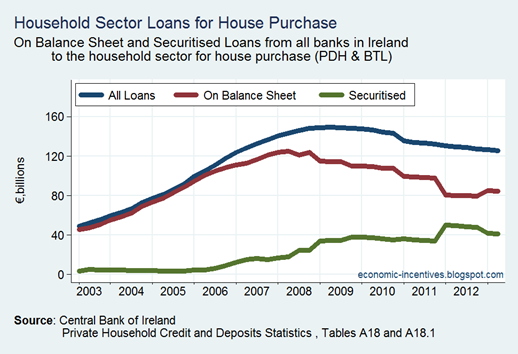

The Q1 2013 update of the Private Household Credit and Deposits series from the Central Bank gives the following chart for mortgage debt in Ireland.

Since peaking at €149 billion at the start of 2009 the amount of mortgage debt issued by banks in Ireland to Irish households has fallen to €126 billion. However, there are two reasons why these figures are not directly comparable.

First, it should be noted that a good portion of this drop is accounted for by the exit of Bank of Scotland (Ireland) from the set of reporting institutions following its withdrawal from the Irish market in December 2010 (see step decline at that time in chart above).

Second, December 2010 also saw a change in how the data are reported. From the explanatory notes:

As of December 2010, the outstanding amount of loans is reported at nominal value, i.e. the gross position owed on loans by the credit institutions’ counterparties. Prior to December 2010, the book value of loans is reported, which reflects the carrying value of these loans on credit institutions’ balance sheets and are net of impairment provisions recognised against those loans. As a result, the outstanding amount of loans and related series increased substantially in December 2010.

This change may have “increased substantially” the outstanding amounts the departure of BOSI and its estimated €10 billion mortgage book meant there was an €8 billion decline in the reported total for December 2010.

All told there probably has been a nominal reduction of around €17 billion in the total amount of mortgage debt owed by Irish households in the past four years. Separate data from the Irish Banking Federation show that €8 billion of new mortgage debt has been issued to first-time buyers and mortgage top-ups. It also likely that some elements of the loans to mover-purchasers, re-mortgagers and BTL borrowers would lead to more new debt.

Given the €17 billion reduction in the nominal amount owing and the €8 billion increase from new debt then something around €25 billion of the mortgage debt that existed at the peak Q1 2009 has been repaid. This is a repayment rate of around €1.5 billion per quarter.

Of course a large portion of the €126 billion that remains will never be repaid and very slow steps are being taken to address that. The scale of this problem is usefully described in this chart from a recent piece in The Atlantic magazine.

The following table breaks down the total amount of mortgage debt by Private Dwelling House and Buy-To-Let loans with detail on the interest rates applicable to each also provided. [A small amount of loans for second homes/holiday homes are omitted]. Click to enlarge.

No comments:

Post a Comment