The downward slide of Irish government bond yields continued today and the nine-year yield as calculated by Bloomberg finished at 7.91%. Apart from a two-week period at the start of October this is the only time that this has been below 8.0% in the past year. This time last year the yield was at 8.4%.

Here is the one-chart for the nine-year yield.

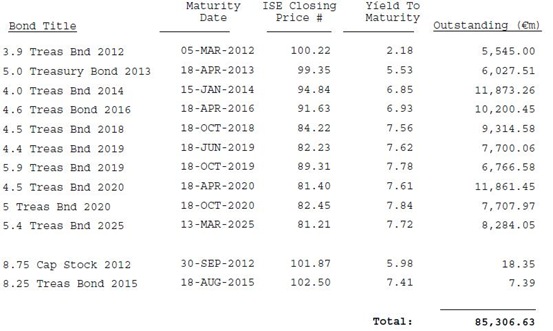

What is perhaps of even greater interest is the Daily Outstanding Bonds Report published by the NTMA.

We can see that no Irish government bond is yielding more than 8%. Michael Noonan has spent the day proclaiming that “Ireland is fully funded until 2013” (or two-thirteen in Noonan-speak). This is true. What happens in 2014?

The €11.9 billion bond due to mature on the 15th January 2014 is now yielding 6.85%. It now costs €94.84 to buy a unit of this bond. Last July this bond could was trading at less than €70 giving a yield of close to 20% (if you could find someone willing to sell). The perceived risk of this bond has dropped considerably in the past six months.

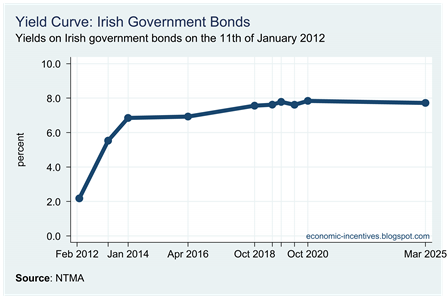

Finally, it is interesting to see the reasonably normal shape of the yield curve for Irish government bonds.

It would be more than reasonably normal if we could knock a few more percentage points off the yields but lets take it one step at a time. It’s a good deal better than this yield curve from just five months ago.

No comments:

Post a Comment