table combines data from the original stress test document which covered AIB, BOI, EBS and IL&P and this week’s addendum which dealt with Anglo and INBS.

The figures for Anglo are a little confusing and unfortunately we are not given the same detail as provided for the other banks. The analysis for Anglo was merely a check on the PwC analysis undertaken last September. There are a number of loss rates given for Anglo but the addendum states that “[t]he loss rate used by CBI in the capital assessment in September 2010 was 33.6%.” There is also a figure of 46.7% which is listed as “Central Bank additional conservatism to stress Sept 2010” but I’m not sure what was done with this figure so we’ll stick to the 33.6% projection.

The stress tests on the four live banks also allow for €13.2 billion of losses on the run-off and disposal of non-core assets. This will be the deleveraging of €72.6 billion of (mainly foreign) loans. Although a €13.2 billion loss is allowed for the banks, BlackRock estimate that the lifetime loss on these loans will be €3.0 billion. We will use this as our measure of loan losses.

There are also losses other than the NAMA transfers that had been allowed for by the end of December 2010. The stress test documents show that the four banks had stock provisions of €9.9 billion accounted for at that time.

All told, the total amount of loan losses accounted for is now €107.6 billion and is pretty much aligned to the most conservative of loss projections made during the crisis.

Will the banks have enough money to be able to absorb these losses? Remember that about half of these losses are projected losses from the adverse scenario of the stress tests. These may or may not materialise.

There are four sources of funds available to absorb these losses:

- The banks’ existing equity capital at the start of the crisis,

- The banks’ operating profits during and after the crisis,

- Haircuts enforced on junior bondholders, and

- Capital injections from the State

The Nyberg Report shows that the covered banks had about €25 billion of equity capital in 2007. This is been eliminated. Over the period 2007 to 2010 the banks generated about €5 billion of operating profits and BlackRock forecast that under the adverse scenario the four banks in the original stress tests will generate €4 billion of operating profit in the period from 2011 to 2014.

Junior bondholders have already taken about €10 billion of haircuts. There is little actual evidence of this but his is Dail statement on the day of the stress test announcements, Michael Noonan said:

It is acknowledged by all that a large part of the €46.3 billion already invested by the State in the banks will not be recovered, but the State has not borne the full burden of the collapse. Approximately €60 billion of private equity value in Irish banks has also been destroyed since early 2007, much of it held by ordinary Irish citizens. Subordinated bondholders have also already contributed approximately €10 billion to the cost of the bailout.

The most recent round of haircuts junior bondholders are expected to raise another €4 billion. The €20 billion contribution of the State to the €24 billion recapitalisation will bring the State’s support to the banks up to €66 billion.

All told, there have been contributions of €114 billion to our delinquent banks. If the projected losses of €108 billion materialised this would not leave the banks in a very strong position and they would only have €6 billion of capital remaining.

One thing to note here is that the €53 billion of loan losses projected from the stress tests are “lifetime” loan losses. In fact, of the €40 billion of lifetime losses that the BlackRock adverse scenario projects for AIB, BOI, EBS and IL&P, €28 billion of these losses are expected to materialise in the period after 2013 and as it states in the stress test document:

Besides, any such losses are spread over a quarter century, allowing a lot of time for provisions to be set aside out of normal profits in what would then be a recovered and downsized banking system operating in a non-stressed situation.

This may not be ideal but it does mean that the banks will be in better capital position over the next three years than was indicated above. It is assumed then that the operating profits the banks will earn after 2013 will be sufficient to absorb the provisions for the losses that occur after 2013.

I think it is pretty clear that we appear to have finally fully grasped the severity of the banking collapse we face. There has now been recognition of €108 billion of loan losses in the system. Half of this is a projection and we must wait until the true extent of the crisis is revealed but there are few suggestions that it will be higher than this.

To cover these losses, €114 billion of funds have been provided by shareholders, junior bondholders and the State. If all the projected losses occurred immediately the banks would be in a precarious state but because they will be spread out over the next 15 years (though heavily concentrated over the next three years) the capital position of the banks does look like it can be stabilised.

No comments:

Post a Comment