This week Sinn Fein released their budget proposals in a document called ‘Making the Right Choices’. It contains a package similar in scale to the €3.5 billion of ‘adjustments’ proposed for Budget 2013.

There are €2,758 million of proposed tax increases and €705 million of net expenditure ‘savings’ (though €433 million of those come from increased revenue measures in health (recouping the full cost of private beds from private patients)).

One of the tax initiatives is a new wealth tax.

A 1% TAX ON NET WEALTH OVER €1MILLION, EXCLUDING WORKING FARMLAND, BUSINESS ASSETS, 20% OF THE FAMILY HOME AND PENSION

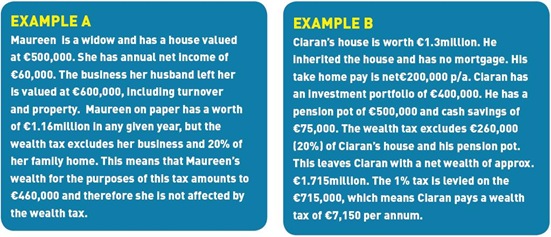

POTS: RAISES €800millionSinn Féin’s proposal is to introduce a 1% tax on all assets over €1million net of all liabilities, including mortgage and other debts. The tax would not be levied on 20% of the family home, the capital sum in pension funds, business assets or agricultural land.

It would apply to the global assets of those domiciled or ordinarily resident in the state and domestic assets only for those who are resident in the state for tax purposes.

Two examples are provided to illustrate how the proposal might work. (Click to enlarge).

Here is a summary of Example B:

Of course, the first item on this list is not a typical component of wealth. Wealth is usually defined as a stock measure of the difference between assets and liabilities at a particular point of time. Income is a flow over a particular period of time.

We have taxes for income through Income Tax, USC and PRSI. The above case would be subject to Sinn Fein’s proposed 48% rate of Income Tax on incomes above €100,000. It also appears to be the case that those who are subject to the wealth tax will be subject to an additional 1% income tax on some measure of ‘net’ income. Thus, the proposal is part wealth tax, part income tax.

If income was excluded from the base for the wealth tax (as would be expected) then the tax liability in Example B would be €5,150. Raising €800 million from a wealth tax such as that would require the equivalent of 160,000 Ciarans. A newspaper report of the proposal says:

Mr Doherty claimed that financial management company Merril Lynch had estimated there were 18,100 people living in the State with assets of more than $1m (€778,000).

No comments:

Post a Comment