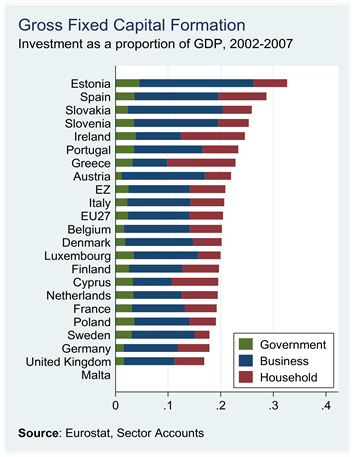

The following graphs contain details of investment of as a proportion of GDP for 20 EU members. These are the EU15 (members of the EU before the accession of Eastern European countries in 2004 and 2007), the members of the Eurozone not in the EU15 (Cyprus, Estonia, Latvia, Malta, Slovakia and Slovenia) and Poland. This gives 21 countries but as Malta has no data reported to Eurostat in the required categories the sample is 20 countries.

First, here is investment as a proportion of GDP in the chosen countries between 2002 and 2007. Ireland ranks fifth of the 20 countries shown and second in the EU15. The top six countries from the EU15 are Spain, Ireland, Portugal, Greece, Austria and Italy.

If we analyse the investment by sector of source, we get the following rankings for Ireland in the 2002-2007 period. Click the links to see graphs.

- Government: 2nd (1st in EU15)

- Household: 2nd (2nd in EU15)

- Business: 18th (14th in EU15)

It is government and household investment that pushed Ireland up to fifth in the overall ranking (and second in the EU15). Business investment as a proportion of GDP was lower in only Greece and Cyprus. The top three countries for household investment between 2002 and 2007 were Greece, Ireland and Spain.

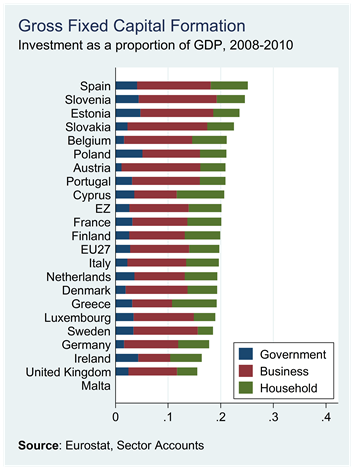

If we move t0 the period since 2007 when investment in Ireland peaked, the following picture emerges for the years 2008 to 2010. .

Ireland drops from fifth to 19th and is now flanked by Germany and the UK. This might be appropriate for a mature economy with low unemployment but that if not an description that is usefully associated with the Irish economy. The rankings by sector now are:

- Government: 4th (1st in EU15)

- Household: 9th (8th in EU15)

- Business: 20th (15th in EU15)

Ireland’s relative position fell in all three sectors with a fall of seven positions for household investment and a drop to last for business investment. Even with the cuts in the public investment since 2008, Ireland still ranked highest in the EU15 for government investment in the three years to 2010.

The IMF provide forecasts of investment up to 2016. They don’t give a breakdown by sector but we can look at the total. Ireland is last.

The average for the 20 countries above Ireland (the IMF provides forecasts for Malta) is 20.0% of GDP. For Ireland, the forecast of investment as a percentage of GDP from 2011 to 2016 is 10.5%.

The recent IMF review for Ireland (Table 2, pdf page 31) shows that they expect public investment to fall to 2% of GDP by 2013 and stay there at least up to 2016, with investment from the household and business sectors bottoming at 6.8% of GDP in 2011 and rising slowly to 9.8% of GDP by 2016.

No comments:

Post a Comment