A previous post showed that total debt in Ireland is probably around 325% of GDP or 390% of GNP. This is an unsafe level of debt and, at a minimum, the aggregate amount of debt should probably be no more than 250% of GNP with any amount over 300% considered unsafe. We cannot expect economic growth to change the denominator significantly so repayments and deleveraging will have to do the heavy lifting to bring the numerator down.

However, repayments will not be the only way to bring the debt down. There will be some defaults. The government’s debt will be rolled over and not defaulted on. Actual repayment of the debt is unlikely and the hope is that in time growth and inflation will bring the public debt ratio down. A lot of the private debt will be repaid but there will be defaults. Lots of defaults.

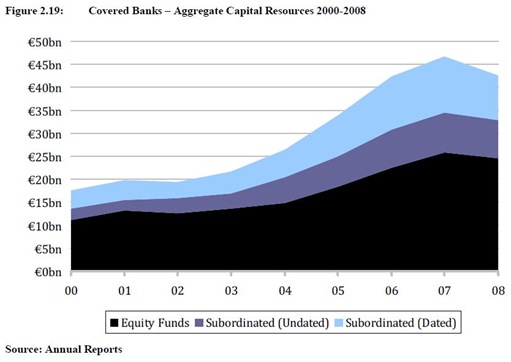

The State has provided €64 billion to cover loan losses in the covered banks (AIB, BOI, PTSB, EBS, Anglo and INBS). This is not so much an outright default as a transfer of the liability from one sector of the Irish economy to another. There are investors in the banks who have covered losses. This is a graph from page 42 of the Nyberg Report.

Before the start of the crisis in 2007 the capital resources of the covered banks was estimated to be around €47 billion. Since then the subordinated bondholders in the six banks have provided about €15.5 billion to meet loan losses and defaults in the covered banks. The contributions across the covered banks are neatly summarised in this recent parliamentary question to Minister for Finance, Michael Noonan.

The €25 billion of shareholder equity has been almost completely eliminated by loan loss provisions by the banks’ over the past three years. The provisions have been made but it will be over the coming years that the loans will be written down. The banks will try to obtain as large a repayment as they can but many of the loans made into the Irish economy over the past few years will never be repaid.

It is not only the covered banks that will suffer defaults on their loan books. The covered banks make-up about two-thirds of the Irish banking sector and the State will make good losses in excess of those not covered by the capital resources wiped out above (as well as providing an adequate capital base for the banks).

One-third of the Irish banking sector is foreign owned and the State has accepted no responsibility for defaults on the loan books of these banks. Some of the loans books of these banks were very large. The loan books and loss provision to March 2011 were neatly summarised by Simon Carswell in this Irish Time article.

These banks have allowed for the fact that almost one-fifth of the money they have lent into the Irish economy will not be repaid. The banks’ owners have provided the capital to cover these losses. For example RBS (82%) and Lloyds (40%) are both part-owned by the UK government. Between them they have received €18 billion from their parent companies to cover loan losses in Ireland.

The details provided by Simon Carswell also show that the covered banks had made loss provisions of €75 billion from 2008 to the end of March 2011.

Although the figures here include loans in other countries (particularly for AIB, BOI and Anglo) it is likely that most of the loss provisions relate to their Irish loan books. The largest part of the provisions (€42 billion) are for the loans transferred to NAMA but there are still large provisions on their remaining loan books, and it is likely that these will increase. Last March’s stress tests projected €43 billion of lifetime loan losses under the adverse scenario which is greater than the stock of provisions in the banks. See here for more details of the NAMA transfers and projected losses.

There was more the €350 billion of bank loans issued by Irish banks into the economy at the end of 2008. The banks have already provided for defaults of almost €100 billion on these loans. It is not clear what the final losses actually will be but it is expected that there will be a lot of loan defaults in Ireland. This won’t happen in a big bang but will be steady stream over the next few years. There has also been repayments over the past three years which will continue in most cases.

If we assume that this €100 billion of loan loss provisions translates to €100 billion of loan defaults then Ireland’s private debt mountain will be reduced to about €230 billion. This will not be a painless process but last week’s draft Personal Insolvent Bill provides some details about how this can be achieved.

In this hugely hypothetical scenario private debt is €230 billion, and with a general government debt of €166 billion at the end of 2011, that would out total debts at just under €400 billion. That would be 256% of GDP or 312% of GNP. This is not far from the “danger” threshold of 300% of national income.

Getting there won’t be easy and even at 300% of GNP, Ireland’s debt level will be excessive but it won’t be terminal. It will take much longer to get the debt below 250% of national income level which could be considered “safe”. Once the loss provisions have worked their way through the system into actual write down the process of deleveraging will accelerate. Ireland has a large and excessive level of debt but we are not likely to fall over a cliff face.

No comments:

Post a Comment