After five months of reasonably steady increases in retail sales from December 2009 to April 2010, the five months have seen a return to the decline that marked retail sales during 2008 and 2009.

The figures come from today’s release of the September Retail Sales Index from the CSO. As is usual with our analysis, we will focus of the patterns of the sales index that excludes the impact of sales in the motor trades.

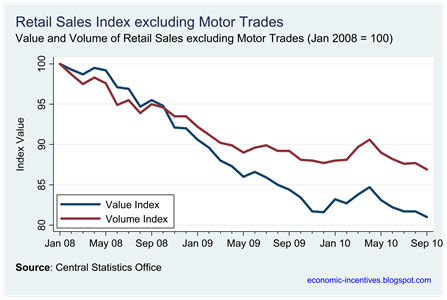

The value and volume retail sales indices excluding motor trades since January 2008 are shown below. The all-business equivalent can be seen here and it has been steadied by the strong performance in new car sales this year. The remainder of the index (c.80% in September) is once again heading south.

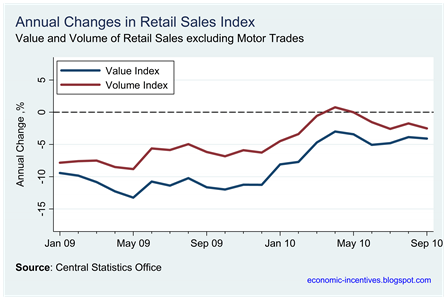

The ‘turning the corner’ momentum that was heralded at the start of the year has evaporated. The gap between the value and volume series that emerged through 2009 has not narrowed as some downward pressure on prices still remains. In fact, if we look at the annual change in the indices we see that the annual fall in the value index has been consistently lower than the fall in the volume index for the past two years. Consumers are buying less and paying lower prices for what they do buy.

The monthly changes are no less glum. The batch of positive monthly changes that were seen during the early part of the year have been replaced by negative monthly changes. The monthly changes in the value and volume indices have been negative for four of the past five months, and the August exceptions barely carried in to positive territory.

In the five months since April, the value of retail sales excluding motor trades has fallen 4.4%, with the volume of retail sales falling 4.1% in the same period. This was the fastest five-month drop in volume since May 2009 (-4.9%) and the fastest five-month drop by value since December 2009 (-4.9%). The does not bode well for upcoming VAT receipts. By comparison the five-month changes recorded to September 2009 were –3.3% for value and –0.9% for volume.

Next we provide some brief details on the sub-indices produced by the CSO

Along with the All Business and All Business excluding Motor Trades the CSO’s Retail Sales Index provides 13 sub-indices. Here are the seasonally adjusted monthly and annual changes for each of these sub-indices by volume and value for September.

Clicking any of the titles under the ‘Sub-Index’ heading will bring up a graph showing the values of the sub-index for the past three years (rebased to January 2008 equals 100), with the associated annual and monthly changes in the value index (blue line) and volume index (red line), as well as the weighting given to each sub-index in the overall Retail Sales Index for each month.

| Sub-Index | Value | Volume | |||

| Monthly | Annual | Monthly | Annual | ||

| Motor Trades | -1.2% | +7.4% | -0.6% | +13.2% | |

| Non-Specialised Stores | -0.3% | -1.1% | | -0.3% | +0.8% |

| Department Stores | +1.3% | +2.0% | +1.5% | +8.5% | |

| Food, Beverages & Tobacco | -1.3% | -7.2% | | -1.1% | -4.2% |

| Fuel | -1.8% | +0.6% | -3.0% | -8.9% | |

| Pharmaceutical, Medical & Cosmetics | -1.5% | -0.6% | | -1.1% | +4.6% |

| Clothing, Footwear & Textiles | +0.6% | -3.2% | +0.4% | +3.7% | |

| Furniture & Lighting | -1.3% | -14.4% | | -1.1% | -9.0% |

| Hardware, Paint & Glass | -6.1% | -10.9% | | -5.4% | -8.7% |

| Electrical Goods | +4.4% | -2.9% | +5.4% | +5.5% | |

| Books, Newspapers & Stationery | -9.9% | -12.1% | | -4.2% | -9.4% |

| Other Retail Sales | -3.1% | -12.2% | | -3.0% | -12.4% |

| Bars | -2.1% | -13.8% | | -2.2% | -11.6% |

When we looked at this table back in February only 26 of the 52 cells were red. Now there are 37 red cells, with the number of monthly figures in the red increased from nine in February to 20 now. The only sectors to show monthly increases in September were Department Stores, Clothing and Electrical Goods.

The best performing sector in the annual comparison is the Motor Trades with most sectors reporting value and volume sales below those seen 12 months ago.

The growing gap between the value and volume series is very evident in some sectors. Sales by volume in Department Stores are up 8.5% on the year but are only up 2.0% by value as these stores have been discounting to maintain volume. Sales of Electrical Goods are up 5.5% by volume, but the value of these sales is sown 2.9% on the year. Non-Specialised Stores, Pharmaceutical, Medical & Cosmetics and Clothing, Footwear and Textiles are other sectors to show increases in annual sales by volume but decreases by value.

Click the titles in the table above to see the graphs. In the graphs the red line represents the volume figures and blue line the value figures.

No comments:

Post a Comment