The previous post looked at the household balance sheet and the declining levels of household debt in particular. At the end of 2011, the household balance sheet has €179 billion of loans. This can roughly be broken down as:

One aside of the above table relates the graph of debt-to-gross disposable income for the household sector at the end of the previous post. As can be seen above about one-fifth of the debt in the household sector relates to buy-to-let mortgages. These debts are not dependent on gross disposable income to be serviced; they are dependent on rental income. These are not typical household debts; they are business or investment debts.

The buy-to-let sector will come into focus in the next few weeks with the first official release of arrears statistics from the central bank. The sector is apparently in turmoil (see slide 7). Apparently, because in Census 2006 there were 145,000 recorded as renting from private landlords while in Census 2011 the equivalent figure is that 305,000 households are now renting from private landlords. There are more thoughts in the BTL sector in this comment.

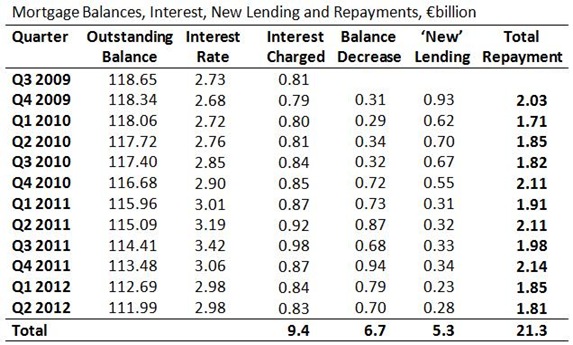

The focus here is on the largest item of household debt; owner-occupied residential mortgages. The Financial Regulator has been providing mortgage arrears statistics since the third quarter of 2009. The following table combines this with data on mortgage lending from the Irish Banking Federation.

At the start of the mortgage arrears statistics in the Q3 2009, the aggregate balance on all owner-occupied mortgages was €118.7 billion. In the 11 quarters since this balance has fallen by €6.7 billion to €112.0 billion.

This alone does not reflect capital repayments by borrowers as additional lending by new and existing borrowers will offset these repayments. The IBF dataset breaks down owner-occupied mortgage lending into four categories. Here they are with the amount of lending that has taken place since Q4 2009:

- First-time buyers: €4.3 billion

- Mortgage top-ups: €0.9 billion

- Mover-purchasers: €3.4 billion

- Remortgages: €0.9 billion

The first two are unambiguously new lending and are summed in the column labelled ‘New’ lending in the table. Payments by existing borrowers must exceed these new drawdowns to reduce the overall balance outstanding.

The latter two are less clear cut. It is impossible to tell if mover-purchasers lead to an increase in mortgage debt. This depends on whether they sell they existing home and on whether the new loan is greater than than the original loan. Remortgages won’t reduce the amount of debt but it is impossible to tell if they increase it. These are summed in the column labelled ‘Other’ lending and to be conservative it is assumed that they add nothing to new lending.

The Capital Repayments column is thus made up of the reduction in the overall outstanding balance and new lending to first-time buyers and top-ups. With no allowance made for mover-purchasers or remortgages this is likely to be lower limit of actual repayments.

In this case there has been nearly €12 billion of capital reducing payments made in less than three years, an average rate of almost €1.1 billion per quarter.

At the start of the arrears statistics in Q3 2009, the total amount of arrears that had accumulated at that time was €354 million. Since then it has risen to €1,439 million, an increase of €1,084 million.

The €1.1 billion rise in arrears in the 11 quarters since Q3 2009 is equivalent to the average amount of capital repayments that takes place in one quarter. Also, the arrears figure includes arrears on capital and interest repayments on the mortgage. Using the retail interest rates data from the Central Bank we can roughly gauge the interest component on mortgage repayments:

We can see that since September 2009 households have made repayments of around €21 billion on their home mortgages. This is 20 times greater than the arrears that have accumulated over the same period.

This is not to dismiss the severe distress that thousands of households are suffering as a result of excessive mortgage debt. There are huge difficulties and addressing these has to be a priority. But there are many more households meeting their mortgage commitments.

No comments:

Post a Comment