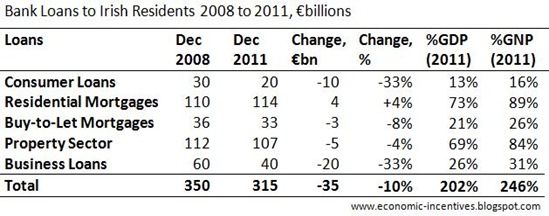

A previous post showed the increase in private sector loans from 2003 until its peak at the end of 2008. This showed that the level of private sector loans to Irish residents from banks in Ireland was around €350 billion in December 2008.

Since then consumer loans from the banks have fallen to about €20 billion. Residential mortgages have increased to €114 billion while buy-to-let mortgages have fallen to €33 billion offsetting the increase. Loans to the business sector excluding the property sector have fallen to €40 billion. Here is a summary table which updates the table from the earlier post.

In the Central Bank data loans to the construction sector have fallen from €9 billion to 2008 to €3 billion now while loans for land and development activities have fallen from €103 billion to €56 billion. Most of this fall is as a result if transfers to NAMA rather than repayments.

The “transactions” data provided by the Central Bank which accounts for the NAMA transfers and bank exits rather then the “volume” data which doesn’t. This shows about a €5 billion drop in construction loans and no change in land and development loans because of transaction (draw downs and repayments) over the past three years.

We don’t know what has happened to the loans that went to NAMA or what has happened to the loans in Bank of Scotland (Ireland) that are now being handled and wound-down by Certus. We will just assume that there has been a €5 billion drop in property sector loans over the past three years based on the drop in construction loans.

Summing these changes means bank loans into the Irish economy are down to around €315 billion. By adding in credit union loans and loans from other sources it is likely we would get up to €330 billion, give or take. This is the total extent of private sector loans in the Irish economy.

With 2011 GDP likely to around €156 billion and GNP around €128 billion the loan to national income ratios will be around 210% for GDP and 260% for GNP.

At the end of 2011 the General Government Debt was around €166 billion. Around €46 billion of this is to cover losses the covered banks made on the above loans. Most of these losses were in land and development loans but the losses will by no means be confined to that category. In our €330 million private sector total we have counted these non-performing loans but it is money from the government that will pay them (though only for losses in the covered banks).

The extra debt from the government sector is around €120 billion, about one-third of which is the debt the government brought into the crisis in 2007 and two-thirds the debt the government has accumulated by running huge deficits since 2008. This €120 billion of government debt onto the earlier €330 billion of private sector loans gives a total of €450 billion of debt in Ireland.

If we want to sure to be sure that this is the total amount of debt in Ireland we can make an allowance for some other loans such as those sourced from outside Ireland. All in, it is likely that the sum of household, business and government debt accumulated by Irish residents is something under €500 billion.

At €500 billion it would put the debt ratios at 320% of GDP or 390% of GNP. This is an excessive level of debt. The next post will consider how this can be brought under 300% of national income though a reduction to well below that will be necessary to return to “safe” levels of debt.

No comments:

Post a Comment